Tesla is one of the three most shorted U.S. auto stocks

Pre-market update:

- Asian markets traded 1.0% higher.

- European markets are trading 0.1% higher.

- US futures are trading flat ahead of the market open.

Economic reports due out (all times are eastern): Jobless Claims (8:30), Import and Export Prices (8:30), EIA Natural Gas Report (10:30), Treasury Budget (2).

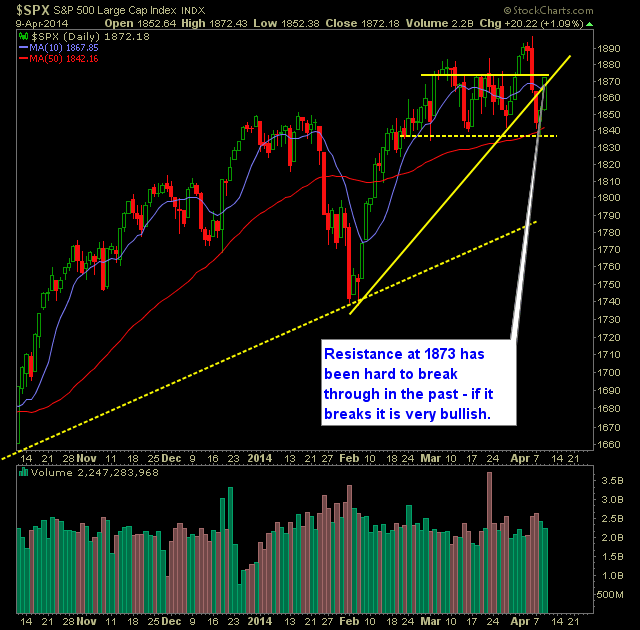

Technical Outlook (SPX):

- Challenge at 1873 resistance is back in play. Prior to breaking it before, SPX struggled to break this price level nine straight times.

- Yesterday it closed just a shade below the price level to leave traders in suspense of the market's intentions from here.

- This is a significant crossroads for the bears. If they are to drive this market lower, they need any attempt to break 1873 to fail and push price back down towards the lower end of the price range. (i.e. 1839 on SPX).

- For the bulls, break 1873, and you are likely off to the races again with a new challenge at 1900 to eventually take place.

- SPX 30 minute chart shows a very unsure and muddled direction with no clear edge as to which side holds the advantage.

- VIX dropped a substantial amount all the way to 13.82.

- Critical support at 1839. If that price level breaks, a much greater downward push should arise.

- The most important trend-line and level of support for the bulls is the rising trend-line off of the August lows which currently sits at 1784. It wouldn't surprise me if that is where this market is ultimately going.

- The Market doesn't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- No new trades yesterday.

- Did not close out any trades yesterday.

- Will look to add 1-2 new positions today.

- No current positions in the portfolio.

- 100% Cash.

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.