Pre-market update:

- Asian markets traded 0.5% lower.

- European markets are trading -0.7% lower.

- US futures are trading 0.4% lower ahead of the market open.

Economic reports due out (all times are eastern): PMI Services Index (9:45), ISM Non-Manufacturing Index (10)

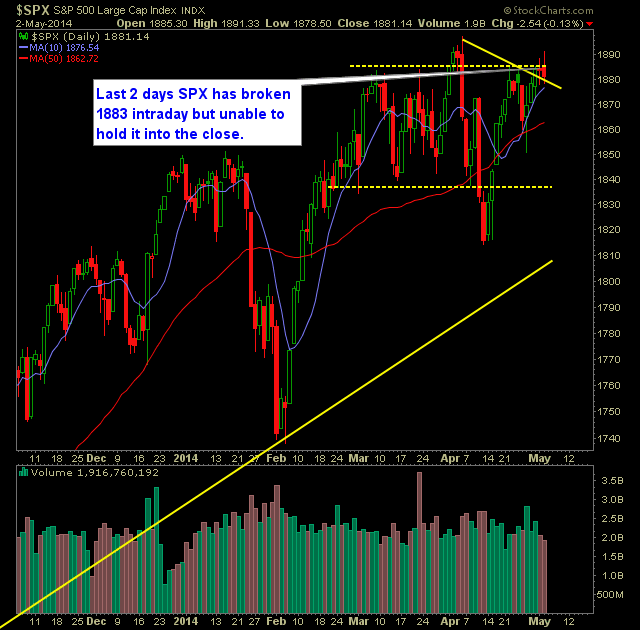

Technical Outlook (SPX):

- An impressive start on Friday turned red and despite trading at the all-time closing highs, managed to finish yet again below 1883.

- For the bears, the goal, at a minimum today, would be 1873 which has provided strong support/resistance in the past.

- Now for almost three weeks, SPX has continued to see dwindling and below average trading levels.

- SPX 30-minute chart shows an incredible amount of choppiness and indecision.

- Price is at the upper end of the trading range that has mired the market over the past +2 months and during that time it has served traders better to fade the rallies.

- Until SPX can break and close above 1883, there is little reason to be bullish towards this market. Far too many reversals have occurred here.

- 10-day moving average continues to offer solid support for the bulls. A break of this moving average will be key for the bears.

- VIX dropped for the fifth consecutive day and below 13.

- 20, & 50 day moving averages have converged together offering some support for SPX.

- In this market, you have to be aggressive with the gains. Take them quick, and don't expect them to last.

- The Market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My Opinions & Trades:

- Added one new short position on Friday.

- Closed out CTSH at 49.56 for a 2.9% loss.

- Will look to add 1-2 new positions today.

- Remain short MT at $16.03, TEL at 59.01 and JPM at 55.52.

- Short 30% / 70% Cash

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.