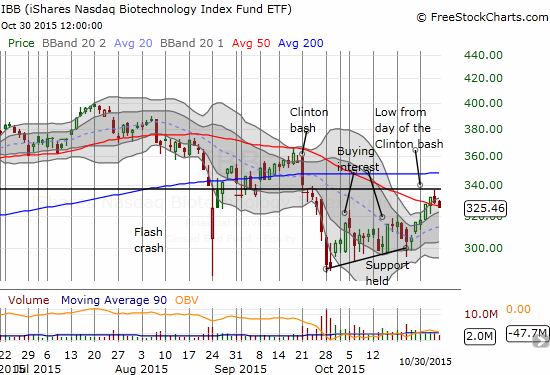

The iShares Nasdaq Biotechnology ETF (O:IBB) finally broke out above resistance from its downtrending 50-day moving average (DMA) on Wednesday, October 28th. This was the same day as the Federal Reserve’s October decision on monetary policy. Unfortunately, the breakout failed its first test as it stopped cold right at the low of the “Clinton Bash” from September 21st.

iShares Nasdaq Biotechnology ETF (IBB) ends the week with a post-breakout failure.

IBB’s 50DMA breakout was its first trade above this critical line of support/resistance since early August. While the weak close for the week was disappointing, encouraging signs continue to build for IBB. In previous posts, I pointed out the appearance of significance buying interest as support along the uptrend from recent lows generally held firm (see the chart above). This rally has accumulated enough strength to produce an uptrend in the 20-day moving average (dashed line in the chart). While the 50DMA support may quickly fail here, I am expecting the 20DMA to hold as support. I am targeting my next trade(s) on IBB at this line of support.

Most importantly, this overdue test of the Clinton Bash low is the first sign that my prediction of a complete reversal of that loss is finally somewhere just over the horizon.

Be careful out there!

Full disclosure: no positions

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.