Trading around a core position using elliott wave analysis: DATA

Often you can spend a fair amount of time with “dead money” in a growth stock that you love, but again, your money is sitting dead for weeks or even months on end while you hold it.

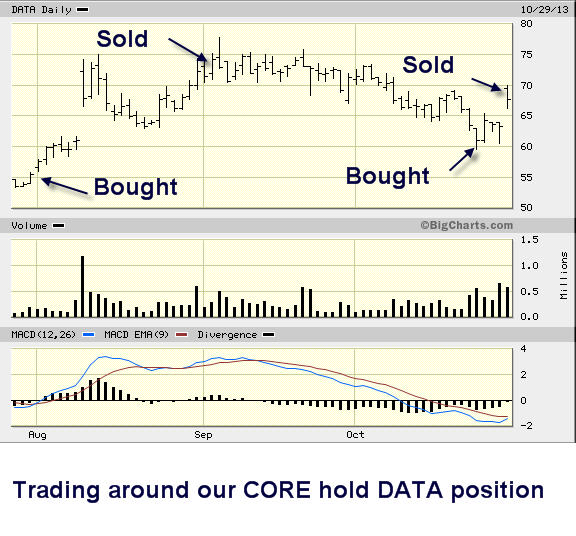

What we often do at ATP is try to trade around a Core long position, in this case we look at DATA (Tableau Software).

We first picked up a Full position at around $55 per share in the late summer

We sold 1/2 at 59, bought it back at 55 for a net average of 51 on 1/2 the position.

Then we sold that 1/2 at 72-73 after 2nd quarter earnings for huge 32% gains

Then we just bought it back at 60-61 when that gap in the chart we watched for a few months finally filled last week.

We just sold that 1/2 for 69 this morning for a 14% gain

We still hold the original 1/2 from 55, but net net we have booked huge gains by trading around this core holding.

Below is the chart showing you our entry and exit points, and again in the meantime we continue to hold the original 1/2 from $55.

55-59- 9%

55-73- 32%

61-69- 14%

So 3 trades of 9, 32 and 14% on 1/2 , while still holding 1/2 currently up 25%.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.