Trump says Canada to face 35% trade tariffs from August 1

Pre-market update:

- Asian markets traded 0.4% higher.

- European markets are trading -0.3% lower.

- US futures are trading -0.3% lower ahead of the market open.

Economic reports due out (all times are eastern): Chicago PMI (9:45), Pending Home Sales Index (10), Dallas Fed Manufacturing Survey (10:30)

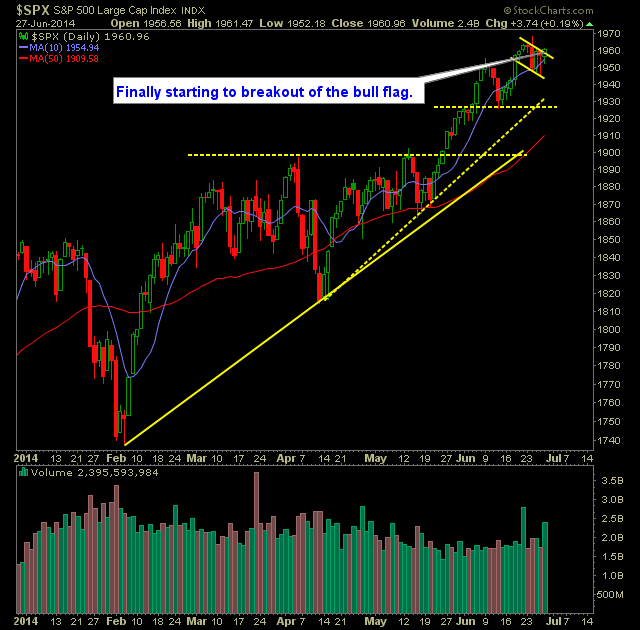

Technical Outlook SPX:

- SPX has started to breakout of the bull flag and still maintains support at the 10-day moving average.

- Strong possibility of SPX establishing new closing highs today.

- Near-timer support level to hold is Thursday's lows which is currently at 1944.

- More importantly is support at 1925, as a break of that price level would establish a new lower-low.

- VIX dropped another 3.2% on Friday to close at 11.26.

- Volume was light on Friday.

- SPX 30 minute chart has a quasi-double bottom chart that it formed last week and is now starting to break out of it.

- The rising trend-line off of 4/14/14 currently sits at 1927.

- The market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Closed out FSLR at $71.24 for a 2.2% gain.

- Closed out KATE at 37.64 for a 2.6% loss.

- I added one additional long position on Friday.

- Will look to add 1-2 new long positions today. May also look to take some gains in existing positions.

- Remain long FB at 66.63, YOKU at 22.02, DDD at 56.54, FSLR at 69.69, CX at 13.22.

- 50% Long / 50% Cash

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.