Intel closes 23% higher after Nvidia takes $5B stake

It's not just crusty old skeptics like me who wonder about the growing disconnect between Wall Street and Main Street:

"Summertime Blues" (The Economist)

The slowdown is spreading around the world

NOT for the first time, the recent behaviour of financial markets has been at odds with economic fundamentals. The living has been easy on American and European stock exchanges this summer, despite plenty of gloomy data. Investors may have been placing too much faith in the capacity of central banks to counteract economic weakness.

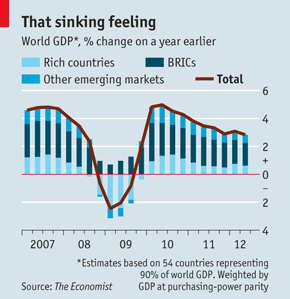

The global economy expanded by just 2.8% in the year to the second quarter, according to The Economist’s measure of world GDP (see chart). That is the slowest rate since the end of 2009, when recovery from savage recession in the wake of the financial crisis was getting under way. The most perturbing aspect of the current slowdown is that the weakness is so widespread, affecting emerging economies as well as rich countries.

In contrast, rich-country stockmarkets have been buoyant over the summer. During the past month American equity prices rose by 4%; European stockmarkets were even more sunkissed, gaining an impressive 6%. The rallies are now petering out, perhaps because investors are becoming more realistic about what central banks can truly deliver.

I have a funny feeling there will be lots more of the latter in the weeks to come.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes dozens of winning stock portfolios chosen by our advanced AI.

Year to date, 3 out of 4 global portfolios are beating their benchmark indexes, with 98% in the green. Our flagship Tech Titans strategy doubled the S&P 500 within 18 months, including notable winners like Super Micro Computer (+185%) and AppLovin (+157%).

Which stock will be the next to soar?