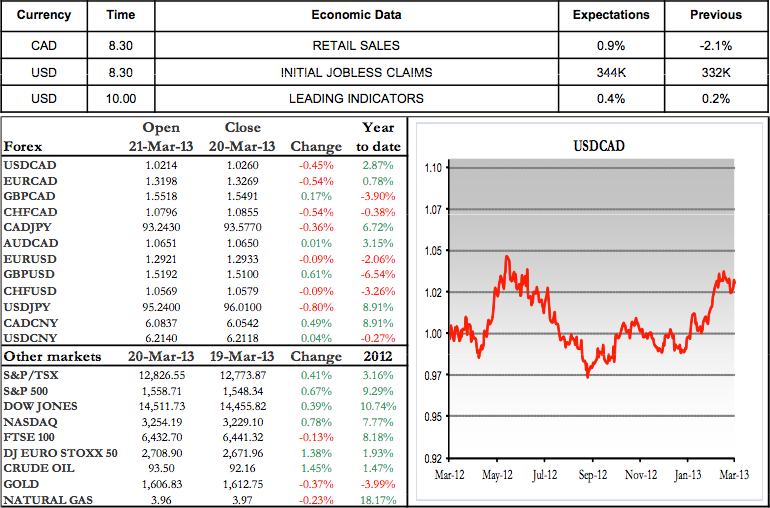

- The Federal Reserve confirmed yesterday that, despite the slight improvement in economic conditions, it will maintain its bond-buying program at a pace of some $85 billion a month. According to Bernanke, it will take more that gains in the job market for the FOMC to alter its position. The USD/CAD pairing barely moved further to the news.

- Weekly U.S. Initial Jobless Claims figures are expected at 8:30 this morning. Markets are forecasting some 344,000 claims over the past 7 days, versus 332,000 previously. This would explain, at least in part, why Bernanke is biding his time before reducing the Fed’s contribution.

- In Canada, we are expecting the release of January Retail Sales data. Markets anticipate growth of 0.9% for the month, compared to -2.1% previously. This could bode well for the Canadian dollar. Wishing you a great day. Xavier Villemaire.

- Range of the day: 1.0180 - 1.0280

- Range of the next 5 days: 1.0075 - 1.0400

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.