Forget about the alligators. Let's talk about draining the swamp. There is a way out of this quagmire for Europe. Ken Rogoff, in an interview with Der Spiegel, believes that political integration (or a "United States of Europe") is closer than anyone expects:

SPIEGEL: Do you honestly believe that the countries in the euro zone can bring themselves to hand over that much more power to Brussels?

Rogoff: The terrible thing is that few countries in Europe seem genuinely prepared for that. Those politicians who know what is needed keep quiet, fearing opposition from the voters. But the pressure of this crisis will create a momentum whose scope and impact we cannot yet imagine. At the end of the day, the United States of Europe may well come about a lot quicker than many would have thought.

SPIEGEL: With all respect to your optimism, the Europeans are unlikely to play along with that.The popular opinion in most member states is that Europe has far too much power, not too little.

Rogoff: Europe is in an interim stage, quite similar to that in late 18th century America. The ratification of the United States constitution in 1788 was preceded by 12 years of a loose confederation, which sometimes worked but usually didn't. Europe is in a similar situation today. States are like people, it is difficult to sustain a stable half-marriage; either you go for it or you forget it. Much of the latest eurozone crisis stems from the fact that there was economic integration without political integration. Rogoff believes that the European elite within the Community will take this latest crisis to push for greater integration.

This is all part of the Grand Plan that I wrote about before. Mario Draghi, in an interview with the WSJ, said that the steps include:

- Austerity, defined as lower government expenditures and lower taxes; followed by

- Structural reform, defined as the elimination of the European social model.

The optimist in me says that if the Europeans manage to pull this off, it will result in a new Renaissance for the EU and the global economy. The World Bank warned this week that China may be at risk of a middle-income trap as the supply cheap labor, which was the primary source of competitive advantage, diminishes. Were Chinese growth were to slow and the slack were to be taken up by a surge in Europe in the next decade, it would be a source of welcome global rebalancing.

Key risks

The caveat, of course, is that everything has to go right. For example, Bruce Krasting pointed out that some hospitals in the PIGS countries have not paid their drug bills for up to three years and the outstanding bills amount to €12-15 billion. Stories like these suggest that there are liabilities out there beyond sovereign debt as represented by the bond market that the market isn't very aware of. How much and can the Powers That Be skirt these potholes as they come up? I don't know.

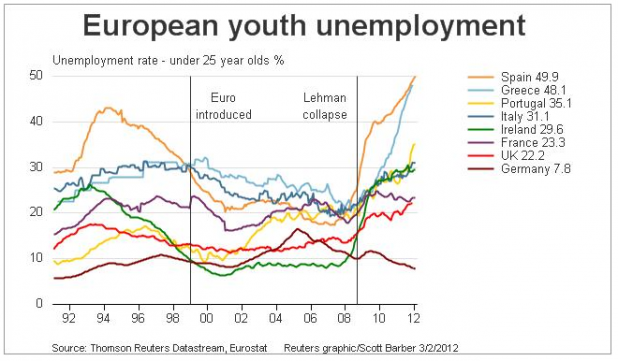

The greatest political challenge to the Grand Plan of austerity, structural reform and political integration is the discontent on the Street. Consider this chart of European youth unemployment. Note how it is going up everywhere except for Germany.

We have a map showing how to get out of the swamp. Can the European elites steer the EU out? I am not sure, but not all is lost. Just remember how Thatcher's reforms revitalized Britain. Is the current situation on the Continent very much different from the UK in the early 1980's?

I remain cautiously optimistic longer term. Consider the judgment of the markets. If Europe is in such trouble, then why has the EURUSD exchange rate been rallying?

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.