Bitcoin price today: reaches new record high over $122k ahead of ’crypto week’

Pre-market update:

- Asian markets traded -1.4% lower.

- European markets are 0.5% higher.

- US futures are trading 0.7% higher ahead of the market open.

Economic reports due out (all times are eastern): GDP (8:30), Jobless Claims (8:30), Pending Home Sales Index (10), EIA Natural Gas Report (10:30)

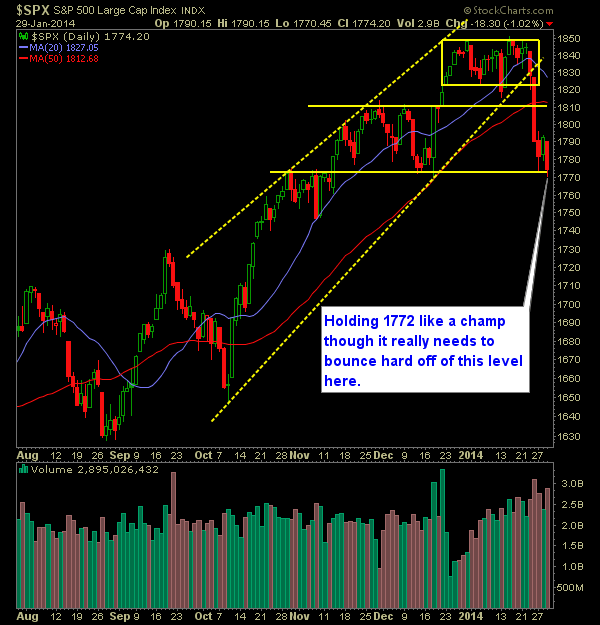

Technical Outlook (SPX):

- SPX ready to bounce at the open after another heavy sell-off yesterday.

- Four out of the last five trading sessions have seen heavy sell-offs.

- Yesterday we tested the 1772 level again and despite dipping below the level intraday, the SPX managed to hold the level.

- For the bulls, any bounce today needs to take price back above 1795 at the close.

- For the bears any legitimate sell-off needs to take price below 1772 at the close.

- A strong oversold bounce seems likely at current price levels.

- Even in dead-cat bounce scenarios there are usually 2-3 days of positive momentum before the sell-off continues. Keep that in mind if you are looking to remain bearish on the market.

- First time since 12/16 that we have been oversold - which was right before the market popped off of the FOMC statement then.

- A multi-day bounce could easily take the SPX back up to 1809 without much resistance.

- VIX popped back up to 17.35 yesterday.

- Over the last two months - you have a beautiful double top that has formed.

- Until 1772 is broken there is not a significant lower-lower put in place for SPX.

- Three out of the last four Red January's have resulted in a bullish market for the year. So the January barometer really isn't that much to rely on.

- Markets don't care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Did not add any new positions yesterday.

- Closed out BAS at $16.65 for a 2.7% loss.

- Long 50% / Cash 50%

- Will look to add 1-2 new positions today.

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.