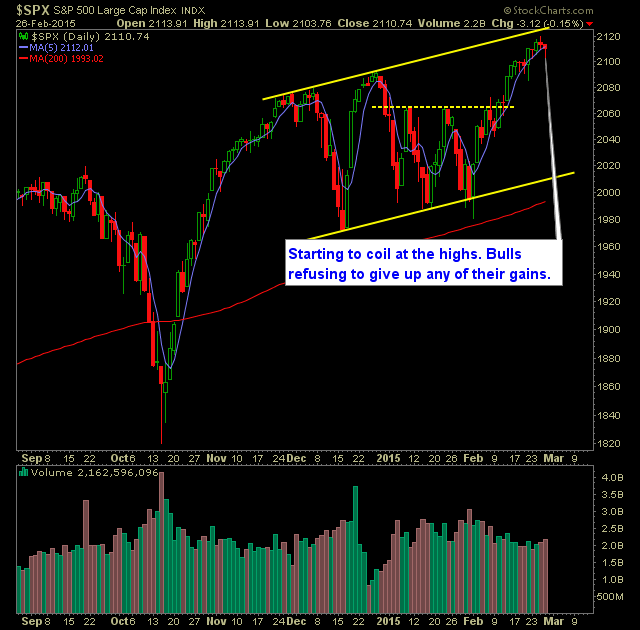

Technical Outlook S&P 500:

- Another near-problematic trading session for the bulls that saw the bulls close below the 5-day moving average for the first time since 2/9/15. The 10-day moving average was tested and held strong - to perfection actually.

- For now, the uptrend of SPX is not jeopardizing, but the bulls need to pull it together here real soon, or the bears may become reinspired. Currently SPX is down 3 of the last 4 trading session and 5 out of the last 7.

- SPX 30 minute chart was saved in the final hour from confirming a near head and shoulders pattern. The pattern has not yet been nullified and is still in play for today.

- 2102 on the 30 minute chart would confirm the H&S pattern.

- VIX finished 0.5% higher to close at 13.91.

- Crude oil is continuing the trend lower and could be a problem for the SPX in terms of advancing higher.

- SPX very close to the upper band but has yet to formally test it - today it is at 2128.

- Volume remains very light of late.

- The current trend-line for the SPX shows that the trend itself is maturing and not giving us the big pops that we saw early on in the rally.

- SPX is continuing with the theme of slight weakness at the market open, followed by selling thereafter, and a bottom in the first hour of trading that results in a rally off the lows.

- Oil broke to the downside and out of the recent range. Be careful about any long positions connected to oil.

- A pullback on SPX would not be able to drop below 2065 level without threatening key price support and the integrity of the current uptrend.

- Russell 2000 breakout out perfectly above the box range it has been in for over a year now.

- Oil remains extremely volatile and becoming more so each and every day. Very difficult to trade - as are the oil stocks.

- The market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My Trades:

- Closed out MA yesterday at 91.62 for a 6.2% gain.

- Closed out MS yesterday at 36.10 for a 1.6% loss.

- Added two new positions yesterday.

- 40% Long / 60% cash.

- Will look to add another new long position today.

- Remain long DD at 77.19, VZ at 49.29

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI