Trump announces trade deal with EU following months of negotiations

Pre-market update:

- Asian markets traded 0.4% lower.

- European markets are trading 0.9% lower.

- US futures are trading 0.4% lower ahead of the market open.

Economic reports due out (all times are eastern): Consumer Credit (3)

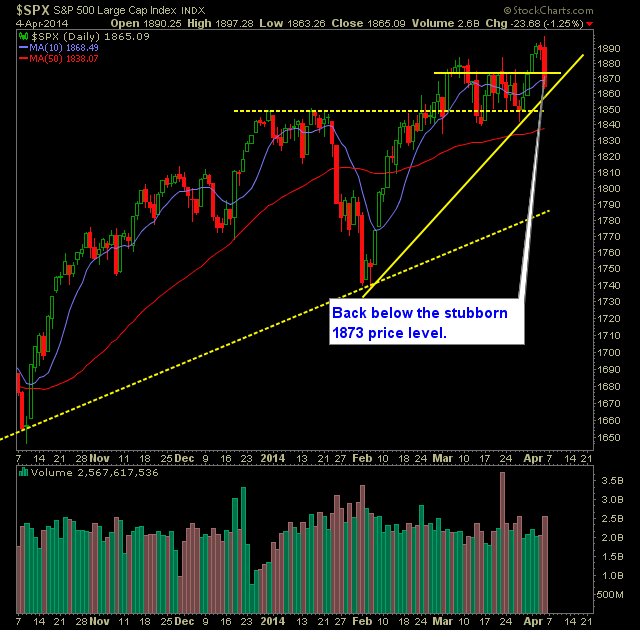

Technical Outlook (SPX):

- One of the more detrimental days in the stock market over the past year took place on Friday, particularly in the Nasdaq which plunged 2.6% and made new lower-lows.

- 10-day and 20-day moving averages on SPX were breached on Friday.

- More importantly the resistance level at 1873 that the bulls fought hard to break through was lost yet again.

- Overall, Friday saw a 32 point drop from its high print of the day to the closing price.

- Above average volume, but the VIX only bounced 4% to 13.96 which is a bit strange to me. I would've expected a much strong pop in the VIX for the kind of sell-off that was seen.

- Heading into the new week stocks are definitely tilting bearish. However, like what we've seen over the past five years, this market proven to be plenty resilient. Respect that.

- The biggest technical support level is the strength SPX found from the trend line that started off of the August '13 lows.

- The Market doesn't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions And Trades:

- Sold Axiall Corporation (AXLL.K) on Friday at $48.34 for a 6.5% gain.

- Sold Seagate Technology (NASDAQ:STX) on Friday at $56.27 for a 0.1% gain.

- Sold MetroPCS Communications (NYSE:TMUS) at $32.77 for a 0.4% loss.

- Sold EI du Pont de Nemours and Company (NYSE:DD) at $67.30 for a 0.7% loss.

- Will look to add 1-2 new positions today either long or short.

- Remain long W&T Offshore Inc (WTI) from $16.99, Joy Global (NYSE:JOY) at $58.68.

- Long 20% / Cash 80%

Chart for SPX:

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.