Economic reports due out (all times are eastern): Wholesale Trade (10)

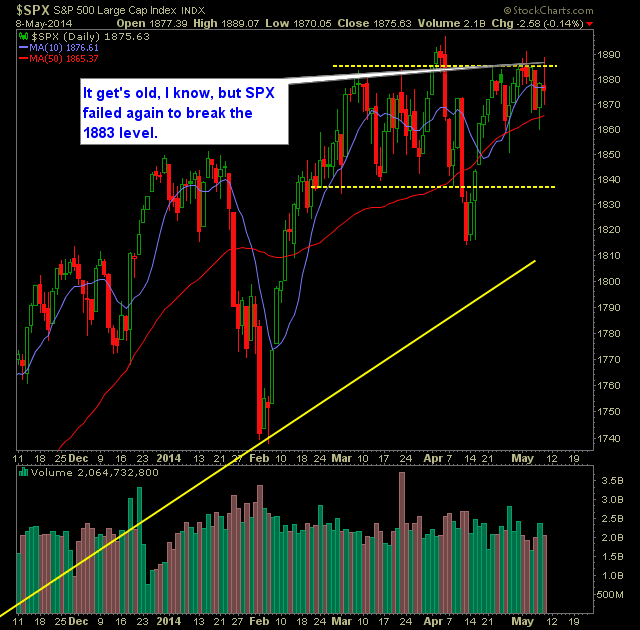

Technical Outlook (SPX):

- There is no conviction to the upside, if so, we'd be way above 1883 by now, instead when the price level breaks intraday, it just gives traders a reason to short the market.

- However, the bears continue to let opportunity after opportunity slip through their hands and let the bulls by every dip.

- As a result you have a market that is in a stand off with the bulls and bears and neither one of them seem to be motivated to protect their turf.

- So the key will be the same tomorrow as before, to get long biased, the market needs a decisive break through 1883. Otherwise, the rallies should be sold at 1883.

- Before the momentum can really turn in the bear's favor they need to push price below 1850.

- The 30-minute SPX chart is a bloody mess with no sense of direction.

- In this market, you have to be aggressive with the gains. Take them quick, and don't expect them to last.

- The Market doesn't care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

Added 1 additional short yesterday.

- Remain short JCI at 44.68, RCL at 51.93.

- Remain long BHI at 70.04.

- Short 30% / 10% Long / 60% Cash

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Chart for SPX:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.