Trump diagnosed with chronic venous insufficiency, remains healthy

Pre-market update:

- Asian markets traded 0.3% lower.

- European markets are trading 0.1% lower.

- US futures are trading 0.2% higher ahead of the market open.

Economic reports due out (all times are eastern): PMI Manufacturing Index (8:58), ISM Manufacturing Index (10)

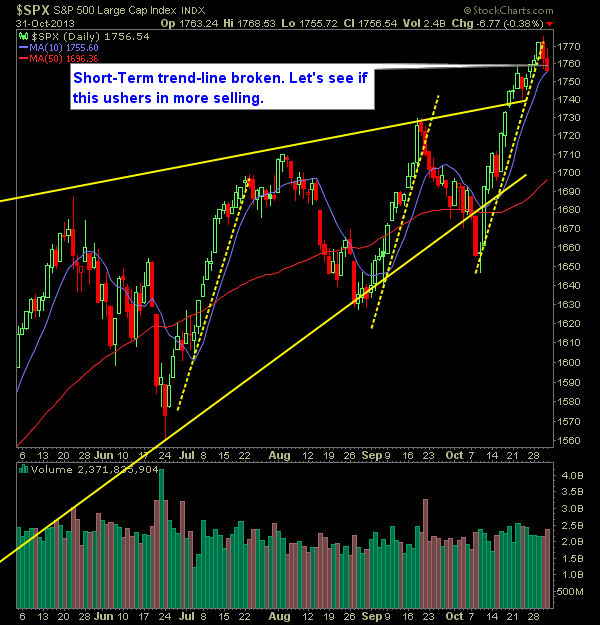

Technical Outlook (SPX):

- Second consecutive day trading lower. The dip buyers tried to come in early on, but the bears managed to take price action back down to the day's lows.

- Most concerning for the bears is the fact that they couldn't break through the 10-day moving average, which could act as a second attempt for the bulls to push this market higher.

- Volume the last two days has been very strong, especially when compared to the light volume on the rally that proceeded the 2-day sell-off.

- If the bears are going to control this market, it needs to take out the 1740 level.

- The last 5 trading sessions that started out the month, has been bullish for the markets.

- I'm beginning to look for a more legitimate sell-off from the markets here, much like we saw after September's rally. However, I will let the price action come to me and stay nimble with my portfolio allocation to the short-side, just in case the market chooses to continue its euphoric rally.

- Watch the 10-day moving average at 1757 today. A very telling sign will be if price can break and close below this level since we haven't done so since the rally began on 10/9.

- Volume was well above average and almost twice what we had seen recently on the SPY.

- 30-minute chart on the SPX already shows a pullback in play.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Closed/covered FCX at 36.79 for a 1.3% gain.

- Closed PRU at 81.68 for a 0.8% gain.

- Closed POR at 28.98 for a 0.9% loss.

- Went short HLF at 66.34 yesterday.

- Currently 30% short / 70% cash.

- Current Shorts: FFIV at 83.15, HOG at 64.25, HLF at 66.34.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI