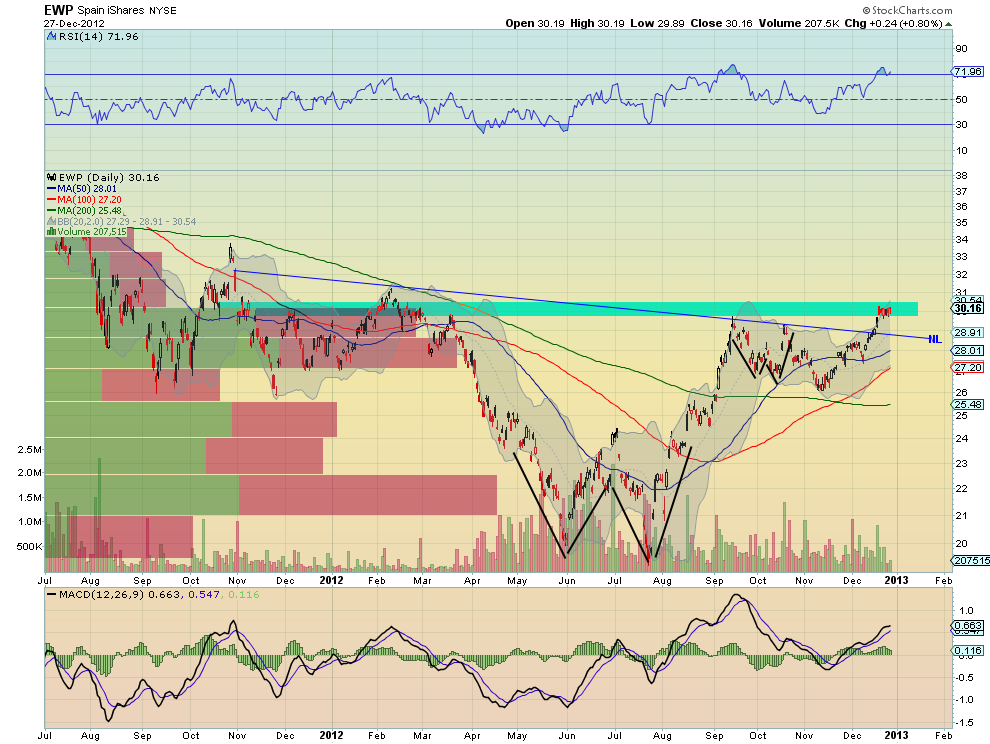

European equity markets have been red hot with the Spanish Market (EWP) being one of the best since mid November. But there are signs that the run higher is at the end. The light blue band has been a difficult area for it over the last 2 years. And with the Relative Strength Index (RSI) in a technically overbought condition a reversal is sought by many soon. The consolidation taking place at the top of the "W" could be the start of a reversal. But there are also several signs that this could be the start of a massive run higher.

Above that blue band there is very little previous price history to slow it down. The "W" and then consolidation is also a Cup and Handle and there is an Inverse Two Heads and Shoulders pattern that broke the Neckline last week. These give price objectives between 39 and 40.50. And the Measured move higher out of the bull flag takes it to 33.40. The reaction to the blue zone is the key on whether you play this long or short.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.