Stock market today: S&P 500 ekes out gain as Trump says open to deals on tariffs

The Federal Reserve Bank has printed trillions of dollars to monetize US government debt just to keep the government afloat. Any significant rise in interest rates will probably decimate US government finances, the fragile housing market and in the bond market it will cause a financial catastrophe through interest rate derivatives.

This is a solid reason why the Fed will not raise any rates in any foreseeable future.

The power to create money out of thin air is great! Should we give it to politicians and secretive central bankers? Will this power be abused? Will those in charge yield to the temptation for "legalized counterfeiting?" Apparently the answer is 'YES'.

All that the Federal Reserve has done was to inflate equity markets. They never solved any of the original financial problems that lead to creating "The Credit Bubble of 2007". There was as well no financial resolution by our elected political officials to resolve this serious problem so that it would never occur again in the near future. This process called "Quantitative Easing" created a shift of a tremendous amount of wealth from the middle class and the poor to the rich.

Inflated stock prices, usually held by the wealthy, created a clear "redistribution of wealth", which will be paid for by future generations to come. The concept by the Fed was that centralizing the wealth would help in creating new jobs and increase capital expenditures in their businesses.

The problem with this philosophy is that it never filtered down from the billionaires into real economic growth within our economy. Instead, rather than experience expansion, we have been experiencing contraction which is resulting into an economic deflationary depression that will appear evident to all by the end of this year.

The top 1% of Americans hold 35% of the nation's wealth. This inequality has continued to grow exponentially.

There are several reason that I can refer to why the Fed will NOT raise rates anytime in the near future. There are interest-rate cuts and devaluations going on all around the world at the moment. Japan and the Eurozone are both implementing Quantitative Easing. China is resorting to its alternatives to hold its financial system together and stave off a hard landing. Emerging-market economies are being hammered by commodity price falls, while oil-producers are being similarly hit by oil price falls. There is no Inflation in developed countries. The world is entering a deflationary slump. Why would the Fed ever even think about raising interest rates?

The unwinding of QE will have many negative effects in a market that is already short of liquidity. So, the unwinding that must be delayed for quite some time will be welcomed by many. The unwinding of QE purchases and the normalization of bond prices would be extremely negative for the bond markets, so the tin can will be kicked down the road for quite some time still.

The PBOC has significant room to lower required reserve ratios on banks to encourage lending. Even after a series of cuts, the RRR remains at 18.5 percent for major banks which is among the worlds highest. Reducing the ratio by 10 percentage points would free up 13 trillion yuan ($2.1 trillion) of additional capacity for banks to lend. On the fiscal policy side, the country’s $3.69 trillion of foreign-exchange reserves and relatively low national government debt levels mean it has the ammunition for fiscal stimulus. China is planning at least 1 trillion yuan ($161 billion) in long-term bonds to fund construction projects as the economy struggles. Most of the interest payments on the bonds will be subsidized by the central government. I believe that more projects of this type will be initiated in 2015. This is a major factor why the Federal Reserve will continue pumping liquidity in the financial system.

I believe that the FOMC minutes suggest that it is very far from a rate hike, the US economy is more likely to see QE4 first!

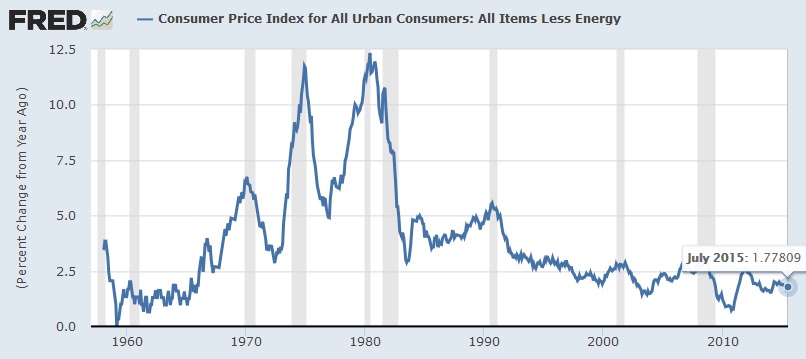

In short, there is no reason to believe that core inflation will rise to the 2% target any time soon and raising interest rates at the moment would jeopardize the US’s fragile recovery.

CPI Continues To Decline

The FOMC members gave the following reasons for caution:

- Wages aren’t rising much

- Prices aren’t rising much either

- The dollar is strengthening

- Commodity prices are falling

- gdp is still pretty weak

- The labor market isn’t as strong as the unemployment figures suggest

Conclusion

We continue to see the US and global economies struggle. The writing is on the wall that a collapse in equities is drawing near, but we have yet to see the broad stock markets breakdown. When they do, there will be a lot of money made by taking advantage of falling prices, which is what my focus will be with my trading capital and ETF trade alert newsletter.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI