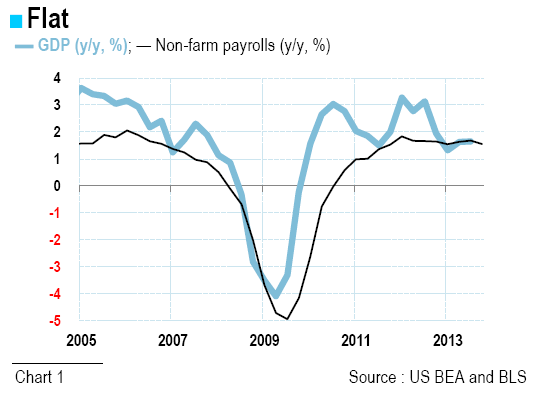

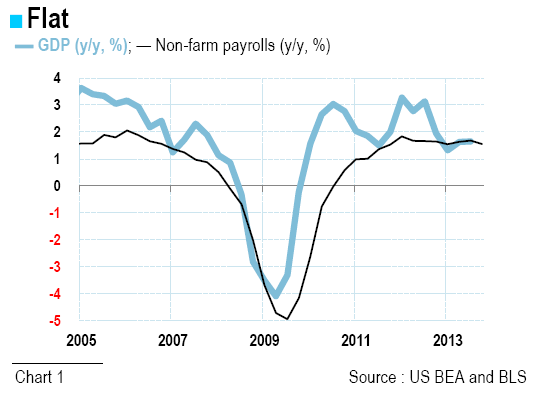

At first sight, GDP growth accelerated from Q2 to Q3 (2.8%). But this was under a mix of positive contributions from the inventory change, net exports, investment on structures and rebounding public spending. In nominal terms, the year-on-year growth is stuck, growing steadily by 3.1%, a rate insufficient to substantially improve labour market conditions.

In the third quarter, GDP growth accelerated to +2.8% (quarterly annualised rate) after 2.5% in Q2 and an average of 0.6% during the previous two quarters. But this acceleration of the headline number hides worrying details.

In Q3, both the inventory change and net exports brought positive contributions (respectively +0.8 percentage points and 0.3 pp), meaning that final domestic sales actually slowed down from one quarter to the other. After a rate of 2.1% in Q2, this component of demand gained just 1.8%. Furthermore, part of the acceleration came from spending of State and local governments (+1.5% in Q3, after +0.4% in Q2) that turned the change in total public spending into positive (+0.2%) for the first time in a year.

The final demand from the private domestic sector (households and businesses) grew a limited 2.1% after 2.7% in Q2, with a large contribution from spending on structures, residential (+14.6%) and non-residential (+12.3%). In short, the core of the US demand slowed. Private consumption was up a limited 1.5%, the slowest rate of growth since 2011 Q2, while the business sector cut on equipment investment (-3.7%).

As for prices, the GDP deflator somewhat rebounded in quarterly terms but remained stuck at 1.4% in year-on-year terms. In nominal terms, the US GDP is thus growing remarkably steadily at a low 3.1% y/y rate since the beginning of the year.

This explains why the conditions on the labour market do not improve substantially with backlash effects on households’ income and thus spending. The October labour market report is definitely difficult to read, and the 16-day shutdown of the federal government is just adding to the headache. The report is a set of data drawn from two different surveys: one conducted among employers (the establishment survey) and one among households. If the early October shutdown did not impact the first set of data, the damage is great according to the second set of data.

Non-farm payrolls indeed gained 204k in October, accelerating from 163k in September, while the August reading was markedly revised upwards (from a preliminary 169k to 238k). Here, it is impossible to see any sign of the shutdown. According to the other survey, employment dropped by 735k from one month to the other, which did, however, not increase unemployment (that gained only 17k) as the labour force was the one to shrink. The US Bureau of Labor Statistics notes that “the number who reported being on temporary layoff increased by 448k”.

However, the difficulty of assessing the labour market conditions goes beyond that short-term effect, and beyond the usual discrepancy between the two surveys, as the unemployment rate edged up (to 7.3%) even if job creations accelerated. The number of jobs added in October is definitely good news. Still, the number of hours worked went down from one month to the other in the private sector (this could be an indirect impact of the federal government shutdown, though), while the rate of growth in hourly wages marginally accelerated.

In short, the pace of monthly job creations is needed to be sustained to drive an overall improvement in the labour market conditions. As it has been everything but regular lately, the Fed is even less likely than usual to react to monthly developments.

With such a slow rate of growth, the US economy remains vulnerable to shocks, and the cuts in federal government spending are set to be one of the worst. The Fed will keep on trying whatever it can to offset the contractionary effects of austerity, but as aggressive as its response might be, Ben Bernanke is not almighty, and neither will be Janet Yellen.

As powerless as monetary policy might be in the current context, it is definitely better that it remains as accommodative as possible, and there is indeed no reason to expect a different diagnosis from the Fed. It is pretty clear that the US central bank is failing on both parts of its mandate, as the unemployment rate is roughly 2 points above its natural rate while prices keep on decelerating. In September, the year-on-year rate of growth in the PCE deflator was back below 1% with the core index stable at a low 1.2%.

BY Alexandra ESTIOT

In the third quarter, GDP growth accelerated to +2.8% (quarterly annualised rate) after 2.5% in Q2 and an average of 0.6% during the previous two quarters. But this acceleration of the headline number hides worrying details.

In Q3, both the inventory change and net exports brought positive contributions (respectively +0.8 percentage points and 0.3 pp), meaning that final domestic sales actually slowed down from one quarter to the other. After a rate of 2.1% in Q2, this component of demand gained just 1.8%. Furthermore, part of the acceleration came from spending of State and local governments (+1.5% in Q3, after +0.4% in Q2) that turned the change in total public spending into positive (+0.2%) for the first time in a year.

The final demand from the private domestic sector (households and businesses) grew a limited 2.1% after 2.7% in Q2, with a large contribution from spending on structures, residential (+14.6%) and non-residential (+12.3%). In short, the core of the US demand slowed. Private consumption was up a limited 1.5%, the slowest rate of growth since 2011 Q2, while the business sector cut on equipment investment (-3.7%).

As for prices, the GDP deflator somewhat rebounded in quarterly terms but remained stuck at 1.4% in year-on-year terms. In nominal terms, the US GDP is thus growing remarkably steadily at a low 3.1% y/y rate since the beginning of the year.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

This explains why the conditions on the labour market do not improve substantially with backlash effects on households’ income and thus spending. The October labour market report is definitely difficult to read, and the 16-day shutdown of the federal government is just adding to the headache. The report is a set of data drawn from two different surveys: one conducted among employers (the establishment survey) and one among households. If the early October shutdown did not impact the first set of data, the damage is great according to the second set of data.

Non-farm payrolls indeed gained 204k in October, accelerating from 163k in September, while the August reading was markedly revised upwards (from a preliminary 169k to 238k). Here, it is impossible to see any sign of the shutdown. According to the other survey, employment dropped by 735k from one month to the other, which did, however, not increase unemployment (that gained only 17k) as the labour force was the one to shrink. The US Bureau of Labor Statistics notes that “the number who reported being on temporary layoff increased by 448k”.

However, the difficulty of assessing the labour market conditions goes beyond that short-term effect, and beyond the usual discrepancy between the two surveys, as the unemployment rate edged up (to 7.3%) even if job creations accelerated. The number of jobs added in October is definitely good news. Still, the number of hours worked went down from one month to the other in the private sector (this could be an indirect impact of the federal government shutdown, though), while the rate of growth in hourly wages marginally accelerated.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

In short, the pace of monthly job creations is needed to be sustained to drive an overall improvement in the labour market conditions. As it has been everything but regular lately, the Fed is even less likely than usual to react to monthly developments.

With such a slow rate of growth, the US economy remains vulnerable to shocks, and the cuts in federal government spending are set to be one of the worst. The Fed will keep on trying whatever it can to offset the contractionary effects of austerity, but as aggressive as its response might be, Ben Bernanke is not almighty, and neither will be Janet Yellen.

As powerless as monetary policy might be in the current context, it is definitely better that it remains as accommodative as possible, and there is indeed no reason to expect a different diagnosis from the Fed. It is pretty clear that the US central bank is failing on both parts of its mandate, as the unemployment rate is roughly 2 points above its natural rate while prices keep on decelerating. In September, the year-on-year rate of growth in the PCE deflator was back below 1% with the core index stable at a low 1.2%.

BY Alexandra ESTIOT

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.