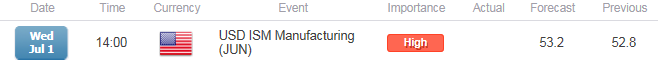

Trading the News: U.S. ISM Manufacturing

Another uptick in the ISM Manufacturing survey may boost the appeal of the greenback and trigger a more meaningful pullback in EUR/USD as it boosts speculation for Fed liftoff in the second-half of 2015.

What’s Expected:

Positive developments coming out of the world’s largest economy may put increased pressure on the Federal Open Market Committee (FOMC) to remove the zero-interest rate policy (ZIRP), and we may see a growing number of central bank officials prepare U.S. households and businesses for higher borrowing-costs as the region gets on a more sustainable path.

Expectations: Bullish Argument/Scenario

Release | Expected | Actual |

Personal Spending (MAY) | 0.7% | 0.9% |

Philadelphia Fed Business Outlook Survey (JUN) | 8.0 | 15.2 |

Advance Retail Sales (MoM) (MAY) | 1.2% | 1.2% |

Improved business confidence paired with the pickup in household spending may produce a meaningful advance in the ISM survey, and a better-than-expected print may generate a bullish USD reaction as market participants ramp up bets for a Fed rate hike later this year.

Risk: Bearish Argument/Scenario

Release | Expected | Actual |

Housing Starts (MoM) (MAY) | -4.0% | -11.1% |

Industrial Production (MoM) (MAY) | 0.2% | -0.2% |

Factory Orders (APR) | -0.1% | -0.4% |

Nevertheless, the ongoing slack in the real economy may continue to drag on business output, and a dismal manufacturing report may produce near-term headwinds for the greenback as it raises the Fed’s scope to retain its highly accommodative policy stance beyond 2015.

Bullish USD Trade: ISM Survey Climbs to 53.2 or Higher

- Need to see red, five-minute candle following the release to consider a short trade on EUR/USD.

- If market reaction favors a bullish dollar trade, sell EUR/USD with two separate position.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to entry on remaining position once initial target is hit; set reasonable limit.

Bearish USD Trade: Manufacturing Report Disappoints

- Need green, five-minute candle to favor a long EUR/USD trade.

- Implement same setup as the bullish dollar trade, just in the opposite direction.

Potential Price Targets For The Release

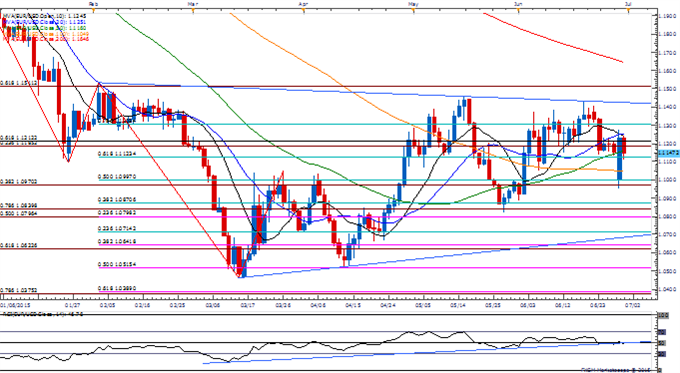

EUR/USD Daily

Chart - Created Using FXCM Marketscope 2.0

- Despite the risk for a Greek exit, EUR/USD may continue to consolidate with the wedge/triangle formation from earlier this year as the pair holds above the May low (1.0818).

- DailyFX Speculative Sentiment Index (SSI) shows the retail crowd remains net-short EUR/USD since March 9, with the ratio holding near extremes as it sits at -2.02.

- Interim Resistance: 1.1510 (61.8% expansion) to 1.1532 (February high)

- Interim Support: 1.0970 (38.2% expansion) to 1.1000 (50% retracement)

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

MAY 2015 | 06/01/2015 14:00 GMT | 52.0 | 52.8 | -79 | -47 |

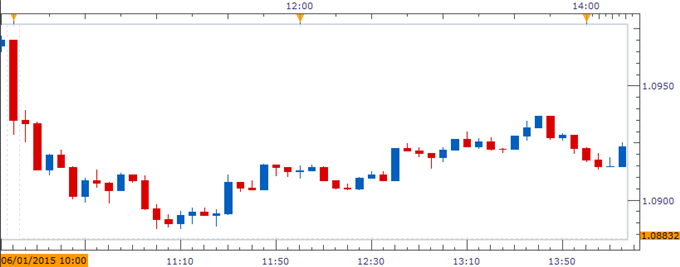

May 2015 U.S. ISM Manufacturing

The U.S. ISM Manufacturing survey increased for the first time since October as the index climbed to 52.8 in May from 51.5 the month prior. A deeper look at the report showed a pickup in New Orders as the figure advanced to 55.8 from 53.5 in April, with the Employment component bouncing back to 51.7 during the same period after marking the contraction since May 2013. The bullish dollar reaction to the better-than-expected ISM report pushed EUR/USD below the 1.0900 handle, but the pair consolidated throughout the North American trade to end the day at 1.0923.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI