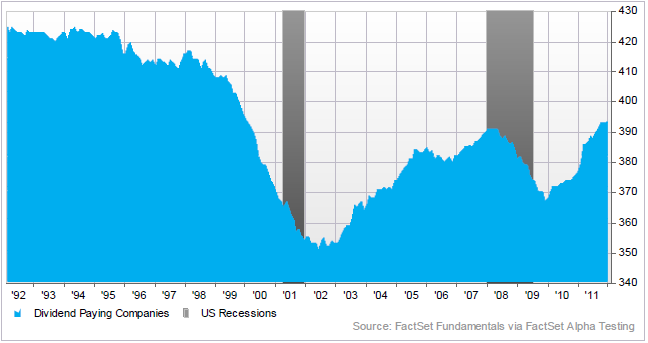

In a dividend report released by Factset this past Friday, it is noted the number of dividend paying companies in the S&P 500 Index has reached a 12-year high. The report notes:

The number of dividend-paying companies was 393 at the end of Q4 2011 (January 2012), which marks a 12-year high. Aggregate quarterly dividend payments amounted to $260.8 billion over the trailing twelve months. On a per-share basis, the aggregate figure was $26.78 per share, reflecting year-over-year growth of 16.1%. The Financials, Materials, and Information Technology sectors led all sectors in year-over-year growth on a per-share basis (40.0%, 28.4%, and 23.5%, respectively).

Interestingly, a majority (53.5%) of the companies in the technology sector now pay a dividend. This is up from only 17.9% in July of 2002, nearly 10-years ago. Is this a sign the technology sector is maturing?

We believe a primary reason for investors to look at a company's dividend practice is it provides insight into future expected earnings growth. And assuming a company is consistently growing its dividend at say a 10% rate, and all else being equal, that is, not borrowing to sustain the dividend growth rate and the payout ratio is not increasing, then the company's earnings are likely growing 10% as well. Over time, the stock price should advance in line with the company's earnings growth rate. I am simplifying the analysis here as investors need to evaluate cash flow, etc. The Factset report, however, notes:

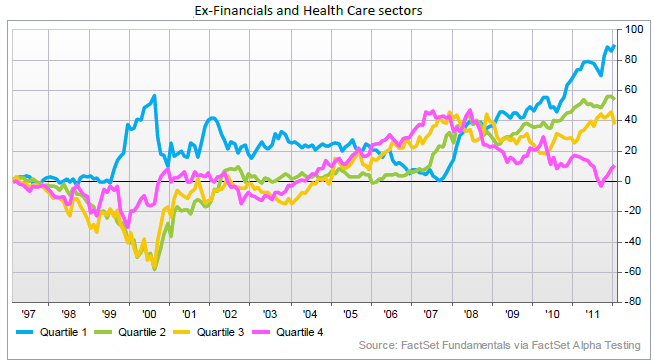

a back test utilizing FactSet’s Alpha Testing application shows that stocks with the highest five-year compound annual growth rates in earnings per share have outperformed stocks with lower growth rates over fifteen years. However, the results for dividend per share (DPS) growth rates show a different relationship. Dividend paying stocks in the top quartile by DPS growth have underperformed the S&P 500 Total Return Index, while the lower three quartiles outperformed (emphasis added).

If one removes the financial and health care sector stocks from the analysis, the top quartile dividend growers do exhibit the highest total return.

The negative influences to the health care and financial sector are well know, the housing bubble and heath care reform legislation. So just looking at dividend growth and investing based on this can be treacherous. Investors certainly need to evaluate macro factors that can negatively (or positively) influence a sector or stock's performance.

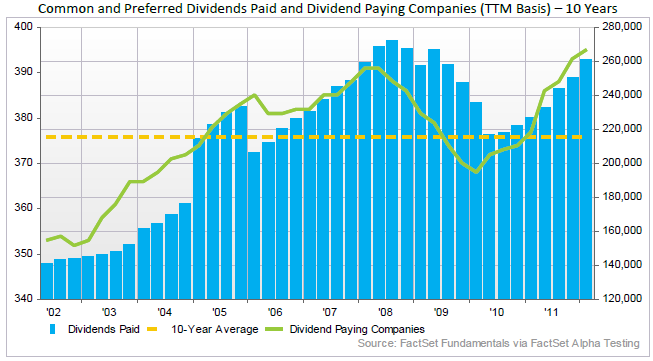

Companies in the S&P 500 index are now paying dividends at a record level after J.P. Morgan's (JPM) recent dividend announcement. This was noted recently by Howard Silverblatt, S&P's senior index analyst. The below chart is for the period ending 12/31/2011 and includes preferred dividends.

Lastly, given the level of cash on corporate balance sheets, and the still low payout ratio, future dividend growth looks promising.

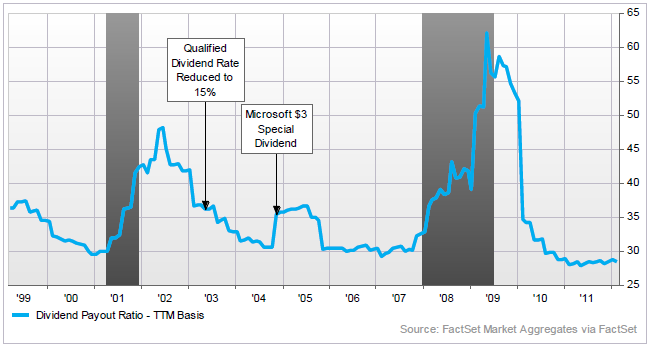

Certainly, the change in the tax structure for dividend payments might be a headwind as noted in a recent Wall Street Journal article, Will A Dividend Tax Hike Spoil The Party?; however, the discipline of using dividend growth in one's stock analysis can be rewarding for even total return investors.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.