Nvidia to resume H20 chip sales in China, announces new processor

Pre-market update:

- Asian markets traded -2.7% lower.

- European markets are trading -0.4% lower.

- US futures are trading 0.7% higher ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Gallup US ECI (8:30), Redbook (8:55)

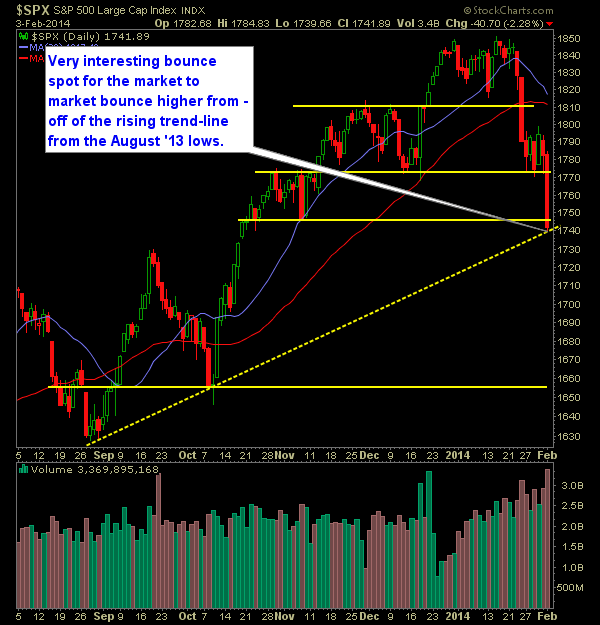

Technical Outlook (SPX):

- Huge sell-off yesterday on the SPX took the index down 40 points.

- That kind of sell-off hasn't been seen since 6/20/13.

- August 2013 rising trend-line off of its lows has provided some temporary support for the fast falling SPX at 1741.

- Critical support at 1772 was broken yesterday and next significant level is all the way down to 1655.

- A lower-low has now been formed on the SPX chart.

- The previous two gap ups held well, which bodes well for today's market open.

- VIX rose 16% to 21.44. Above 20 is considered bearish territory.

- For any bounce at this point, the bulls need to push price above 1770.

- For the bears they need to endure the bounce and make sure it is nothing more than a dead cat.

- Volume strong the last two days.

- January represented the first down month since August 2013.

- A bearish January has had little effect the rest of the year, as three out of the last four bearish January's have seen a positive return on the year.

- Five out of the last seven trading sessions have seen heavy sell-offs.

- The potential for a major short squeeze is very possible - traders are getting sucked into the short trade and it is already becoming very crowded.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Closed out CX at 12.04 for a 1.9% loss and UTX at 110.79 for a 2.3% loss.

- Remain long SPLK at 75.00 and MU at 23.19. CAM at 60.40.

- Will consider 1-2 new positions based on market conditions.

- Long 30% / Cash 70%

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.