Technical Outlook:

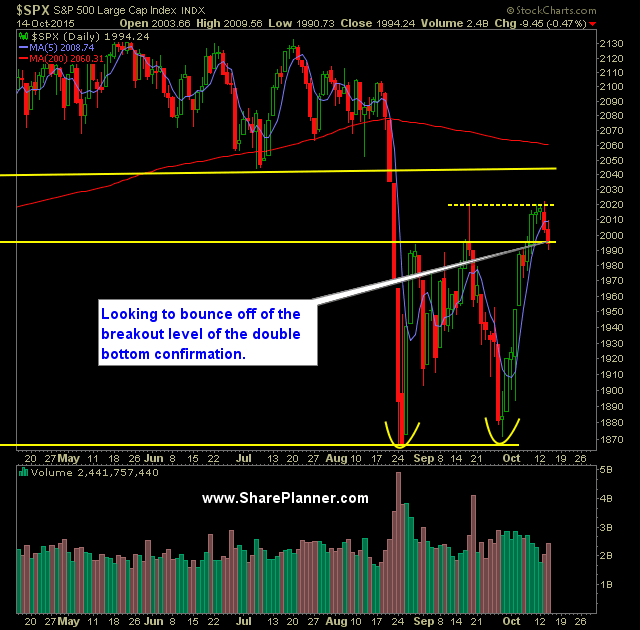

- S&P 500 managed to breakout above Tuesday's intraday highs, and more importantly managed to close above 2020 again after a two-day pullback that threatened to rollover the market.

- Volume rose for the third straight day and almost was at recent average levels.

- SPX now poised to challenge the 200-day moving average in the coming weeks which is right at the year's breakeven level of 2059.

- In the meantime, expect for there to be some resistance in the 2040's.

- Second straight day where SPX tested the 10-day moving average - this time it rallied hard off of the MA.

- 5-day moving average was reclaimed yesterday.

- VIX dropped 11% yesterday to finish the day at 16.05. I still maintain that the current rally in equities continues until VIX goes sub-12 again.

- T2108 rallied a hard 14.6% yesterday to close the day at 66%

- Inverse head and shoulders pattern formed and confirmed over the last two trading sessions. The parabolic rise in afternoon trading yesterday with no pullback of any kind leads me to think that the bears were being forced into a short squeeze rally.

- Weekly Chart of SPX suggests that it needs to close over 2020 this week to clear resistance at that price level.

- The Fed has never raised interest rates at a point where the market was trading lower on the year.

My Trades:

- Added one new long position yesterday.

- Did not close out any long positions yesterday.

- 60% Long / 40% Cash

- Remain long: (O:SBUX) at $58.67, (N:DIS) at $105.88, (O:GOOGL) at $676.40, (O:FB) at $95.09, (N:MA) at $95.51

- My focus in trading remains to trade to the long side.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI