Nvidia shares jump after resuming H20 sales in China, announcing new processor

Pre-market update:

- Asian markets traded 0.7% higher.

- European markets are 0.4% higher.

- US futures are trading 0.4% higher ahead of the market open.

Economic reports due out (all times are eastern): None

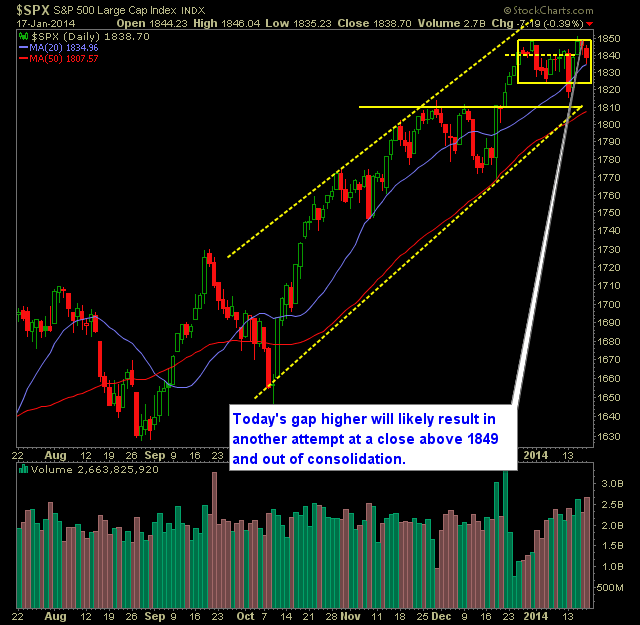

Technical Outlook (SPX):

- SPX pulled back for the second straight day on Friday, but held the 10 and 20-day moving averages perfectly.

- With the 10-day and 20-day moving averages converging together, it should provide extrasupport in the days ahead.

- You also have the rising trend-line off of the October lows that is getting much closer to the price action - now at 1825.

- Volume was noticeably higher on Friday's sell-off.

- Consolation in this market has been the theme since 12/23. Almost a full month of it to start 2014 out.

- January, which is often used as a barometer for the rest of the year, in terms of sentiment, remains in the red for the month.

- VIX continues to hover around the 12 mark. In the past this has led to some minor sell-offs.

- No clear-cut pattern on the SPX 30 minute chart - only choppiness.

- We are coming up on a month of price action where we have been stuck in a 27 point price range.

- SPX is back into overbought conditions.

- Once the SPX closes above 1849, the bears will have all chances of a significant pullback temporarily suspended yet again.

- At this point the bears need to send price lower without giving up any more ground. Doing so would create the possibility for a short-term double top using the peak from yesterday and the one from 12/31.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My Opinions & Trades:

- Did not add any new positions on Friday.

- Remain long TRN at 56.17, IPG at 17.71, FLS at 77.75, MEOH at 60.16, BRO at 32.06

- I will look to add 1-2 new positions today.

- Long 50% / Cash 50%

Chart for SPX:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI