Mr Draghi, a few questions for you:

You say that whatever measure you take, it will be “enough” to support the euro. Seeing as you’ve already spent over €1 trillion via your LTRO 1 and LTRO 2 schemes only to find that:

1) The uptick in EU banks shares lasted less with each new scheme

2) The bond and credit markets punished those banks who sought funding via these vehicles

My question then is what exactly is “enough”? Obviously €1 trillion wasn’t. Would €2 trillion be? What about €5 trillion? Seeing as banking deposits at the troubled PIIGS banks exceed €5 trillion alone, it seems even €5 trillion wouldn’t be enough to backstop the EU and get it out of this mess. So could you quantify “enough” please?

My second question: if you were to announce some “Hail Mary” policy of monetizing trillions of euros worth of sovereign and banking debt, how would you stop the euro from imploding?

You’ve no doubt observed the impact that QE 1 and QE 2 had on the US dollar. How would you stop the euro from collapsing if you were to announce an amount that would indeed be “enough” to contain the EU Crisis?

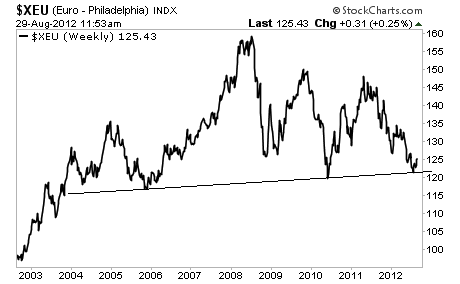

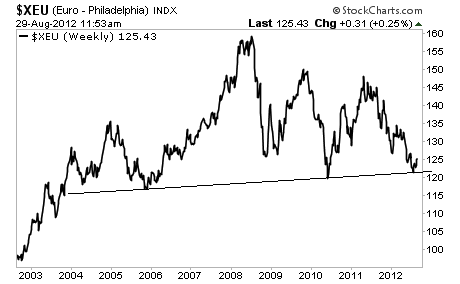

As the below chart shows, the euro is already on the ledge of a very big cliff:

My third and final question: Thus far the ECB, when acting in concert with Germany

After all, if the ECB didn’t have “enough” to handle Greece, what makes you think you have “enough” to handle Spain or Italy? I note regarding this last point that Spain’s bonds are falling again despite a shotgun bailout of €100 billion just a few months ago.

If you actually have answers to these questions, I’m sure the world would love to hear them.

Make no mistake, the crisis in Europe is far from over. If anything, we’re fast approaching the REAL storm over there: when countries actually start defaulting and leaving the euro.

When this happens, we will see the return of systemic risk. And the US will not prove immune to it. Europe is the single largest economy in the world.

It’s also China’s single largest trade partner. If the EU goes down, it will send ripple effects around the globe. And with China entering a hard landing and the US re-entering a recession the potential for another 2008 type event is higher than at any point in the last three years.

You say that whatever measure you take, it will be “enough” to support the euro. Seeing as you’ve already spent over €1 trillion via your LTRO 1 and LTRO 2 schemes only to find that:

1) The uptick in EU banks shares lasted less with each new scheme

2) The bond and credit markets punished those banks who sought funding via these vehicles

My question then is what exactly is “enough”? Obviously €1 trillion wasn’t. Would €2 trillion be? What about €5 trillion? Seeing as banking deposits at the troubled PIIGS banks exceed €5 trillion alone, it seems even €5 trillion wouldn’t be enough to backstop the EU and get it out of this mess. So could you quantify “enough” please?

My second question: if you were to announce some “Hail Mary” policy of monetizing trillions of euros worth of sovereign and banking debt, how would you stop the euro from imploding?

You’ve no doubt observed the impact that QE 1 and QE 2 had on the US dollar. How would you stop the euro from collapsing if you were to announce an amount that would indeed be “enough” to contain the EU Crisis?

As the below chart shows, the euro is already on the ledge of a very big cliff:

My third and final question: Thus far the ECB, when acting in concert with Germany

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

and the IMF, has failed to contain the Greek crisis (there is now talk of Greece needing a third bailout), how exactly do you intend to handle Spain or Italy (economies and banking systems many multiples larger than those of Greece)? After all, if the ECB didn’t have “enough” to handle Greece, what makes you think you have “enough” to handle Spain or Italy? I note regarding this last point that Spain’s bonds are falling again despite a shotgun bailout of €100 billion just a few months ago.

If you actually have answers to these questions, I’m sure the world would love to hear them.

Make no mistake, the crisis in Europe is far from over. If anything, we’re fast approaching the REAL storm over there: when countries actually start defaulting and leaving the euro.

When this happens, we will see the return of systemic risk. And the US will not prove immune to it. Europe is the single largest economy in the world.

It’s also China’s single largest trade partner. If the EU goes down, it will send ripple effects around the globe. And with China entering a hard landing and the US re-entering a recession the potential for another 2008 type event is higher than at any point in the last three years.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.