Nvidia shares jump after resuming H20 sales in China, announcing new processor

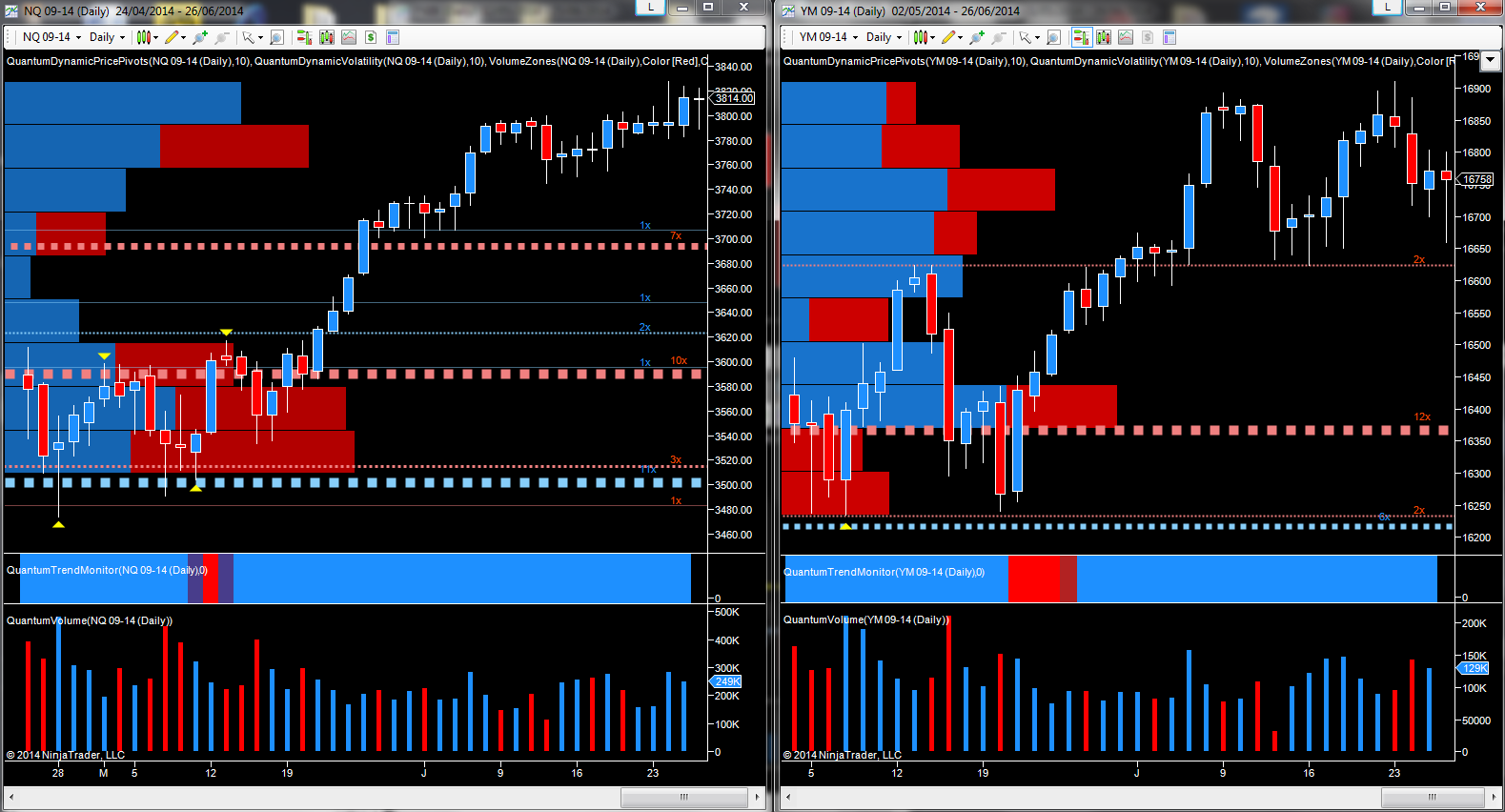

For the doom mongers and doubters, the last two months have been a salutary lesson in trying to predict the top of the market – unless of course you happen to be a VPA trader ( volume price analysis to the uninitiated). The maxim sell in May and go away could not be further from the truth, and whilst the price action in June has been muted as the market pauses, today’s price action has once again confirmed the bullish tone with the daily NQ E-mini leading the way, bouncing off the lows of the session at 3789 to currently trade at 3812 at the time of writing, with a consequent deep lower wick to the body of the candle. What is perhaps more revealing is that whilst the Dow Jones is the most widely reported index in the US, it fails to reflect the true nature of the market given the type and number of constituents, whilst the NQ ( and indeed others ) reflect the true picture for broader equity markets. As an example, the recent reversal in the YM earlier in the week, was not reflected in the NQ which continues to lead equity markets ever higher, as the other major indices follow.

Yesterday’s price action on the NQ which broke out of recent congestion with a wide spread up candle and solid volume, coupled with today’s price action, has simply confirmed the bullish sentiment for equities, bouncing off the now established platform below, and pushing higher to attack the 3820 level in due course.

For the YM, the key resistance level is now well established just below the 16,900 level, and if this is taken out, as expected, then expect to see the index break through the psychological 17,000 and move on to build the next phase of the bull trend. For the doom merchants, today was another salutary lesson, and with no selling climax yet in sight on any time-frame or index, the status quo remains firmly in place, with the NQ leading the way out of recession, and into an early expansion phase of growth.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI