Forex News and Events

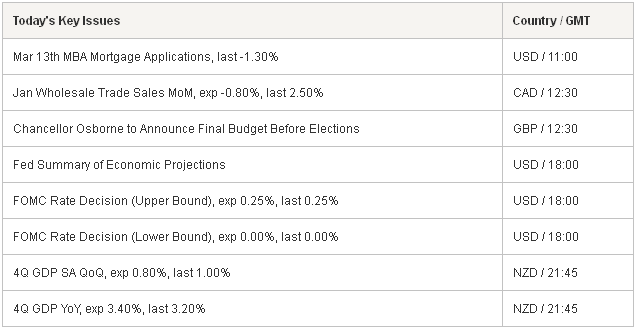

The financial markets are broadly in wait-and-see mode, waiting for the outcome of the two-day FOMC meeting due at 18:00 GMT. The Fed is widely and enthusiastically expected to drop its call for « patience » before the first Fed fund rate hike happens. Given FOMC Chair Yellen’s dovish track record, as part of Bernanke’s team that introduced and supported the ultra-loose monetary policy since 2008 crisis, we believe that even the removal of “patience” wording will not push the Fed to commit to any specific timing to begin the monetary policy normalization. Yellen will most probably stay cautious vis-à-vis the economic data, reiterate the low trending inflation and the remaining slack in the labor market. The risk for the Fed is to rush into a premature normalization as the long-lasting ZIRP has led to negative shadow rates in the US, therefore leaving little room for any policy mistake.

We do not see the Fed moving toward higher rates any time before June meeting, while the market is broadly pricing in the probability of September action. More information will be looked for via Fed dots. The median estimate for year-end should give an idea on the bias at the heart of the FOMC. A median forecasts in 1.00/1.25% range would be in line with a gradual and soft start in June (therefore assuming 25 basis point hike through ¾ or all scheduled Fed meetings before the year-end), otherwise the market will stick to September bet.

Should the Fed prefer to remain “patient” before the first FF rate hike, it will only increase the probability that the so-expected announcement happens at next meeting. We are already in this spiral of hawkish expectations. There is limited and short-lived US Dollar downside in case of disappointment post-FOMC.

The FOMC post-“patient”

Once the normalization starts, the Fed will no doubt keep its cautious stance and proceed via softer and gradual rate hikes. Traders will be exceptionally in tune to comments about deflationary effects of lower oil prices and up-trending USD. The importance of the economic data will be once again put forward to help manage the strength of the greenback. Regardless of the start date, a lower normalization path should hence temper an oversized USD rally amid the potential drop of “patient” wording from the statement. All in all, traders should expect higher US yields and stronger USD, yet no fireworks.The hawkish Fed expectations are already priced in across the money and currency markets. Although a knee-jerk USD strength should squeeze the FX market later today, there is greater chance of seeing a more significant reaction on the stock indices.

WTI Crude falls to $42

Fresh sell-off in oil deepens the panic in the oil industry. The oil producers are looking to reduce production and definitely postpone new projects that are by far uneconomic at current market prices. In the UK, the CEO of the Oil & Gas lobby is preparing to ask for tax cuts today in order to deal with the macro environment, Saudi Arabia extends deficit on its production in an effort to gain market share before the global recovery pick-up, Norwegian trade balance shrinks pushing the Norges Bank to cut the deposit rate by a 25 basis points tomorrow to sustain the economy. The oil industry is on a narrowing path, except in the US, where the crude production per day has reached 9.40 million barrels per day and is trending higher. In this setting, we hear that the nuclear negotiations with Iran, currently taking place in Lausanne, Switzerland, will unlikely end on an agreement this week. As two sides say “unmistakable progress” has been made during these last days, there is still time until March 31st to come to a framework agreement. Despite the shrinking global demand, difficulties on the supply side will help traders building support at $40 and above.

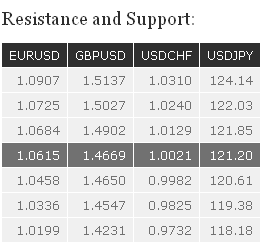

EUR/USD: Monitor the resistance at 1.0684.

The Risk Today

EUR/USD

EUR/USD is trying to bounce near the 1.0500 psychological support. Hourly resistances can be found at 1.0684 (12/03/2015 high) and 1.0907 (09/03/2015 high). An hourly support lies at 1.0458. Today's FOMC meeting is likely to lead to some intraday volatility. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. A strong resistance stands at 1.1534 (03/02/2015 high). Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD

GBP/USD has broken the key supports area between 1.4952 (23/01/2015 low) and 1.4814 (09/07/2013 low). The short-term technical structure is negative as long as the hourly resistance at 1.4902 holds. Another resistance can be found at 1.5027. An hourly support lies at 1.4700 (13/03/2015 low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). Another strong support stands at 1.3503 (23/01/2009 low). A key resistance can be found at 1.5552 (26/02/2015 high).

USD/JPY

USD/JPY is consolidating below the key resistance at 121.85 (see also the long-term declining channel). An hourly support lies at 121.09 (16/03/2015 low), while supports can be found at 120.61 (09/03/2015 low) and 119.38 (03/03/2015 low). A major resistance stands at 124.14. A long-term bullish bias is favoured as long as the key support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured.

USD/CHF

USD/CHF is consolidating after its recent sharp rise. Hourly supports can be found at 0.9982 (12/03/2015 low) and 0.9825 (09/03/2015 low), whereas an hourly resistance lies at 1.0129. A strong resistance stands at 1.0240. In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. A key support can now be found at 0.9374 (20/02/2015 low, see also the 200-day moving average).

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI