Stock market today: S&P 500 in weekly loss as trade war fears intensifyy

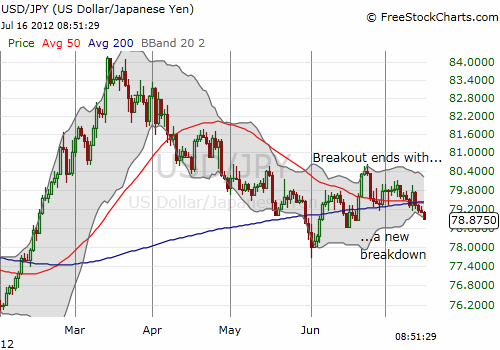

The U.S. dollar’s jagged rally from last year’s lows has finally brought it back to its “QE2 reference price.” At the same time, a carry trade seems to be lifting the Australian dollar in “risk-on” fashion. In the background, the Japanese yen is slowly but surely reasserting itself as the strongest of the major currencies in direct contradiction to the trend in the Australian dollar. In particular, the yen has now reasserted itself against the U.S. dollar with a break below the 50 and 200-day moving averages (DMAs):

The final test will be whether the yen can put an official end to the carry trade in the Australian dollar which seems to mainly victimize the euro (and franc of course) and the British pound:

What this means for U.S. stocks remains unclear. For now, I am assuming the strong correlation between the S&P 500 and the Australian dollar will remain intact no matter what is happening with the Japanese yen. Also, I am staying long small positions in AUD/JPY and USD/JPY while trading in and out of EUR/JPY and GBP/JPY opportunistically with a bias toward long yen.

(As of this writing, poor U.S. retail sales numbers are taking a huge bite out the U.S. dollar across the board and further pushing USD/JPY lower. I am using this as an opportunity to initiate small fresh dollar-long positions, especially against the British pound).

Be careful out there!

Full disclosure: net short Japanese yen, net short Australian dollar, long SDS. (Building fresh net dollar-long positions)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI