Stock market today: S&P 500 slumps as Trump tariff blitz triggers bloodbath

Pre-market update:

- Asian markets traded 0.7% higher.

- European markets are trading 0.2% lower.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): Empire State Manufacturing Survey (8:30), Treasury International Capital (9), Housing Market Index (10), E-Commerce Retail Sales (10)

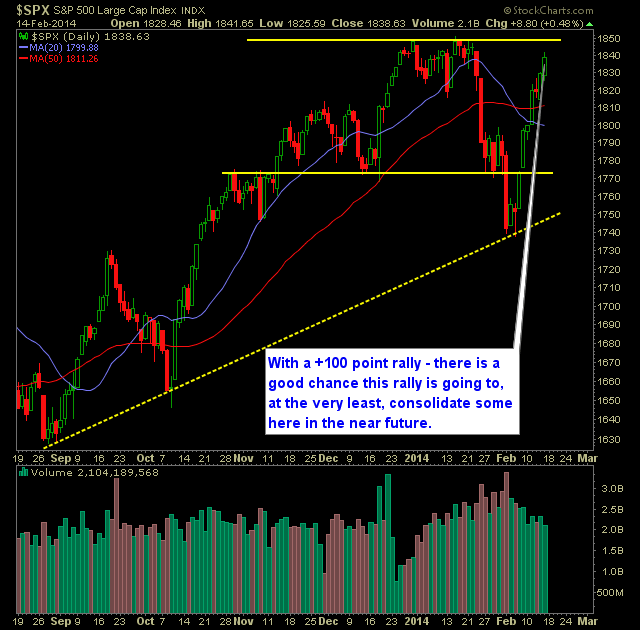

Technical Outlook (SPX):

- Since 2/5, SPX has rallied 101 points and risen 6 out of the last 7 days.

- I suspect that there will be some resistance between 1841 and 1850 this week.

- The problem with the breakout here to new all-time highs is that SPX would have rallied 7% without any pullback and would be making brand new highs after it is extremely over-extended which is likely to lead to a pullback of some type.

- Fair to say, that you should expect at least some kind of consolidation this week, particularly with it being a holiday-shortened week.

- Volume continues to decline on the rise in the last two weeks.

- VIX has dropped all the down to 13.5 from the 21+ two weeks ago.

- Stochastics are overbought yet again.

- The biggest technical support level is the strength SPX found from the trend line that started off of the August '13 lows.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Closed SPLK at $86.58 for a 15.4% gain.

- Closed MU at $25.27 for a 9% gain.

- Closed SWFT at $24.27 for a 10.3% gain.

- Closed out ADSK at $54.62 for a 4.9% gain.

- Did not add any new positions on Friday.

- Remain long HAR at 105.00, MTW at 27.28, CLR at 112.34.

- Will consider 1-2 new positions based on market conditions.

- Long 30% / Cash 70%

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.