Trump says U.K. would fight for U.S., doubts EU commitment

Pre-market update:

- Asian markets traded 1.1% lower.

- European markets are trading 0.1% lower.

- US futures are trading 0.2% higher ahead of the market open.

Economic reports due out (all times are eastern): Chicago Fed National Activity Index (8:30), PMI Services Flash (8:58), Dallas Fed Manufacturing Survey (10:30)

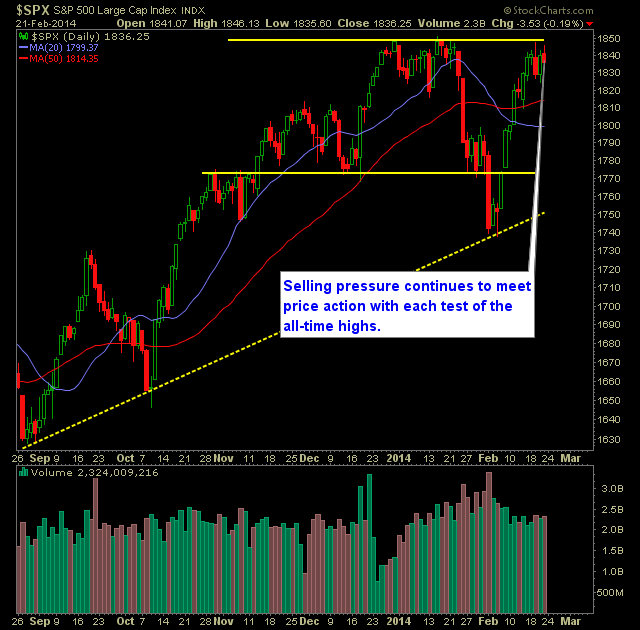

Technical Outlook (SPX):

- Second time in the past three sessions where SPX has failed to break above the all-time highs. Instead it faced immediate, but not heavy selling pressures.

- Watch the 10-day moving average climbing quickly and whether it holds on any test of it - currently at 1824.

- Overall the consolidation over the past five days has been welcomed and necessary for the market after a 100+ point run on SPX

- Strong volume on Friday due mainly to Options Expiration.

- SPX continues to remain overbought since 2/11 and can do so for extended periods of time without a problem.

- With the consolidation at the highs, the SPX presents a bull flag price pattern which bodes well for price action going forward.

- If the bears could hold their ground here and push this market below last week's lows today, you could see fears of a possible double top on the SPX daily chart emerge.

- Two support levels to watch to day are 1825, 1809. The latter of which should result in more bears coming to the table to short this market.

- When testing significant resistance like we have at the all-time highs, I always consider it to be a bad sign if, when unable to break through, we sell-off instead of consolidate. It often indicates there is a lack of fire power to push price through.

- Some distribution seems to be taking place on the 30-minute SPX chart - possible double top.

- The biggest technical support level is the strength SPX found from the trend line that started off of the August '13 lows.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Added one new position yesterday - UA at $112.68.

- Remain long SLB at 90.48, AXL at 19.51, NBL at 67.10.

- Will consider 1-2 new positions based on market conditions.

- Long 40% / Cash 60%

Chart for SPX:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI