Pre-market update:

- Asian markets traded 0.2% higher.

- European markets are trading flat.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): Housing Starts (8:30), Industrial Production (9:15), Consumer Sentiment (9:55)

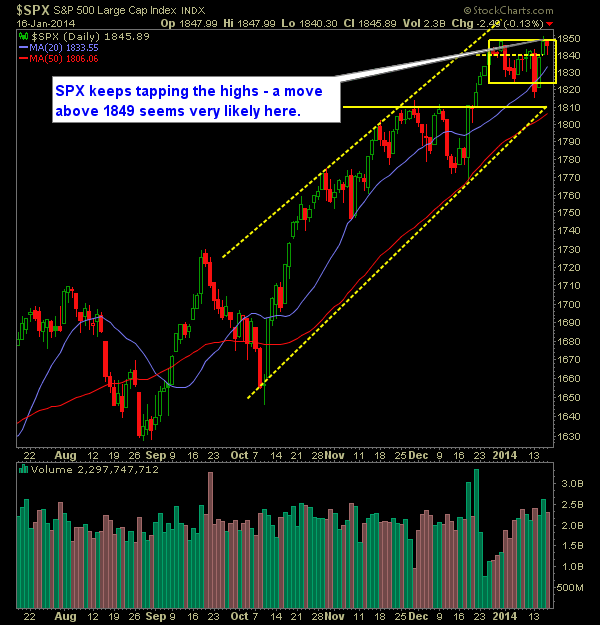

Technical Outlook (SPX):

- SPX continues to tap the all-time closing highs at 1849.

- What makes this bullish is the last two days, it has tested the highs but has not seen strong selling ensue. Price action is instead hovering right at the highs in anticipation of a future break.

- We are coming up on a month of price action where we have been stuck in a 27 point price range.

- Volume continues to be steady.

- SPX is back into overbought conditions.

- Once the SPX closes above 1849, the bears will have all chances of a significant pullback temporarily suspended yet again.

- At this point the bears need to send price lower without giving up any more ground. Doing so would create the possibility for a short-term double top using the peak from yesterday and the one from 12/31.

- Any heavy sell-off at this point needs to take price at least below the rising trend-line off of the October lows - which currently sits at 1820.

- After that key support becomes 1809 which is the point where SPX broke out on 12/18/13.

- 2% pop in the VIX yesterday to 12.53.

- January is trading in much the same way as December 2013 did.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Sold ALGN at $62.04 yesterday for a 5.2% gain.

- Added 1 new positions yesterday.

- Remain long AIG at 51.54, TRN at 56.17, IPG at 17.71, FLS at 77.75, MEOH at 60.16.

- I will look to add 1-2 new positions today.

- Long 60% / Cash 40%

Chart for SPX:

Original post