We are now in the worst seasonal period for stocks.

The old adage “sell in May and go away” does have some merit. According to the Ned Davis (NDR) database, had you invested $10,000 in the S&P 500 every May 1st starting in 1950 and sold October 31 of the same year, your initial position would only be worth $10,026 as of 2008.

Put another way, by investing only from May through October, a $10,000 stake invested in 1950 would have only made $26 in 57 years.

In contrast, $10,000 invested in the S&P 500 on November 1st and sold April 30th over the same time period would have grown to $372,890. Out of 58 years, you would have had 45 positive and only 13 negative.

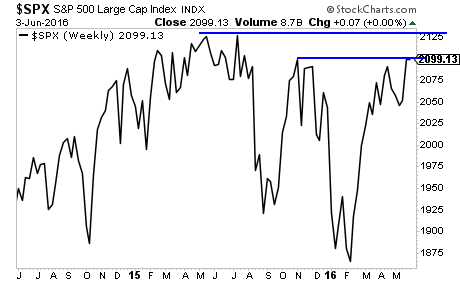

Now consider that stocks failed to produce new highs during this recent rally. Despite being manipulated higher by someone determined to get stocks to 2,100, we’ve slammed into resistance.

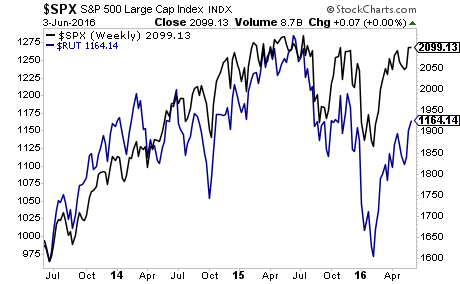

Moreover, the Russell 2000, which usually leads the S&P 500, is lagging far behind: not a good sign if this rally is meant to be the start of something more.

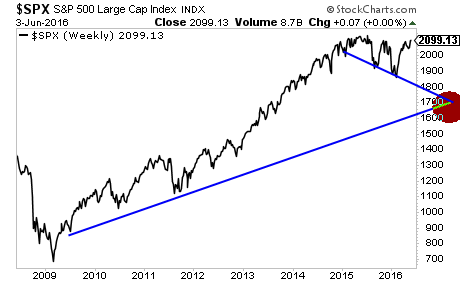

Looking at the long-term S&P 500 chart, we could easily see the market plunge to 1,600: its long-term bull market trendline.

More and more, this environment feels like late 2007/ early 2008: when the economy was in collapse but stocks held up on hopes that the Fed could maintain the bubble.

The time to prepare for this bubble to burst is now. Imagine if you’d prepared for the 2008 crash back in late 2007.

We did, and we’re currently preparing for a similar situation today.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.