Trump slaps 30% tariffs on EU, Mexico

Pre-market update:

- Asian markets traded 0.3% lower.

- European markets are 0.6% higher.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Producer Price Index (8:30), Retail Sales (8:30), Redbook (8:55), S&P Case-Shiller HPI (9), Business Inventories (10), Consumer Confidence (10)

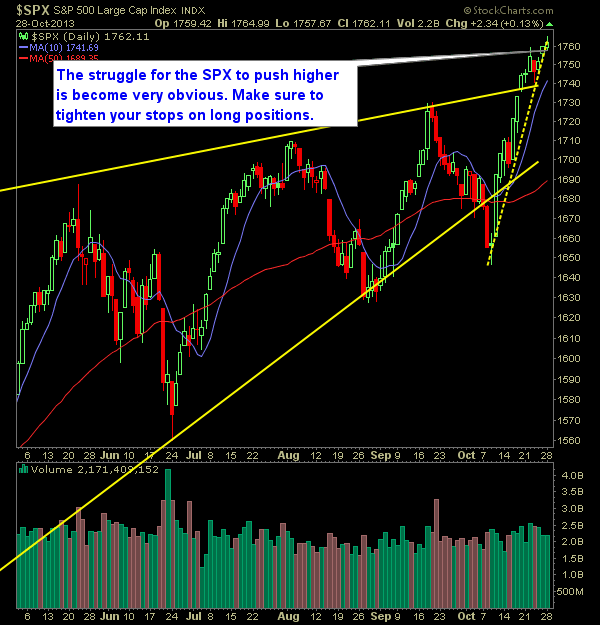

Technical Outlook (SPX):

- SPX continues to rise for a third straight day, but the effort in doing so is a major struggle for bulls in which most of the gains occur on a last ditch effort at the end of the day.

- This 'second-leg' of the rally's price action is looking awfully similar to the price action from 7/16 through 7/22 of this year.

- Also accompanying the lackluster effort of the past three days has been a well-below average volume showing.

- Perhaps a pullback to the 10-day moving average is in order which would be at 1746 today.

- If there is any selling going forward over the course of the next week, the bulls must make sure they hold the 1740 level.

- If that break happens, expect a larger pullback in equities.

- The 30-minute chart continues to trend upwards.

- VIX was higher despite the market being up as well. A bearish divergence.

- After Wednesday's sell-off, I'm guessing that the SPX is entering into a second and final leg before another September-like pullback. These second legs tend to last 5-8 days. But let the price action come to you. Don't front-run it.

- The bias in this market is still to the upside and should be traded accordingly.

- Very little in the way of head-winds for the market as Syria has left the spot-light, shut-downs, debt-ceiling are over with for now, and the most dovish Fed chairman poised to take the helm.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Closed out LYV at 19.26 for a 2.5% gain.

- Added one new long positions and one new short position.

- I am primarily focused on trading to the long side going forward. Will likely look to add more long exposure today.

- Currently 60% long / 10% short / 30% cash.

- Current Longs: MWE at 70.20, GES at 30.96, LPX at 17.87, POR at 29.23, PRU at 81.04.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Original post

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI