The Fed will announce the decision of its July FOMC meeting this evening accompanied by a statement on the decision, though no scheduled press conference from Fed Chair Yellen. With trading volumes reduced into the summer months, the details of today’s statement will likely set the tone for USD trading between now and the September meeting and as such, will be keenly scrutinized by trades.

Given the comments we had from Fed Chair Yellen recently in her semi-annual testimonies regarding the Fed’s commitment and desire to raise rates sooner rather than later, market participants have been cautiously optimistic going into this meeting that the accompanying statement will provide further hawkish support from the Fed.

So what further hawkish support might we get from this statement? It is possible that the Fed could give a further indication as to the proximity of a rate increase similar to the comments we had recently from BOE Governor Mark Carney regarding a UK rate hike, and indication without being too specific. Currently, implied probability shows only a 17% chance of a rate increase at the September meeting, and only a 34% chance of a hike at the October meeting, so clearly any indication of a lift-off date looking near would be welcomed by USD bulls.

However, going into this meeting, it feels as though the risks are skewed more to the downside. The Fed have reiterated their commitment to raising rates, but also to their data dependent stance on a lift-off. Looking at the recent data, we have had some improvements, CPI came in with a small beat, NFPs have rebounded to register a big win, unemployment rate declined, and housing data has looked stronger, besides the big miss we saw in New Home Sales. ISM Non-Manufacturing missed, as did Retail Sales, and just yesterday, we saw a big miss in Consumer Confidence. In comments made during her testimonies, Yellen cited increased consumer confidence as supportive of a rate-increase, so I wonder how recent consumer data will affect the statement we get today.

Similarly, in the last statement, the Fed noted that the downward pressure on inflation due to energy price volatility was likely transitory and that “energy risks appear to have stabilized;” however, since that statement, we have seen further declines in energy prices, surely dampening the Fed’s view that these negative impacts will be soon to clear? Again, the same story with commodity prices and the negative impact of non-energy imports; with commodity prices having also deteriorated further, it will be interesting to see how the Fed views current conditions and whether they allow the Fed to be “reasonably confident that inflation will move back to its 2 percent objective over the medium term.”

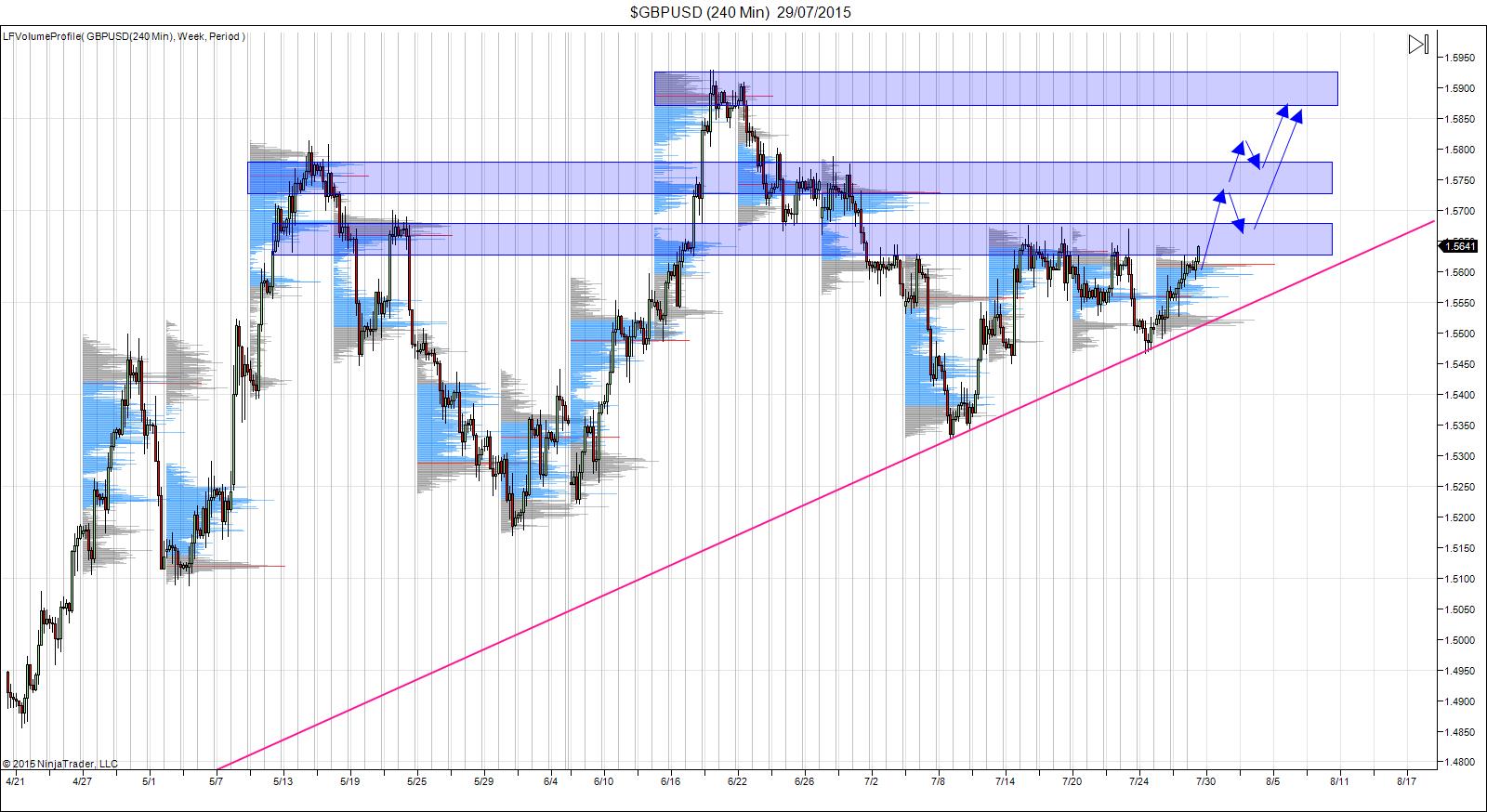

GBP/USD has been fairly pressured pressured in the last month and could see some sharp upside relief if dollar bulls are disappointed. The pair is likely to be supported, given the BOE’s increased hawkishness surrounding rate hikes, with market participants expecting further support from next week’s meeting, following yesterday’s positive GDP release.

A dovish FOMC would open up a retest of the 2015 highs in GBP/USD. Having held the ascending trend line from the yearly low, GBP currently is challenging initial resistance. Following this evening’s statement release, I will be looking for any pull back into the overhead resistance areas for entering longs.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.