Pre-market update:

- Asian markets traded 0.3% higher.

- European markets are trading 0.4% lower.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), Treasury Budget (2)

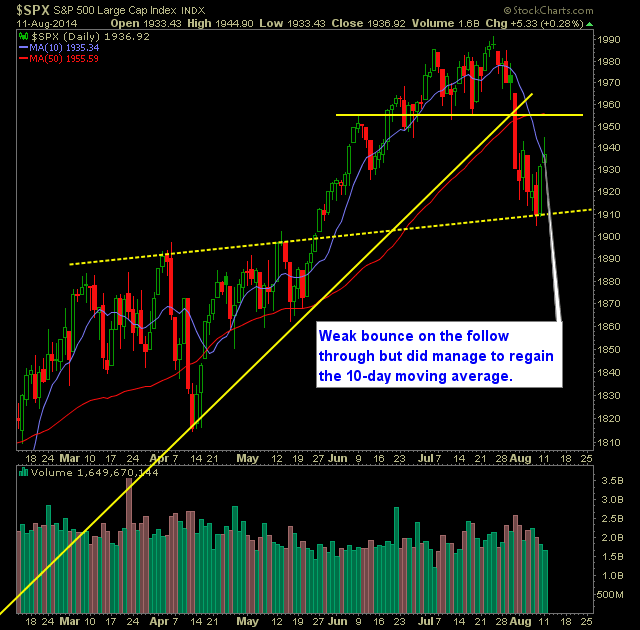

Technical Outlook (SPX):

- A timid follow through yesterday off of Friday's bounce but did manage to re-capture the 10-day moving average.

- Historically the candle isn't necessarily a bad one, but it doesn't necessarily exude bullish gusto either.

- Yesterday is also a sign as well, that the bears have not given up on shorting this market, and that means there is plenty "squeeze" left in this market.

- The main goal for the bears going forward should be to get price back below 1904.

- If price can get back into the 1950's, I expect that to offer a fair amount of resistance.

- Potential bull-flag on the 30-minute SPX chart.

- VIX dropped below the recent consolidation range finished 9.8% lower at 14.23.

- Friday's bounce took place right off of key support as noted below, and also off of the trend-line that dates back to November 2012.

- Volume is slacking off a bit, which is no surprise for yesterday considering the lack of any real direction.

- The market indicators still show conditions to be very oversold still.

- What tends to be the biggest obstacle facing the markets currently is the pipeline of bad news facing the market over the last 3-4 weeks. If the news quiets down, the market should be fine.

- The market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My Trades:

- Sold NFLX at $452.64 for a 5.2% gain.

- Added one additional position to the portfolio yesterday.

- Remain long EBAY at 51.75, GPK at 12.00, AAPL at 95.56, FB at 72.53, WDC at 102.17, ESRX at 71.01.

- Will look to add 1-2 new long positions, or start a short position as a hedge if conditions warrant it.

- 70% Long / 30% Cash

Chart for SPX:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI