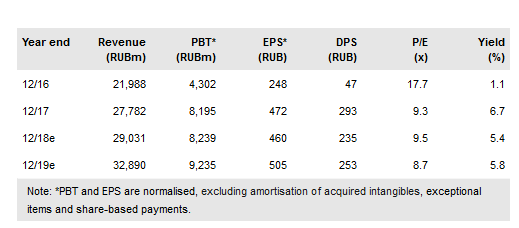

On 29 August, TransContainer PAO (BE:TRCNq) announced Q218 IFRS results. The results showed further growth, with a 6% increase in revenue and 16% growth in EBITDA. We think the main point of interest is how TransContainer has continued to increase productivity by improving the ratio of ‘profit-making runs’ by its containers. The further acceleration in market container volumes in July bodes well for Q3. We have maintained our 2018 EPS but increased our DCF valuation by 2%.

Market data in July bodes well for outlook

TransContainer’s revenue showed further growth in Q218 of 6%. Growth was supported by a further improvement in the Russian rail container market, which increased by 11.9% in Q218. The market grew by 16.5% in July, which will provide a helpful tailwind for TransContainer’s Q3 revenue. We believe that the improvement in market container volumes reflects the sequential improvement in the Russian economy.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI