Fed policy dictates money flows into most markets, including stocks, bonds, commodities and even currencies. As the leading central banker, the Committee sets policy as it sees fit for the US economy yet we often see other nations' central banks pivot off the Fed. That often happens at a slower pace as countries are in an 'I'll wait and see how it works' mode. When the Fed went to a ZIRP (zero interest rate policy) in 2008/09 many other central banks aggressively followed and cut their own lending rates, easing money standards. For many that turned out to be a wise follow.

Until lately, the Fed has not considered raising the Fed Funds rate yet have always known that at some point they would have raise rates due to inflation of prices or assets. From 2009 until mid 2014 I had no interest in looking at the Fed Funds Futures, as the Federal Reserve Committee had no interest in move rates off zero. The policy was first considered temporary but always without an expiration date.

Yet in 2014 we started seeing some movement in futures as the guessing game was on.The Fed has not been shy about rhetoric either, choosing words carefully and looking for a market response. Remember back in May/June 2013 when then Fed Chairman Ben Bernanke floated the idea of reducing Fed purchases of treasury securities? That caused the first 'taper tantrum', but the Fed dialed it back afterward - but the response (the market took a nose dive in subsequent days) was important information and told them the fragility of market psychology.

So, flash forward to today. We are certainly closer to rate hikes today than a year ago.The futures market tells us this fact.Yet, the confusion now is not if but when, and how much. Further, the incremental moves could have a big effect.Traditional moves by the Fed have been no less than 25bps and as much as 75bps (raise or cut). But 'Fedspeak' of late has told us they would prefer a very slow pace of rate increases. Does that mean they could do this in smaller increments, say 10bps?

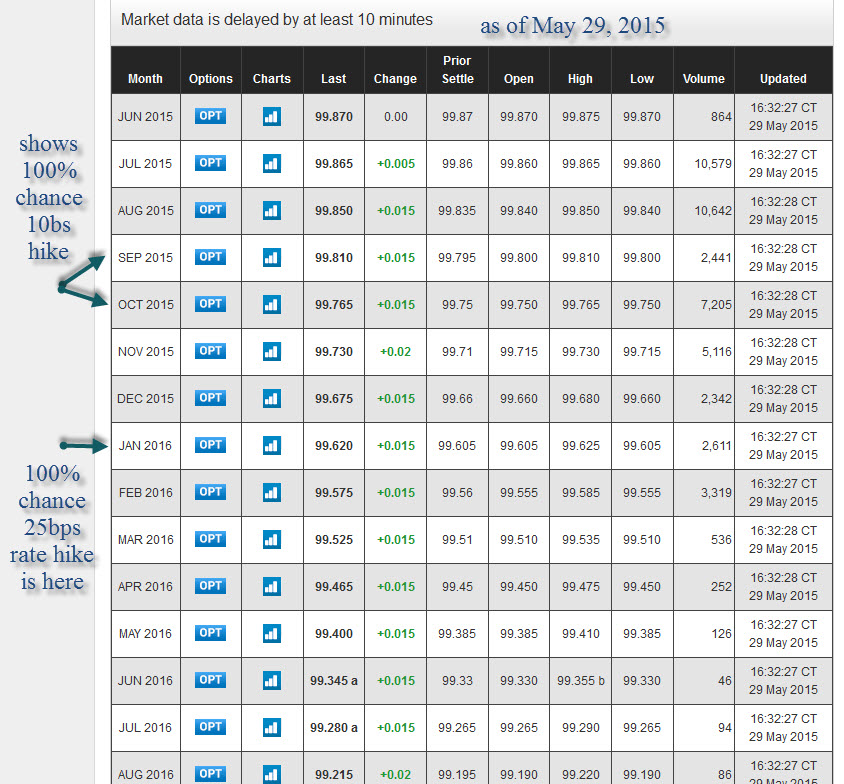

That could be the case, and in line with a gradual approach. Much of the talk is a rate hike coming in at the September meeting, interestingly enough the futures market has priced in a 100% chance of a 10bps rate hike at that meeting (see graphic).

This would likely be a nice compromise to satisfy everyone.The market is betting on a 100% chance of a 25bps rate hike by January. Yet please remember, the Fed should NOT just raise rates for some symbolic reason or to satisfy a faction. If inflation expectations start to rise then rate increases should be the neutralizer.

We will learn more about these expectations with a revised forecast following the June meeting in two weeks. Let's not forget the financial crisis set up unprecedented action and policy for the Fed, and while it has achieved all of their goals it certainly helped the economy sidestep a disastrous outcome.

What's interesting, with the markets already expecting this sort of tightening policy the Fed may have let the market do its work for them.This could be the ideal situation without upsetting the 'apple cart'.Taper tantrums aside, this is a very important moment for the Fed and markets.They have been good stewards of policy so far, let's hope that continues when the time is right for a policy pivot.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI