Gold, loved by many and distained by at least a few (including Warren Buffett) is an unusual investment. It won’t grow, doesn’t offer a dividend, and other than jewelry and some industrial uses it gets stuck in guarded vaults for safekeeping. With no positive cash flow associated with it, the value of gold is whatever the market says it is.

In the past, investors that were bullish on gold and wanted to invest via the stock market bought stock in companies that mined gold. In theory these companies should do very well if gold prices increase, but in practice things like depleted deposits or inflated claims sometimes interfered—giving credence to the old saw, “A gold mine is a hole in the ground with a liar on top.”

With the rise of ETFs that physically hold gold there’s no need to invest indirectly, you can buy shares that closely track the price of gold, and pay 0.40% or less in annual fees. GLD, the biggest of these funds, currently holds $72 billion in assets, second only to SPY in the ETF world. At the end of 2011 ETFs held around 2400 tons of gold—roughly 1.5% of the world’s stock of approximately 165,000 tons. All the ETF gold, currently worth around $135 billion, would fit in a room that was 5 x 5 x 5 meters in size, so I’m guessing the various storage vaults needn’t be very big.

At the recent IndexUniverse’s Inside ETFs Conference I had the opportunity to talk with Will Rhind, Managing Director at ETF Securities. Will’s firm manages ETFs including ETFS Physical Swiss Gold Shares (SGOL) and ETFS Physical Asian Gold Shares (AGOL) which are among the top 10 gold ETFsin the world. I had three general questions for Will:

- Physically backed ETFs have expanded into other materials besides gold, what will be the limits to that expansion?

- How do etf securities’ gold offerings differ from their competitors?

- Does he think the price of gold is becoming more correlated with the stock market?

On the other hand ETF Securities already offers physical ETFs for copper (PHCU) and aluminum (PHAL) that hold their assets at the London Metal Exchange and are listed on the London Stock exchange. At current spot prices of approximately $3.75/pound and $1.00/ pound respectively, these metals require a lot less security than gold, and take up a lot more storage space.

Many investors in gold are very sensitive to security—including geo-political turmoil. By storing SGOL’s assets in Switzerland, and AGOL’s assets in Singapore ETF Securities offers diversification alternatives to GLD which stores its gold in London, and IAU that stores its gold in New York, London, and Toronto.

Will’s opinion is that the price of gold is inherently uncorrelated with the stock market. An interesting research report from ETF Securities reviews gold’s correlation to stocks, currencies, European bond CDSs and examines factors like central bank purchases that might drive the price of gold in 2012.

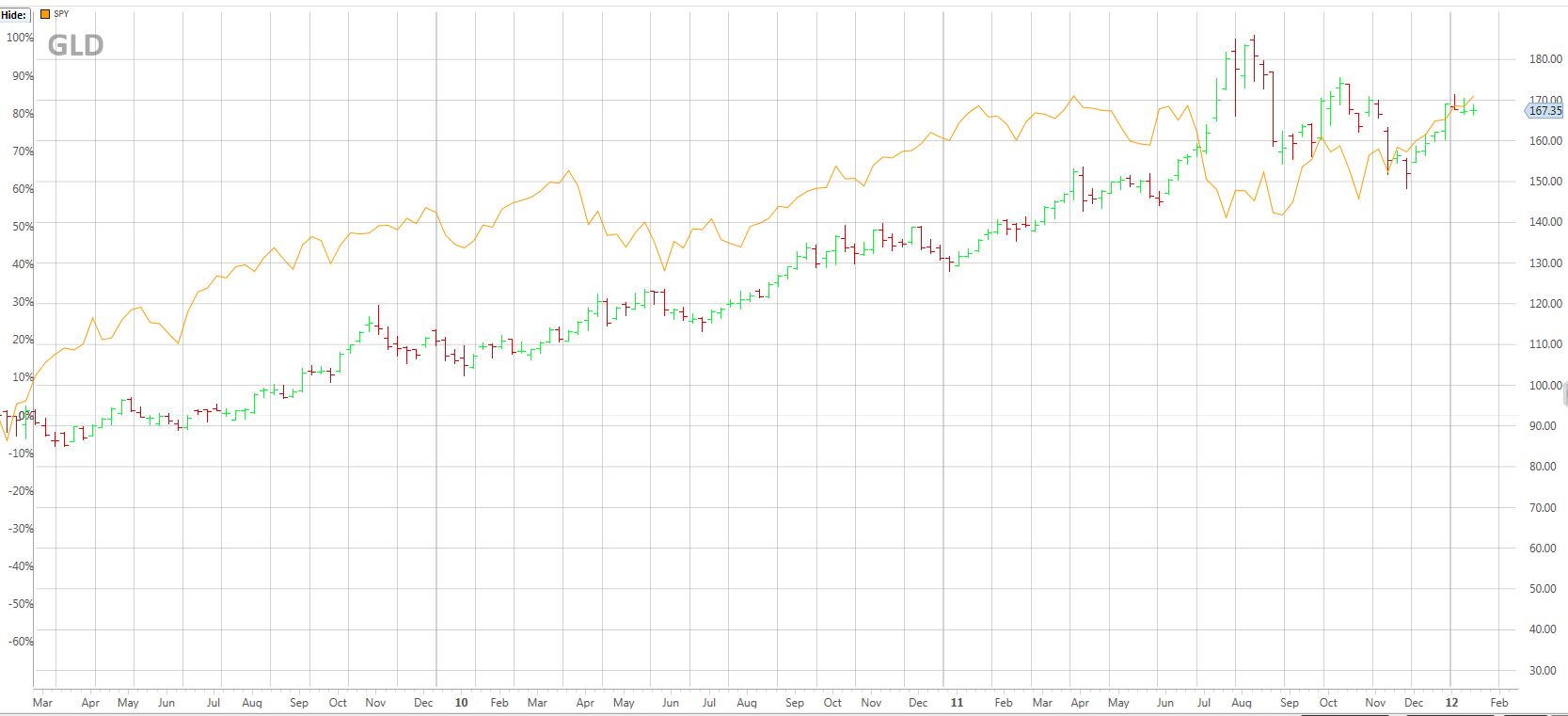

After we talked I pulled up some comparison charts. This first one I generated, starting in March 2009, shows the two investments to be pretty darn correlated. GLD is the bar chart, SPY is the yellow line. Click to enlarge.

GLD vs SPY

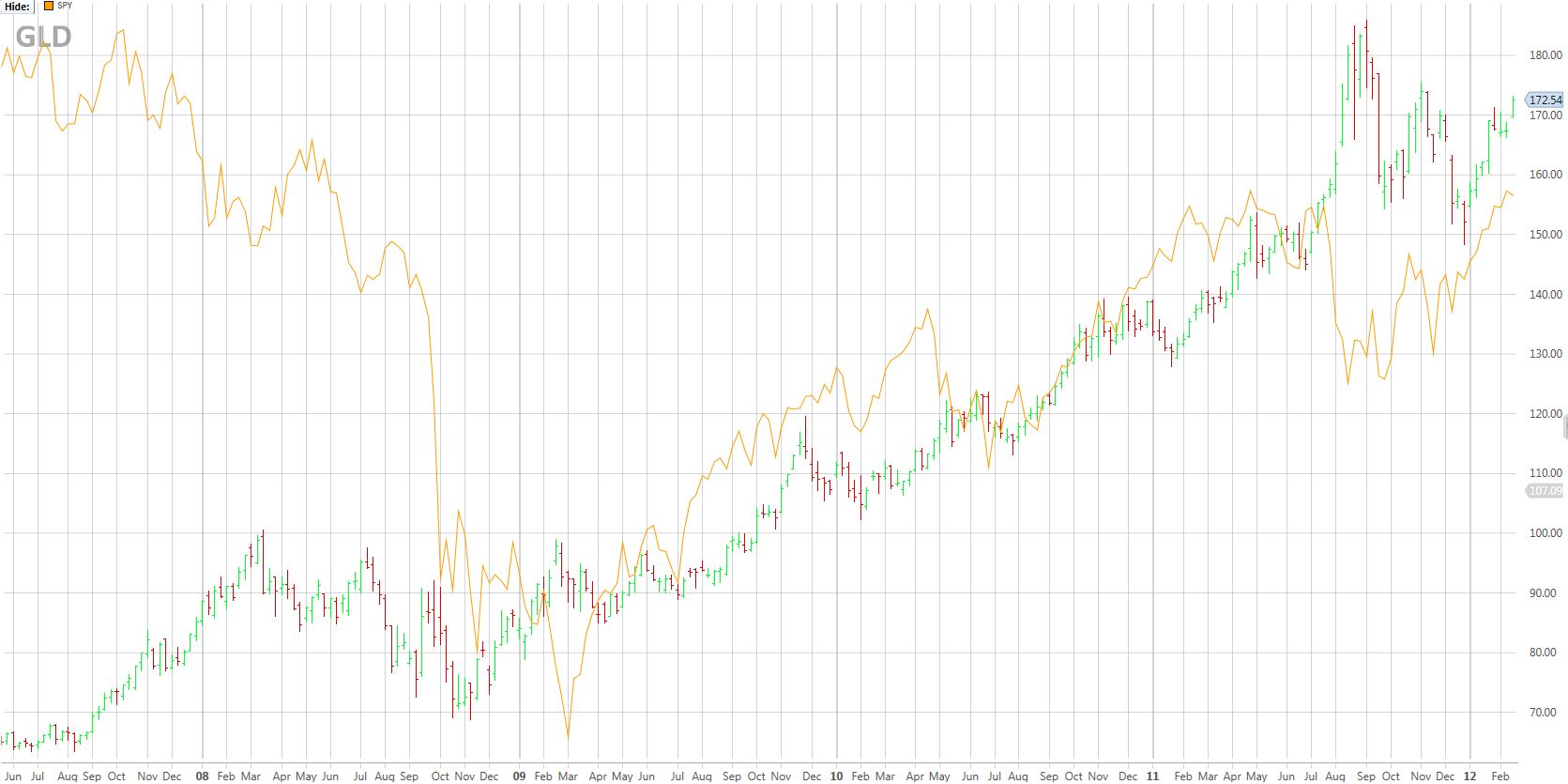

Increasing the time span to start in May 2007 gives a dramatically different picture.

GLD vs SPY starting May '07

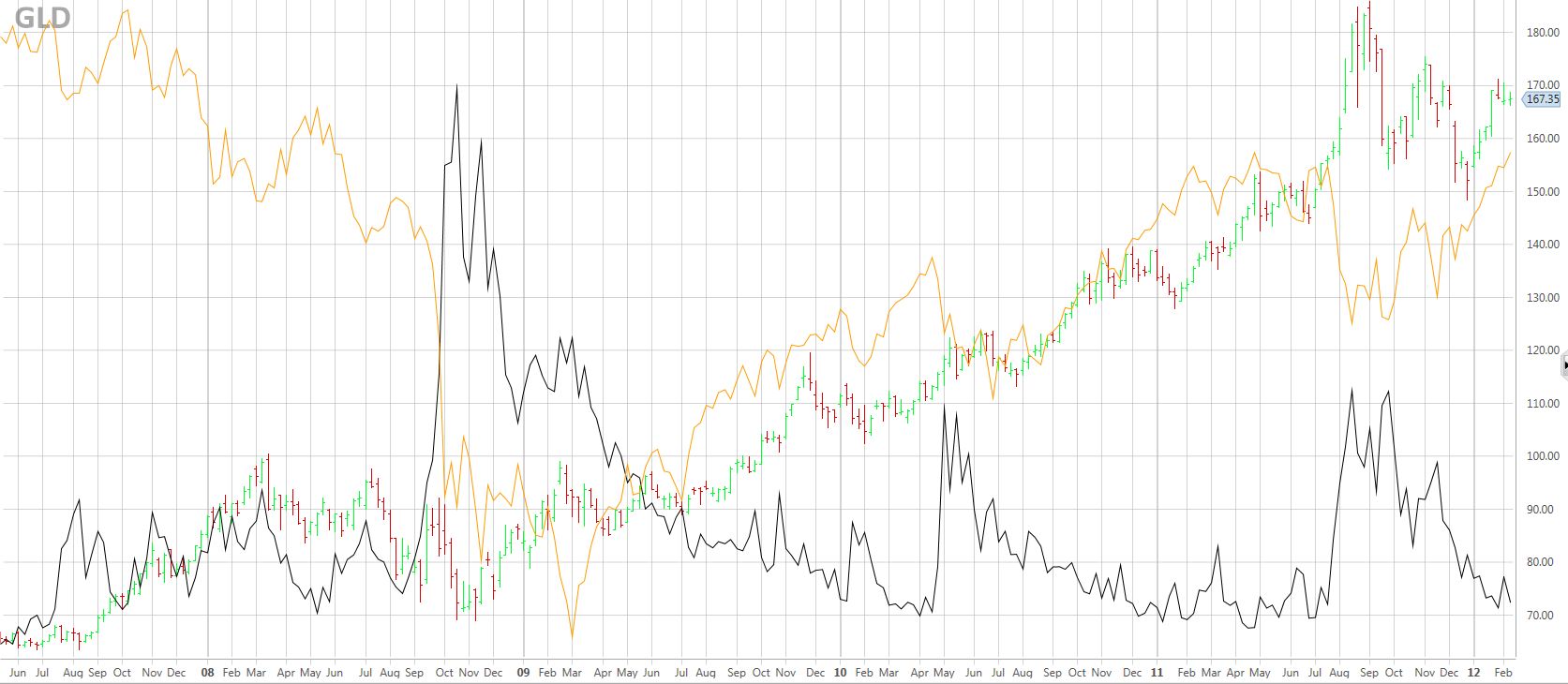

Subjectively gold climbs or holds its value well during the more extreme phases of volatility—the 2008/2009 crash, the flash crash, and the fall 2011 correction. The next chart adds the VIX index, which makes it a busy chart, but better illustrates gold’s correlation with volatility.

GLD vs SPY vs VIX index

In summary, a casual look suggests that gold is well correlated with the general stock market during quiet times, and correlated with the VIX during fearful times. If this behavior persists it will be a very valuable portion of a diversified portfolio.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI