Pre-market update:

- Asian markets traded 0.3% lower.

- European markets are trading 0.5% lower.

- US futures are trading 0.2% lower ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), Consumer Credit (3)

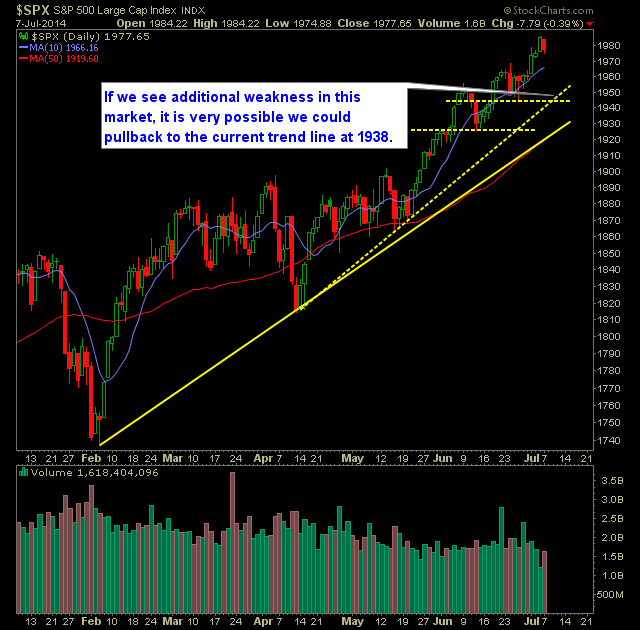

Technical Outlook (SPX):

- An inside day of bearishness yesterday on the candlesticks.

- Additional weakness in the pre-market today will give the bears an instant opportunity at the open to decide whether it wants to buy the dip or not.

- I could see a legitimate pullback taking us back to the rising trend-line (short-term) which currently sits at 1938 (see chart below).

- Volume, though below average picked back up some from last week's light volume sessions.

- It has become very typical to see huge 1-day spikes on the VIX like we saw yesterday (9.8%) only to start the process of giving it all back the following days and seeing SPX trade higher as a result.

- I don't see any reason to be net short on this market or piling into any new shorts at the moment considering there is no damage on the charts and we haven't even broken the 10-day moving average either.

- There is the potential for SPX 30-minute chart to form a head and shoulders formation. Right now there is only a left shoulder and head.

- Long-Term upper channel band that began in March of 2012 was broken last week, which gets some heavy resistance out of the way.

- For the bears to make any kind of impression on this market, they need to start with breaking price below the 10-day moving average. That moving support level has provided substantial support over the last two weeks for the bulls.

- Important support is at 1944, as a break of that price level would establish a new lower-low.

- The rising trend-line off of 4/14/14 currently sits at 1938.

- The market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Sold XLNX yesterday at $48.71 for a 2.9% gain.

- Sold URI yesterday at $106.73 for a 0.9% gain.

- Did not add any new positions yesterday as the market did not provide any favorable conditions for doing so.

- Will look to add 1-2 new positions today.

- Remain long CX at 13.22, AAPL at 91.49, GOOG at $580.51, BKD at $33.79.

- 40% Long / 60% Cash

Chart for SPX: