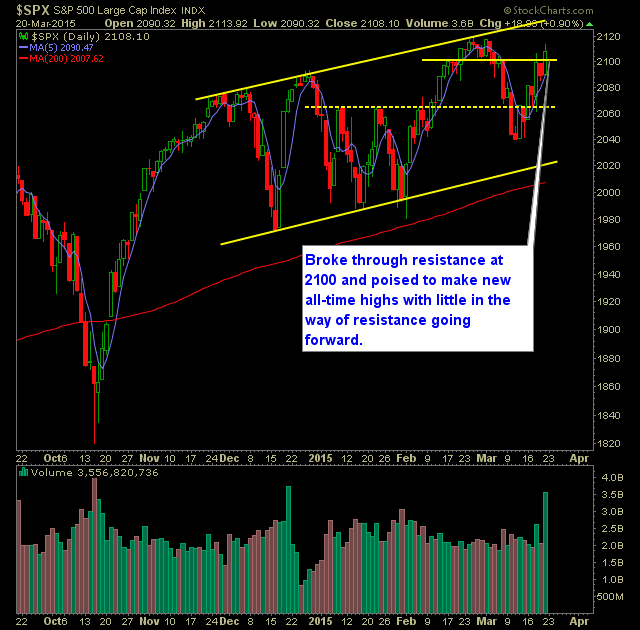

Technical Outlook for (SPX):

- Huge day in the market on Friday, despite quadruple witching.

- Volume was very strong on Friday, and the last two up-days in SPX has seen above average volume levels, while the last two down-days have been below average.

- Today will be a big opportunity for the market to finish higher two days in a row, something the market has not seen in over a month (2/17-2/18).

- The lack of day-to-day continuation to the upside, despite being only a couple of points from all-time highs helps define just how choppy and unpredictable the market has been.

- Last 8 days have resulted in a down-up-down-up price pattern.

- VIX broke a rising uptrend off of the 7/3 lows on Friday when it dropped 7.5% to 13.02.

- T2108 (% of stocks trading above the 40-day moving average) looks very bullish again and making a push to resistance at around 67%.

- 30 minute chart of SPX is marked by a strong move higher with higher-highs and lower-lows. Very healthy.

- Plenty of uncertainty remains in the market short-term. Euro and oil are major players in the market's direction currently.

- Oil remains extremely volatile and becoming more so each and every day. Very difficult to trade - as are the oil stocks.

- The market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Added two new long positions.

- Did not close out any existing positions.

- Will look to tighten stop-losses on existing positions.

- Will look to add 1-2 new positions throughout the day.

- Remain Long: Kohl's (NYSE:KSS) at 75.22, SanDisk (NASDAQ:SNDK) at 84.52.

- 40% long.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.