Last Friday, it was announced that Apple (NASDAQ:AAPL) will join the Dow Jones Industrial Average replacing AT&T (NYSE:T). This change will occur on March the 18th after the close of the bell. At the same time, VISA (NYSE:V) announced a 4:1 stock split.

I am not a huge fan of stock splits as they are dilutive to shareholders. It reminds me of Yogi Barra who once said: "Can you cut my pizza into four pieces because I cannot eat eight." Yes, you have more shares, but you still have the same value and ownership. But, I digress.

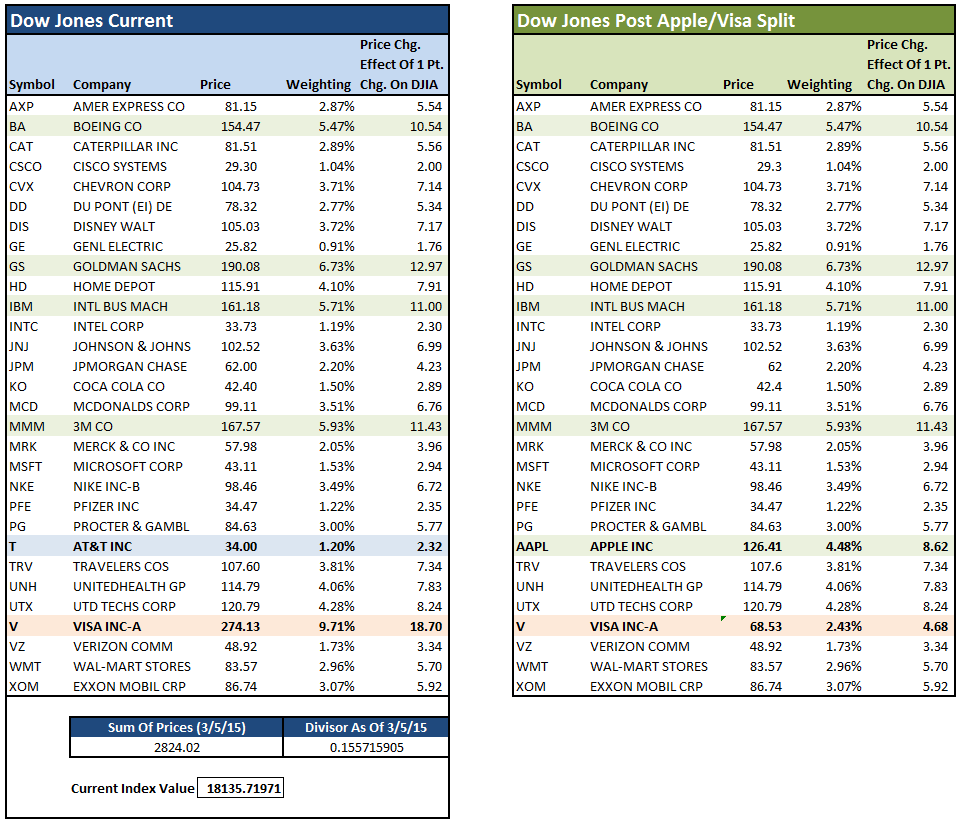

The table below shows the makeup of the Dow Jones Industrial Average pre- and post-changes. (To calculate the price of the DJIA, simply sum the prices of the 30 stocks and then divide by the divisor.)

Importantly, these two changes would have a fairly significant impact on the price movement of the index as a whole. Since the Dow is "price-weighted" the removal of AT&T (where each $1 of price change in the stock has a $2.32 impact on theDow) and inclusion of Apple (NASDAQ:AAPL) (that has an $8.62 impact) would have a fairly significant impact on the volatility of the index.

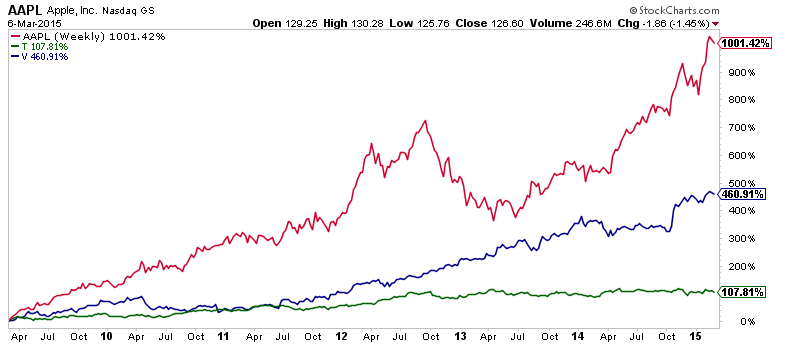

However, the 4:1 split of Visa (NYSE:V) will reduce Visa's price impact from $18.70 to just $4.68, which will offset the inclusion of Apple on a relative basis. Of course, that is assuming that all price movement is relative. Clearly that has not been the case. Since the financial crisis, Apple outperformed both AT&T and Visa combined. $1 invested in Apple would have gained more than 1000% during a time when Visa gained 460.91%, and AT&T rose by just 107.81%.

If Apple's outperformance continues into the future, which is somewhat suspect given the very mature nature of the company and current market cycle, the boost to the Dow could be quite significant. Consider this, assuming that each point increase in Apple's stock adds roughly $8.62 (based on the current divisor) to the index, Apple would have added almost 1000 points to Dow all by itself. It is worth reminding you that the math works just as efficiently during market declines.

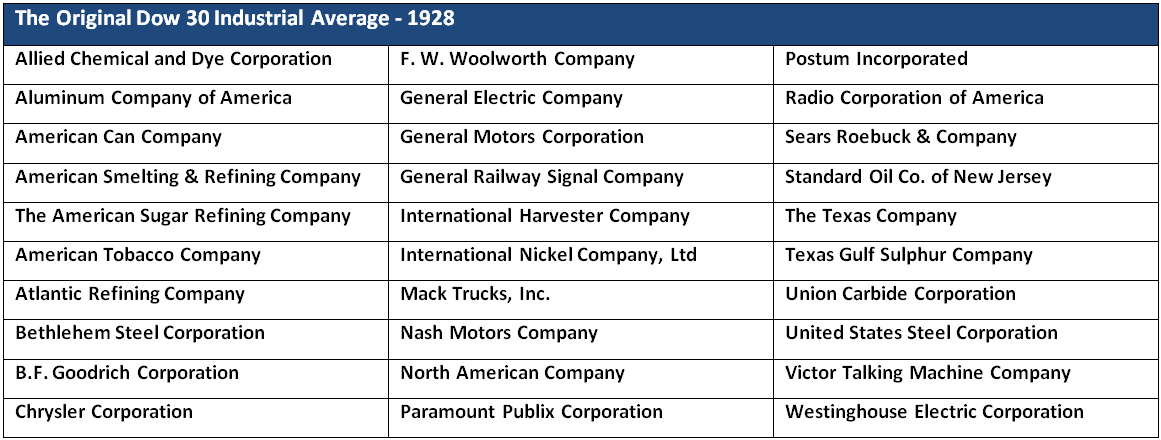

Lastly, the inclusion of Apple also changes the complexion of the Dow Jones Industrial Average. In the beginning, the Dow Jones indexes were concentrated in specific areas – industrials, transportation, and utilities. The table below shows the original makeup of the Dow 30 Industrial Average in 1928. At that time it was literally an index of industrial based companies involved in the manufacturing of steel, automobiles and textiles.

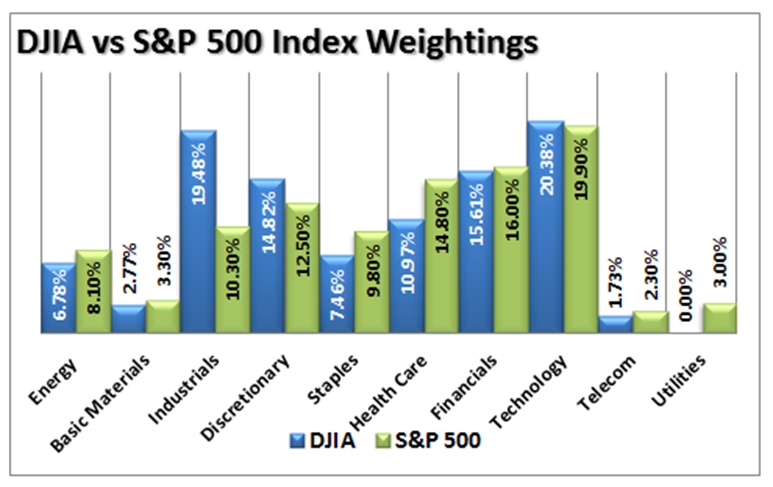

Today, while the Dow Jones Transportation and Utility indices remain concentrated in those specific areas, that is no longer the case for the Dow Jones Industrial Average.

Over the years, the complexion of the Dow Jones has morphed into a diversified index. While the index maintains a slightly heavier weighting towards industrial companies and no utilities, it is much more akin to the S&P 500 index than not.

This restructuring of the index over time has also given market technicians that follow "Dow Theory" more angst in recent years as "false signals" have become much more common.

Lastly, while it is certainly interesting news that Apple will join the venerable Dow Jones Industrial Average, it is really a non-event as there is very little money invested in Dow Jones related index funds relative to the S&P 500.

But then again, if Apple can continue its dominance and rise to the magical $1 Trillion "market cap," then the Dow Jones could indeed potentially become the index to beat. What is clear is that maybe it is time to drop the "Industrial Average" tag and just call it for what it is: The Dow Jones 30 Index.

It ain't sexy, but it is much more accurate.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.