According to the Obama administration, the unemployment rate in the United States has been slowly coming down over the past couple of years. But is that actually true?

When you take a closer look at the data you quickly realize that the real unemployment numbers are much worse than we are being told. For example, if the labor force participation rate was the same today as it was back when Barack Obama first took office, the unemployment rate in the United States would be a whopping 11.2 percent. But every month the Obama administration has been able to show "progress" because of the fiction that hundreds of thousands of Americans are "disappearing" from the labor force each month.

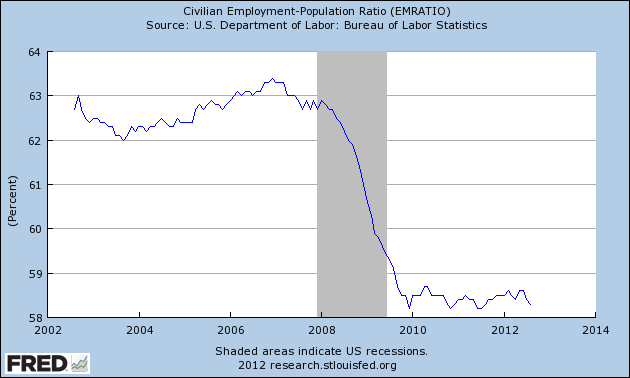

Frankly, the way that they come up with these numbers is an insult to our intelligence. Personally, I much prefer the employment-population ratio. It is a measure of the percentage of working age Americans that actually have jobs. I like to call it "the employment rate". So what happened to the "employment rate" in August? It fell slightly to 58.3 percent. It is lower than it was when the last recession supposedly ended, and it is almost as low as it has been at any point since the very beginning of this crisis. A few times during this economic downturn it has actually hit 58.2 percent. Needless to say, things are not getting any better. So why aren't the American people being told the truth?

After every other recession in the post-World War II era, the employment rate has always rebounded.

But not this time.

Does this look like a recovery to you?....

So how in the world can Barack Obama claim that we are better off now?

In August 2010, 58.5 percent of working age Americans had jobs.

In August 2012, 58.3 percent of working age Americans had jobs.

So where is the recovery?

It is two years later and a smaller percentage of Americans are employed.

It is very frustrating to me that we are not being told the truth about the unemployment numbers. The following are some more indications that the real unemployment numbers are much worse than we are being told....

-In July, 142,220,000 Americans were working. In August, only 142,101,000 Americans were working. So the number of Americans working fell by 119,000 and yet the government would have us believe that the unemployment rate actually declined from 8.3 percent to 8.1 percent.

-According to the federal government, 96,000 jobs were added to the economy in August and the U.S. labor force shrank by 368,000 even though our population is continually growing. If the size of the U.S. labor force had stayed the same, the official unemployment rate would have actually gone up to 8.4 percent.

-Almost all of the new jobs added in August were the result of the "birth-death" model used by the Labor Department to estimate jobs added by new businesses. That model has been heavily criticized for being inaccurate. If you take the 87,000 jobs added by that model out of the equation, then the U.S. economy only added 9,000 jobs in August. But it takes somewhere around 125,000 new jobs each month just to keep up with the growth of the population.

-If the labor participation rate was sitting where it was when Barack Obama first took office, the unemployment rate in the United States would actually be 11.2 percent.

-If the labor participation rate was sitting at the 30 year average of 65.8 percent, the unemployment rate in the United States would actually be 11.7 percent.

-John Williams of Shadow Government Statistics would put the "real" rate of unemployment up around 23 percent after adding in all workers that have given up looking for work and all underemployed workers.

-The labor participation rate for men has fallen to 69.9 percent. This is the lowest level that it has been since the U.S. government began tracking this statistic back in 1948.

-There was more bad news for manufacturing in this latest report. During the month of August the U.S. manufacturing sector lost approximately 15,000 jobs.

-The official unemployment rate has now been above 8 percent for 43 months in a row.

-The percentage of working age Americans with a job has been below 59 percent for 36 months in a row.

-The employment numbers for both June and July were revised downward significantly. For June, it turns out that only 45,000 jobs were added to the economy as opposed to the 64,000 that were originally reported. For July, it turns out that only 141,000 jobs were added to the economy as opposed to the 163,000 that were originally reported.

-Incredibly, 58 percent of the jobs created since the end of the last recession have been low income jobs.

-The U.S. economy currently has 4.7 million less jobs than it did when the last recession started.

So what is the solution to these problems?

The media is breathlessly proclaiming that more quantitative easing is on the way and that the Federal Reserve will save the economy and send the stock market soaring to new heights.

A headline on CNBC on Friday boldly declared the following: "Market Sees 'Helicopter Ben' Coming to the Rescue".

You can almost hear the chopper blades whirling now.

Apparently Bernanke has had a love of showering the economy with money for a very long time. For example, you can see a picture of a young Ben Bernanke in action right here.

Of course that is a joke, but you get the point.

In recent years Federal Reserve Chairman Ben Bernanke and the rest of his cohorts have printed money like there is no tomorrow.

So have the previous rounds of quantitative easing solved our problems?

Of course not.

The employment rate is even lower today than it was two years ago.

But all of that money printing has sent the stock market soaring and it has enabled the big Wall Street banks to make an obscene amount of money.

The truth is that the Federal Reserve, the Obama administration and the big Wall Street banks don't really care about you.

They don't really care that the middle class is rapidly shrinking and that the number of Americans on food stamps has risen by more than 14 million since Barack Obama became president.

What they care about is what is good for them.

As I have written about previously, if we continue on the same path that we have been on for the past several decades, there will never be enough jobs in America ever again.

On our current trajectory, we will end up just like Greece where the unemployment rate is now up to 24.4 percent.

Once upon a time the economy of Greece was thriving.

But today, many formerly middle class Greek citizens are leaving Greece and are picking up whatever work they can find....

As a pharmaceutical salesman in Greece for 17 years, Tilemachos Karachalios wore a suit, drove a company car and had an expense account. He now mops schools in Sweden, forced from his home by Greece’s economic crisis.

“It was a very good job,” said Karachalios, 40, of his former life. “Now I clean Swedish s---.”

Karachalios, who left behind his 6-year-old daughter to be raised by his parents, is one of thousands fleeing Greece’s record 24 percent unemployment and austerity measures that threaten to undermine growth.

Would you be willing to do that?

Don't laugh.

Someday when the unemployment rate in the United States gets that high we will see large numbers of desperate Americans leaving this country in search of work somewhere else.

Already, an increasing number of Americans are buying expired food at auctions.

Times are hard and people are trying to get by any way that they can.

More than 100 million Americans are already on welfare and things have not even gotten that bad yet.

This is nothing compared to what is coming.

As you can see from the chart posted near the top of this article, the last economic downturn appears to have permanently weakened the U.S. economy.

Now the next wave of the economic collapse is rapidly approaching.

How much worse will things get when it finally hits us?

That is something to think about.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.