Here is the latest data from DB on fund flows for the major asset classes:

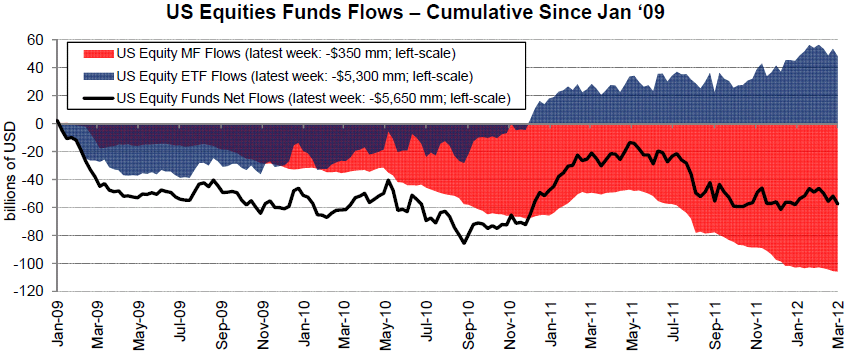

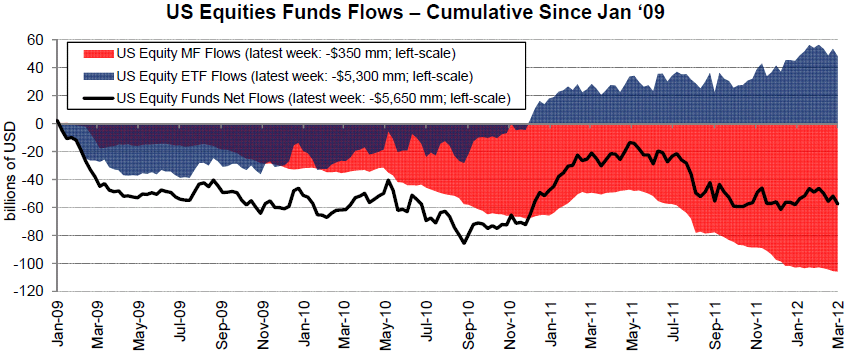

Equity mutual funds are continuing to lose ground to ETFs. The US domestic equity mutual funds have lost some $100bn since Jan of 2009, while equity ETFs are up around $50bn during this period.

But the equity asset class as a whole is losing AUM. Some of this capital is of course flowing into fixed income funds. Investment grade corporate bond mutual funds and ETFs have gained $131bn ($42bn into ETFs and $89bn into mutual funds) for the same period, while HY funds picked up $48bn ($20bn into ETFs and $28bn into mutual funds).

Given the demographic changes in the US that favor fixed income as well as the loss of confidence in equity mutual funds, this trend is expected to continue.

Equity mutual funds are continuing to lose ground to ETFs. The US domestic equity mutual funds have lost some $100bn since Jan of 2009, while equity ETFs are up around $50bn during this period.

But the equity asset class as a whole is losing AUM. Some of this capital is of course flowing into fixed income funds. Investment grade corporate bond mutual funds and ETFs have gained $131bn ($42bn into ETFs and $89bn into mutual funds) for the same period, while HY funds picked up $48bn ($20bn into ETFs and $28bn into mutual funds).

Given the demographic changes in the US that favor fixed income as well as the loss of confidence in equity mutual funds, this trend is expected to continue.