Pre-market update:

- Asian markets traded 0.7% higher.

- European markets are trading 0.3% highr.

- US futures are trading 0.2% lower ahead of the market open.

Economic reports due out (all times are eastern): Jobless Claims (8:30), Janet Yellen Speaks (9:30), EIA Natural Gas Report (10:30)

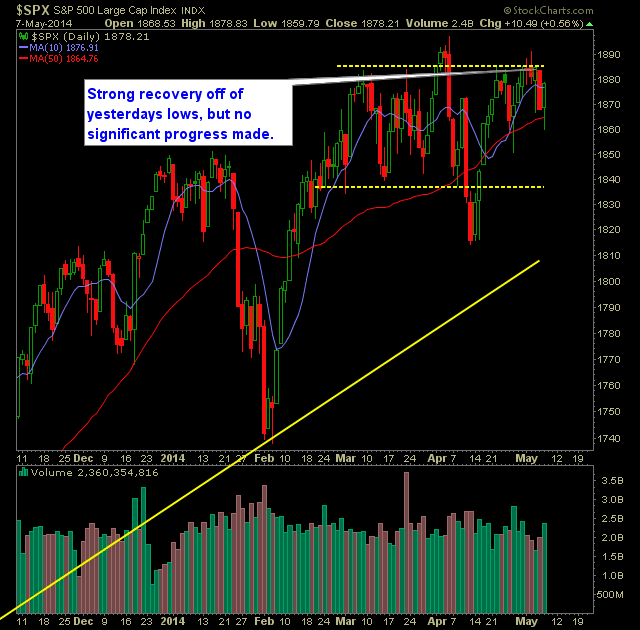

Technical Outlook (SPX):

- After a strong push below the 20 and 50-day moving averages, S&P 500 made a strong push to recapture them into the close as well as the 10-day moving average.

- Despite the strength of yesterday's 19 point move, no progress was truly made in changing the outlook of this market. Still trading under 1883, and that continues to be a "no-go" for bulls.

- With that said, the bears continue to let opportunity slip through their fingers by allowing SPX to remain trading near its all-time highs. Eventually the bull trend will resume unless they crank up the fear factor in this market.

- Volume was stronger today than what we have seen in the previous 6 trading sessions.

- VIX finished a wild day going from the mid-14's down to 13.40.

- While a lot of traders continue to remain bullish on this market, there really is no point in doing so, until a push and close above 1883 can be achieved. Until then, there is far less risk being short on this market than being long.

- Before the momentum can really turn in the bear's favor they need to push price below 1850.

- The 30-minute SPX chart is a bloody mess with no sense of direction.

- In this market, you have to be aggressive with the gains. Take them quick, and don't expect them to last.

- The Market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My Opinions & Trades:

- Covered TEL yesterday at $58.30 for a 1.2% gain.

- Covered MT at $16.15 for a 0.7% loss.

- Added 1 additional short yesterday.

- Will look to add 1-2 new positions today.

- Curbing my short exposure as SPX made a strong recovery off of the lows of the day.

- Remain short JCI at 44.68..

- Remain long BHI at 70.04.

- Short 20% / 10% Long / 30% Cash

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.