Pre-market update:

- Asian markets traded 0.7% higher.

- European markets are trading 0.7% lower.

- US futures are trading flat ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), JOLTS (10)

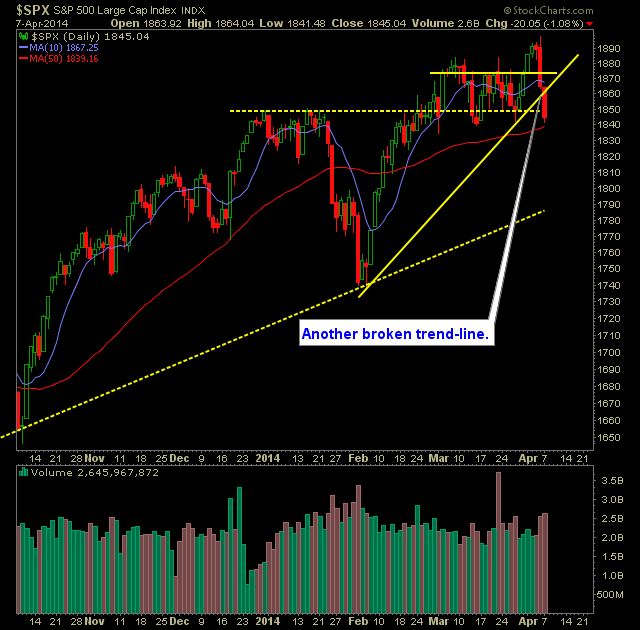

Technical Outlook (SPX):

- Third consecutive day of selling yesterday that led to the trend-line off of the February lows on the SPX to be broken.

- Critical support to be tested at 1839. If that price level breaks, a much greater downward push should arise.

- There is no real pipeline of bearish news driving this market lower which is a bit concerning to me. There is no theme to it besides the fact that it is happening.

- SPX 50-day moving average is in play today at 1839 as well.

- The most important trend-line and level of support for the bulls is the rising trend-line off of the August lows which currently sits at 1784. It wouldn't surprise me if that is where this market is ultimately going.

- SPX has quickly come off of the overbought levels it was at on Friday and making a move towards oversold.

- 30-minute chart of SPX looks completely range bound. Not really bearish in the grand scheme of things.

- VIX popped to 15.57 yesterday. Recent sell-offs have gone into the lower 20's before reversing.

- 10-day and 20-day moving averages on SPX were breached on Friday.

- More importantly the resistance level at 1873 that the bulls fought hard to break through was lost yet again.

- The Market doesn't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My Opinions & Trades:

- Sold WTI at $17.32 yesterday for a 1.9% gain.

- Sold JOY yesterday at $58.80 for a 0.2% gain.

- Will look to add 1-2 new short positions today.

- No current positions in the portfolio.

Chart for SPX:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI