Technical Outlook:

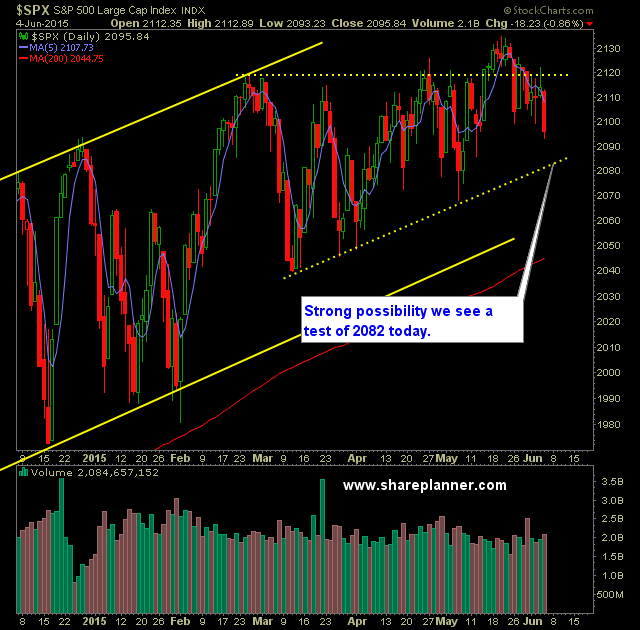

- S&P 500 broke a key short-term support level yesterday at 2099 that had been previously a bounce area for the market.

- SPX also broke the 50-day moving average yesterday which represented another important price level for the bulls to rally off of.

- Now SPX seems likely in the short-term to test 2082.

- If that were to break a test of 2067, or the March lows, would be come a possibility.

- Speaking of 2067, if that were to break at some point, would represent a new lower-low for SPX on the daily time frame.

- VIX closed at 15.22 which represented a break of the declining trend-line off of the October highs. This is an important technical development here for the VIX.

- Bulls need to quickly wipe away the price action from yesterday with a move of its own, by getting price back above 2120 in the near-term.

- Very strong volume came in yesterday and the highest that has been seen since 5/8.

- SPX 30 minute chart shows a head and shoulders pattern that has confirmed.

- The problem with the bulls making new all-time highs during the course of 2015 so far, is that once they are established, nothing else happens; there is no rally that sees a rapid expansion in price.

- Instead the all-time highs have been quickly sold off by the market in general.

- The market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

My Trades:

- I added one additional short position to the portfolio yesterday.

- Did not close out any positions yesterday.

- 20% short / 80% cash.

- Remain long: ProShares UltraShort S&P500 (ARCA:SDS) at 19.90.

- I'll consider adding 1 new short position to the portfolio.

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.