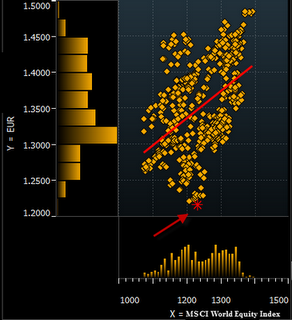

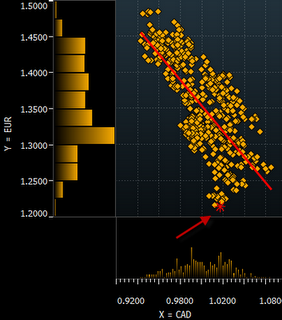

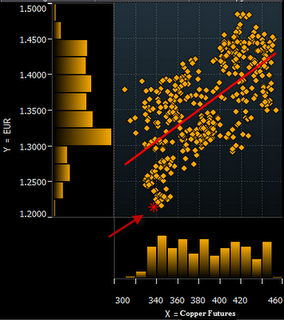

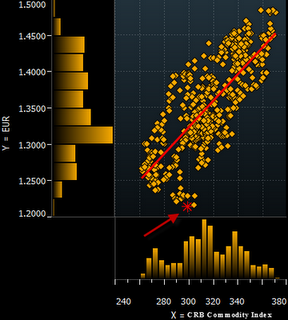

The euro has completely decoupled from other financial instruments that would be classified as "risk-on" assets. Risk-on/off sentiment changes have dominated global market dynamics for several years (see this write-up from Attain Capital for an overview). The following scatter plots show EUR levels vs. other risk asset prices over the past couple of years (red asterisk indicates current levels).

1. Global equities:

2. "Risk-on" currencies:

3. Commodities:

The euro has in fact become the short leg of the "carry trade," which is where the dollar was some three years ago.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.