Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

Pre-market update:

- Asian markets traded 1.4% higher.

- European markets are trading 0.2% lower.

- US futures are trading 0.1% higher ahead of the market open.

Economic reports due out (all times are eastern): Jobless Claims (8:30), Chicago Fed National Activity Index (8:30), PMI Manufacturing Index Flash (9:45), Existing Home Sales (10), Leading Indicators (10), EIA Natural Gas Report (10:30), Kansas City Fed Manufacturing Index (11)

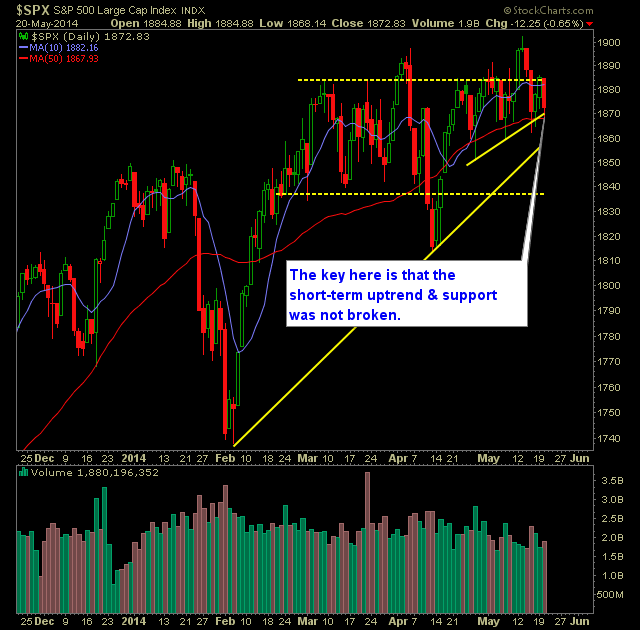

Technical Outlook (SPX):

- Solid bounce day for the market yesterday, particularly SPX.

- Russell Index (RUT) continues to be stuck in its downtrend and lags overall market performance to the upside.

- Clearing above the 1883-5 level sets SPX up for another run toward 1900....this would be the 3rd such attempt in doing so.

- The 50-day moving average continues to be a significant moving average support level to watch going forward.

- VIX saw a significant drop yesterday of 8% and down to 11.91.

- The short-term support rising off of the 4/28 lows continues to hold up well.

- In re: SPY: Don't be troubled by the heavy volume on down days versus the weak volume on up days - that has been happening for years now.

- At all costs, bulls have to make sure that no sell-off results in a close below 1862.

- Bears have shown that despite having favorable market conditions time and time again, that they simply cannot push this market lower over a long period of time.

- Major milestones like 1900 can often lead to profit-taking as it represents a predefined/psychological level where investors decide to book their gains.

- Small caps continue to be the market's weak spot.

- The Market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Added one new long position yesterday.

- Did not close out of any long positions yesterday.

- Will look to add 1-2 new long positions today.

- Remain long EMC at 25.79, GLW at 20.95, LVS at 73.16, EGN at 84.50.

- 50% Long / 50% Cash

Chart for SPX:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI