I came across something today of which I believe is the most important thing for gauging monetary policy. And the mainstream financial media isn’t even talking about it (or worse – isn’t even aware).

Because of this indicator – I actually believe the Fed may begin cutting rates sooner than many expect.

So what am I talking about?

It’s a key Fed tool that measures future interest rate policy – called ‘The Taylor Rule’. . .

Now – I’ve written about this indicator before – but for those that don’t remember – I’ll summarize. . .

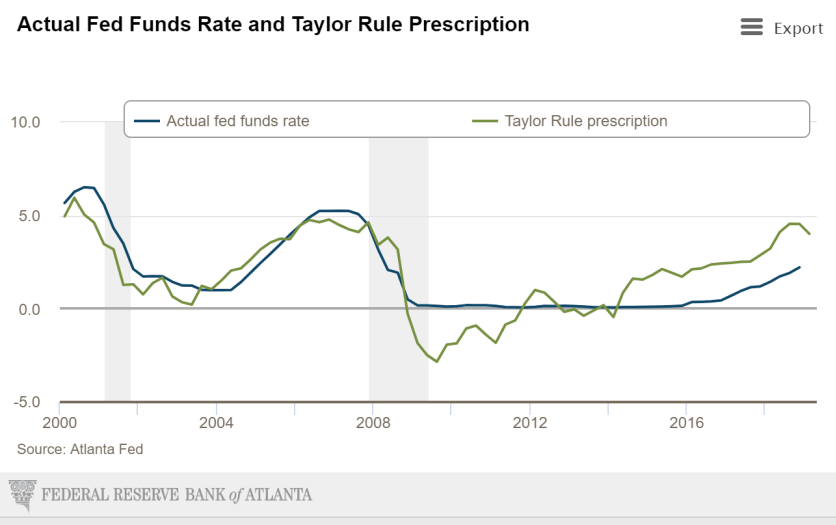

The Taylor Rule’s named after its creator – famed economist John B. Taylor – who first unveiled it in the early 1990s.

It’s a simple equation – essentially a rule of thumb – for the Fed to use and estimate where interest rates should be (or at least what direction) based on inflation, growth, and employment levels.

Putting it simply – the Taylor Rule suggests that the Fed should hike rates when inflation is above target (2%) or when GDP growth is too high (aka “the economy’s running hot”).

And they should cut rates when inflation is below the target rate or when GDP growth is too slow and below potential (a decelerating economy).

So – for instance – according to the Taylor Rule during 2008, the Fed should have slashed rate to negative -2%. And hold it there for at least two years.

Of course, negative interest rates were a very radical concept then (the EU and Japan didn’t cut rates negative until many years later).

But Ben Bernanke – then-Federal Reserve Chairman – agreed with the Taylor Rule prescription that the economy needed greater easing and stimulus.

So instead – he adopted a zero-interest rate policy (ZIRP). Launched consecutive rounds of Quantitative Easing (QE) – which was basically printing money. And many other stimulating effects (such as ‘Operation Twist’, bail-outs, etc).

The point is – we can see how the Fed added extra stimulus to accommodate the economy according to the Taylor Rule principle.

Furthermore – in 2014 – once the Taylor Rule showed interest rates should begin rising, the Fed (led by Janet Yellen at the time) began talking about ending QE and raising rates (tightening).

Thus – it’s clear that the Fed factors in the Taylor Rule when making interest rate decisions.

Now – I’m skeptical of such models and equations like the Taylor Rule – since they’re backward looking and based on unrealistic foundations.

But since the Fed uses this as a compass – we should study it as well.

And according to the latest Taylor Rule reading – it looks like rates are going lower.

See for yourself. . .

See that recent sharp drop? (Notice that this is the first time the Taylor Rule rate has declined more than -0.75% since the Fed began their tightening cycle in December 2015).

After seeing the Taylor Rule rate decline – it shouldn’t come as a surprise why the Fed earlier this week lowered their growth projections and effectively paused their rate hikes for the rest of the year.

It’s clear that the global slowdown taking place in Asia and the eurozone is impacting the U.S. growth outlook.

In non-linear complex systems – such as global economies – little changes abroad can have huge unintended consequences domestically (and vice versa).

This is known as the Butterfly Effect – “does the flap of a butterfly’s wings in Brazil set off a tornado in Texas?”

And even though we can’t exactly spot what will be affected first and exactly when it will be – we can measure the decelerating trend and growing instability of the system.

Thus – look for this downward trend to continue. And the more it does – the more it will negatively affect the U.S. economy. Which will then – eventually – trigger the Fed to begin cutting rates and resume buying bonds via Quantitative Easing (QE).

It’s just a matter of time.

So, for now, I’ll keep an eye on the Taylor Rule. And even though I’m skeptical of it – I know that’s what the Fed uses to navigate interest rate policy.

Otherwise said – it’s better used than ignored. . .