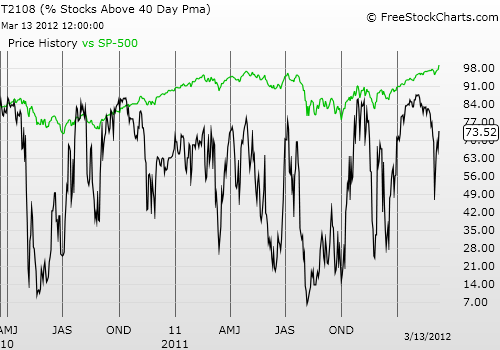

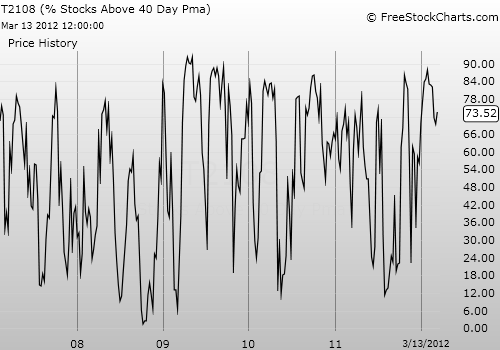

T2108 Status: 73%

VIX Status: 14.7%

General (Short-term) Trading Call: Strong bullish bias – see below for more details and an explanation!

Commentary

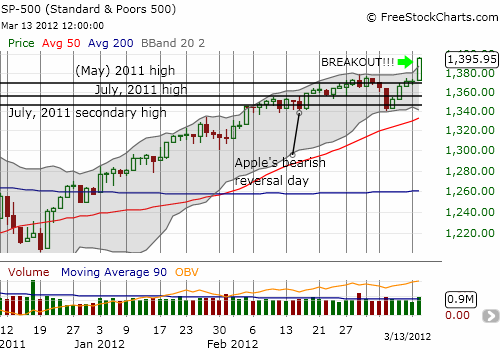

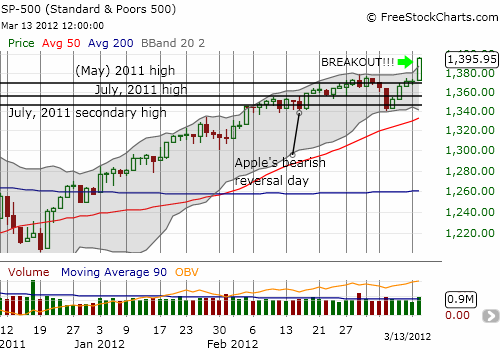

S&P 500 delivers one of its more signficant breakouts in a long time

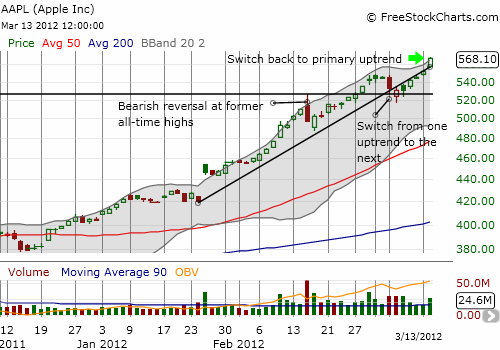

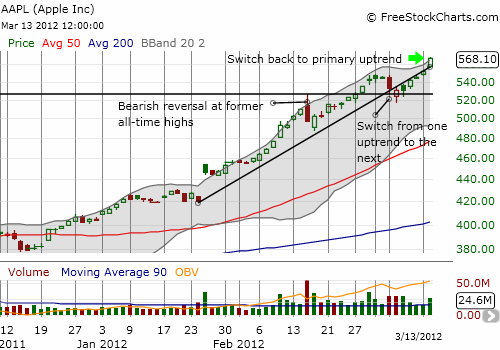

Apple (AAPL) is climbing to infinity and beyond

A picture can say a 1000 words, and a stock chart can broadcast a 1000 lessons. I started this T2108 Update with these two charts because, in my mind, they perfectly symbolize the bullish significance of yesterday’s trading. Buyers FINALLY stepped up in force to power the S&P 500 higher.

The 1.8% gain on the day featured higher than average volume, a breakout to near four-year highs, and a close at the highs of the day. The market simply cannot get more bullish than this on a single trading day. A stellar trifecta. Apple (AAPL) clearly led the way for the bulls; the main differences are the ALL-TIME highs on the winds of persistently strong buying pressure. Enjoy these pictures – I think it is rare to get such convincing breakouts.

OK. Now that I got the excitement out of my system, I can wallow in my queasiness about this setup. T2108 re-entered overbought territory after just a brief rest from the historic overbought period that began this year. I was looking for the 7-8% sell-off that has historically been the worst case scenario following extended overbought periods. I would have gladly bought with both hands under such a scenario.

Instead, we got the equally likely 1-2% sell-off, and I sat on the bearish T2108 bearish portfolio. I braced for a breakout, but hoped for more churn to give me more time to mentally adjust to the bullish implications of the shallow sell-off. Instead, we got the most bullish breakout possible in very short order. In other words, I have not had a chance to get comfortable with the stark reality that it is time for a change in strategy, and this situation leaves me queasy.

Here is a partial reminder of the strategy I outlined for this period in the last T2108 Update:

“Going forward, I will be maintaining the current bearish configuration (SDS and VXX shares) as a hedge to this trend-following strategy. I want to keep this component in place in case some black swan swoops in to deliver an extreme counter-punch. In parallel, I will be aggressively executing swing trades (duration of 1 to 3 days or so) in the indices AND individual stocks, using shares and options. I will particularly focus on fading any and all pops in VXX with put options. The weekly chart…reminds us that VXX’s ultimate fate is always lower prices; I may drop VXX shares altogether if for some reason I am not able to stay ahead of losses with VXX put options. During the current VXX downtrend, trading these puts [has] consistently delivered attractive profits for me (but not in the T2108 portfolio unfortunately!). I recommend reading “

I expect the S&P 500 to grind its way higher and higher over the coming weeks and months, but it should feature constant shifting in and out of overbought periods rather than another extended overbought period. While the bias will be for more upside, the churn will remind us (or at least me) of the on-going downside risks.

Bears will find themselves constantly frustrated, and bulls will find constant relief. However, the historical data also suggest that this next bullish phase will NOT end as well as the first one. In fact, we should expect an outcome very similar to the extended overbought periods of 2009 and 2010. That is, at the end of this road is hiding somewhere the next calamity. This time, it will be something none of us are thinking about and/or worrying about. Yes, I just feel more comfortable thinking about what can go wrong.

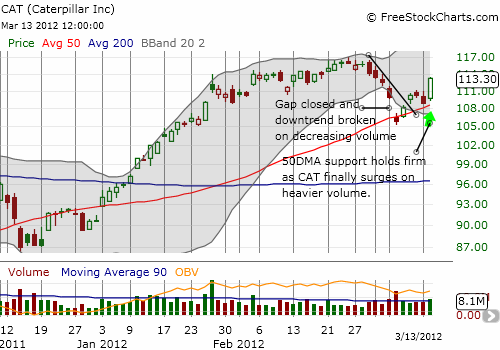

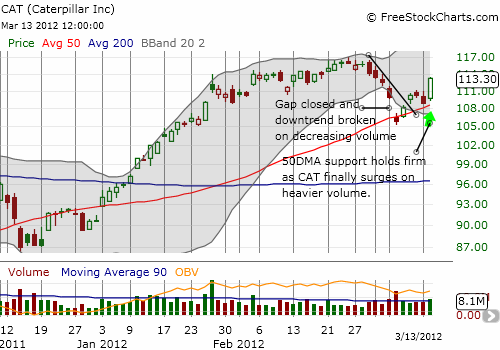

To kick off this trend-following, I executed two aggressive trades: calls and shares in Caterpillar (CAT) and calls in CSX Corporation (CSX). I previously discussed the bearish implications for the divergence in performance of the two stocks. I even cautioned in a separate post that CAT may have printed an ominous breakdown. Yesterday’s bullish trading action invalidated the warning:

CAT is now poised to follow Apple's lead and break to fresh all-time highs

In this next bullish phase, I fully expect CSX to play a lot of catch-up (a slowdown in coal is hurting CSX) and for CAT to represent one of the favorite ways for big buyers to play an on-going recovery in the U.S. and global economy.

I consider these trades to be my first trial balloons of the shift in strategy. I am looking for confirmation that the S&P 500 is truly embarking on a fresh trend. This confirmation should come with a bullish follow-through day within the next week or less WITHOUT the S&P 500 completely reversing yesterday’s breakout. Breaking the lows of yesterday will call into question the breakout. I plan to stay flexible and nimble, especially since I am now traveling a bit away from my traditional comfort zone.

Finally, note that I have written about many bullish scenarios in the past few months. These areas will also be my focus on any future buying setups: commodities, housing, insider buying, and special “situations” or themes. Stay tuned for more pieces in these areas.

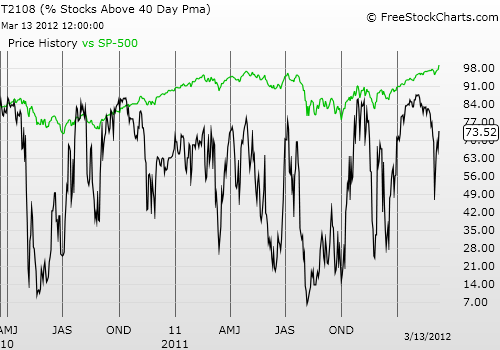

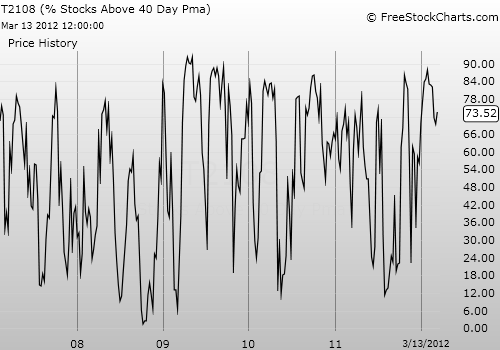

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

VIX Status: 14.7%

General (Short-term) Trading Call: Strong bullish bias – see below for more details and an explanation!

Commentary

S&P 500 delivers one of its more signficant breakouts in a long time

Apple (AAPL) is climbing to infinity and beyond

A picture can say a 1000 words, and a stock chart can broadcast a 1000 lessons. I started this T2108 Update with these two charts because, in my mind, they perfectly symbolize the bullish significance of yesterday’s trading. Buyers FINALLY stepped up in force to power the S&P 500 higher.

The 1.8% gain on the day featured higher than average volume, a breakout to near four-year highs, and a close at the highs of the day. The market simply cannot get more bullish than this on a single trading day. A stellar trifecta. Apple (AAPL) clearly led the way for the bulls; the main differences are the ALL-TIME highs on the winds of persistently strong buying pressure. Enjoy these pictures – I think it is rare to get such convincing breakouts.

OK. Now that I got the excitement out of my system, I can wallow in my queasiness about this setup. T2108 re-entered overbought territory after just a brief rest from the historic overbought period that began this year. I was looking for the 7-8% sell-off that has historically been the worst case scenario following extended overbought periods. I would have gladly bought with both hands under such a scenario.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Instead, we got the equally likely 1-2% sell-off, and I sat on the bearish T2108 bearish portfolio. I braced for a breakout, but hoped for more churn to give me more time to mentally adjust to the bullish implications of the shallow sell-off. Instead, we got the most bullish breakout possible in very short order. In other words, I have not had a chance to get comfortable with the stark reality that it is time for a change in strategy, and this situation leaves me queasy.

Here is a partial reminder of the strategy I outlined for this period in the last T2108 Update:

“Going forward, I will be maintaining the current bearish configuration (SDS and VXX shares) as a hedge to this trend-following strategy. I want to keep this component in place in case some black swan swoops in to deliver an extreme counter-punch. In parallel, I will be aggressively executing swing trades (duration of 1 to 3 days or so) in the indices AND individual stocks, using shares and options. I will particularly focus on fading any and all pops in VXX with put options. The weekly chart…reminds us that VXX’s ultimate fate is always lower prices; I may drop VXX shares altogether if for some reason I am not able to stay ahead of losses with VXX put options. During the current VXX downtrend, trading these puts [has] consistently delivered attractive profits for me (but not in the T2108 portfolio unfortunately!). I recommend reading “

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Volatility ETFs Often Own All VIX Futures” for understanding why the current crop of volatility products perform so poorly over an extended period of time.” I expect the S&P 500 to grind its way higher and higher over the coming weeks and months, but it should feature constant shifting in and out of overbought periods rather than another extended overbought period. While the bias will be for more upside, the churn will remind us (or at least me) of the on-going downside risks.

Bears will find themselves constantly frustrated, and bulls will find constant relief. However, the historical data also suggest that this next bullish phase will NOT end as well as the first one. In fact, we should expect an outcome very similar to the extended overbought periods of 2009 and 2010. That is, at the end of this road is hiding somewhere the next calamity. This time, it will be something none of us are thinking about and/or worrying about. Yes, I just feel more comfortable thinking about what can go wrong.

To kick off this trend-following, I executed two aggressive trades: calls and shares in Caterpillar (CAT) and calls in CSX Corporation (CSX). I previously discussed the bearish implications for the divergence in performance of the two stocks. I even cautioned in a separate post that CAT may have printed an ominous breakdown. Yesterday’s bullish trading action invalidated the warning:

CAT is now poised to follow Apple's lead and break to fresh all-time highs

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

In this next bullish phase, I fully expect CSX to play a lot of catch-up (a slowdown in coal is hurting CSX) and for CAT to represent one of the favorite ways for big buyers to play an on-going recovery in the U.S. and global economy.

I consider these trades to be my first trial balloons of the shift in strategy. I am looking for confirmation that the S&P 500 is truly embarking on a fresh trend. This confirmation should come with a bullish follow-through day within the next week or less WITHOUT the S&P 500 completely reversing yesterday’s breakout. Breaking the lows of yesterday will call into question the breakout. I plan to stay flexible and nimble, especially since I am now traveling a bit away from my traditional comfort zone.

Finally, note that I have written about many bullish scenarios in the past few months. These areas will also be my focus on any future buying setups: commodities, housing, insider buying, and special “situations” or themes. Stay tuned for more pieces in these areas.

Charts below are the latest snapshots of T2108 (and the S&P 500)

Refresh browser if the charts are the same as the last T2108 update.

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI