On July 31st, the first estimate of GDP growth in the second quarter of 2013 will be published. It is more difficult than ever to give a forecast. In part, along with this first estimate this difficulty comes from the publication of a comprehensive revision of historical data, adding new definitions and methodologies. For another part, it is relatively difficult to reconcile monthly (from manufacturing orders, foreign trade...) data with details of national accounts for the latest two quarters already known, complicating the estimation of the upcoming figures.

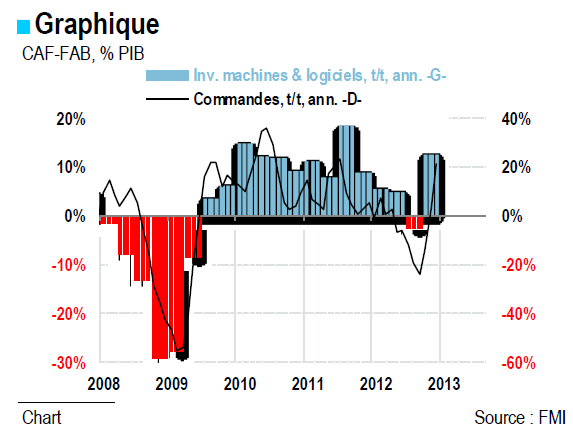

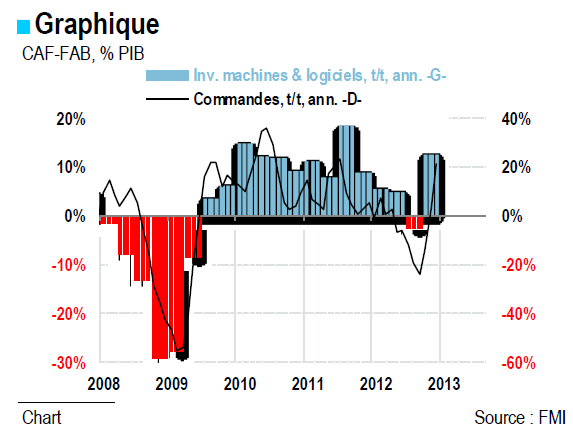

June data of the durable goods industry perfectly illustrate these difficulties. In the first quarter, shipments of the sector were compatible with a unchanged dynamism in business investment expenditures. But GDP data finally highlighted a marked slowdown. The withdrawal announced for Q2, could also not be confirmed next week. Otherwise, the dynamism of new orders owes much to military expenditures, which would be compatible with a highly positive contribution from government spending to growth even though it was the quarter during which the sequester began being implemented.

There are a lot of uncertainties about the evolution of business investment and government spending, which could both rebound. Households consumption is usually much easier to estimate, through retail sales. Real growth of consumption expenditure is likely to have remained rather the same as in Q1, in the vicinity of 2.5%. Residential investment is also an unknown size: if construction spending on residential expenditure published by the Department of Commerce is rather disappointing, new home sales show a much brighter dynamism. Finally, external trade, with strong growth in import volumes, also suggests a solid domestic demand.

The recent development in the finances of the federal government is another source of optimism, as it illustrates very rapid shrinking of the deficit at the beginning of 2013, highlighting the dynamism of the economy. Averaged over 12 months, the federal budget deficit was limited to USD 695 bn in June 2013, versus USD 1,231 bn a year earlier, i.e. a reduction of USD 536 bn. This reduction comes at a time of decreased spending (USD 320 bn between June 2013 and June 2012) and an increase in revenues (USD 216 bn). Detailed data show increases not only in social contribution receipts - in connection with the end of the payroll tax holiday in January 2013, but not only - but also of individuals and corporate tax revenues. The finances of State and local government also improved markedly recently, even if non-uniformly as showed by the bankruptcy of the city of Detroit. Data covering public finances are never revised, and lead us to certain optimism about current economic developments.

On the second day of their July meeting, FOMC members will get preliminary estimates of GDP growth. It is unlikely that this will lead them to revise more than marginally their analysis. Furthermore, this meeting will be not followed by a press brief, and should therefore not mark change in policy. The meeting to be held in September will be a better opportunity. But the Fed will try to not give a too hawkish tone. If labour market reports were positive enough to lead FOMC members to revise downward their forecasts of the unemployment rate, they could choose to announce the slowdown in the monthly pace of purchases of Treasuries and MBS (as part of the third wave of quantitative easing, QE3). But we continue to believe that they will wait until the December meeting, partly because the rise in the labour participation ratio is limiting the decline in the unemployment rate.

But this summer, attention will continue to focus more precisely on the identity of the successor to Ben Bernanke, whose term expires at the end of January 2014 and should not be renewed. The natural candidate remains the Vice-Chair of the Board of Governors, Janet L. Yellen. This economist and central banker of experience would represent continuity, and having been at the heart of decisionmaking on the use of unorthodox monetary policy tools, she is certainly the best to manage and abandon them when it is time.

But Ms. Yellen suffers from a reputation of not being hawk enough, what seems in fact high quality in these times of low growth and low inflation... And so another candidate is gaining credibility. Lawrence H. Summers, former Treasury Secretary of Bill Clinton and Director of the National Economic Council under Barack Obama is currently heading the bets, enjoying the confidence of the President. But his Congress confirmation would certainly be much more difficult than Ms. Yellen’s, Democrat supporters making him an unpopular figure within the Republican party. Furthermore, such an appointment would be certainly interpreted by markets as going hand in hand with a premature end of QE3, while that of Ms. Yellen would be confirmation of an accommodative policy over time. The forward guidance would certainly gain credibility with the latter. Confidence is perhaps not a very scientific data, but when it comes to monetary policy, it is essential.

BY Alexandra ESTIOT

June data of the durable goods industry perfectly illustrate these difficulties. In the first quarter, shipments of the sector were compatible with a unchanged dynamism in business investment expenditures. But GDP data finally highlighted a marked slowdown. The withdrawal announced for Q2, could also not be confirmed next week. Otherwise, the dynamism of new orders owes much to military expenditures, which would be compatible with a highly positive contribution from government spending to growth even though it was the quarter during which the sequester began being implemented.

There are a lot of uncertainties about the evolution of business investment and government spending, which could both rebound. Households consumption is usually much easier to estimate, through retail sales. Real growth of consumption expenditure is likely to have remained rather the same as in Q1, in the vicinity of 2.5%. Residential investment is also an unknown size: if construction spending on residential expenditure published by the Department of Commerce is rather disappointing, new home sales show a much brighter dynamism. Finally, external trade, with strong growth in import volumes, also suggests a solid domestic demand.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The recent development in the finances of the federal government is another source of optimism, as it illustrates very rapid shrinking of the deficit at the beginning of 2013, highlighting the dynamism of the economy. Averaged over 12 months, the federal budget deficit was limited to USD 695 bn in June 2013, versus USD 1,231 bn a year earlier, i.e. a reduction of USD 536 bn. This reduction comes at a time of decreased spending (USD 320 bn between June 2013 and June 2012) and an increase in revenues (USD 216 bn). Detailed data show increases not only in social contribution receipts - in connection with the end of the payroll tax holiday in January 2013, but not only - but also of individuals and corporate tax revenues. The finances of State and local government also improved markedly recently, even if non-uniformly as showed by the bankruptcy of the city of Detroit. Data covering public finances are never revised, and lead us to certain optimism about current economic developments.

On the second day of their July meeting, FOMC members will get preliminary estimates of GDP growth. It is unlikely that this will lead them to revise more than marginally their analysis. Furthermore, this meeting will be not followed by a press brief, and should therefore not mark change in policy. The meeting to be held in September will be a better opportunity. But the Fed will try to not give a too hawkish tone. If labour market reports were positive enough to lead FOMC members to revise downward their forecasts of the unemployment rate, they could choose to announce the slowdown in the monthly pace of purchases of Treasuries and MBS (as part of the third wave of quantitative easing, QE3). But we continue to believe that they will wait until the December meeting, partly because the rise in the labour participation ratio is limiting the decline in the unemployment rate.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

But this summer, attention will continue to focus more precisely on the identity of the successor to Ben Bernanke, whose term expires at the end of January 2014 and should not be renewed. The natural candidate remains the Vice-Chair of the Board of Governors, Janet L. Yellen. This economist and central banker of experience would represent continuity, and having been at the heart of decisionmaking on the use of unorthodox monetary policy tools, she is certainly the best to manage and abandon them when it is time.

But Ms. Yellen suffers from a reputation of not being hawk enough, what seems in fact high quality in these times of low growth and low inflation... And so another candidate is gaining credibility. Lawrence H. Summers, former Treasury Secretary of Bill Clinton and Director of the National Economic Council under Barack Obama is currently heading the bets, enjoying the confidence of the President. But his Congress confirmation would certainly be much more difficult than Ms. Yellen’s, Democrat supporters making him an unpopular figure within the Republican party. Furthermore, such an appointment would be certainly interpreted by markets as going hand in hand with a premature end of QE3, while that of Ms. Yellen would be confirmation of an accommodative policy over time. The forward guidance would certainly gain credibility with the latter. Confidence is perhaps not a very scientific data, but when it comes to monetary policy, it is essential.

BY Alexandra ESTIOT

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI