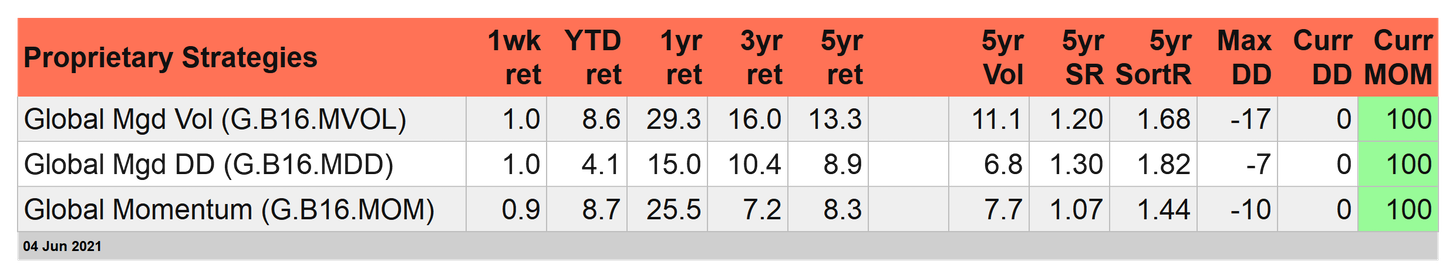

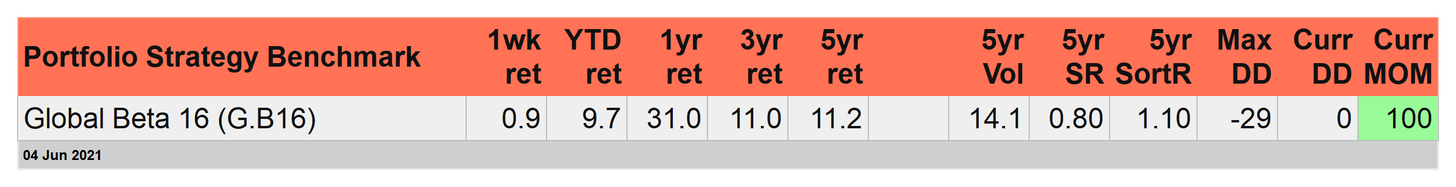

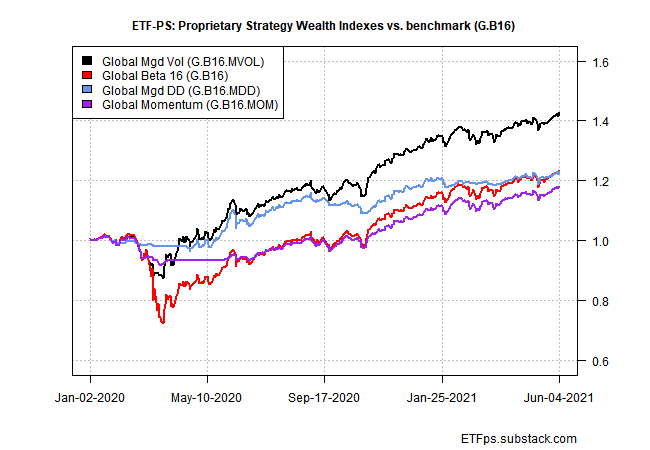

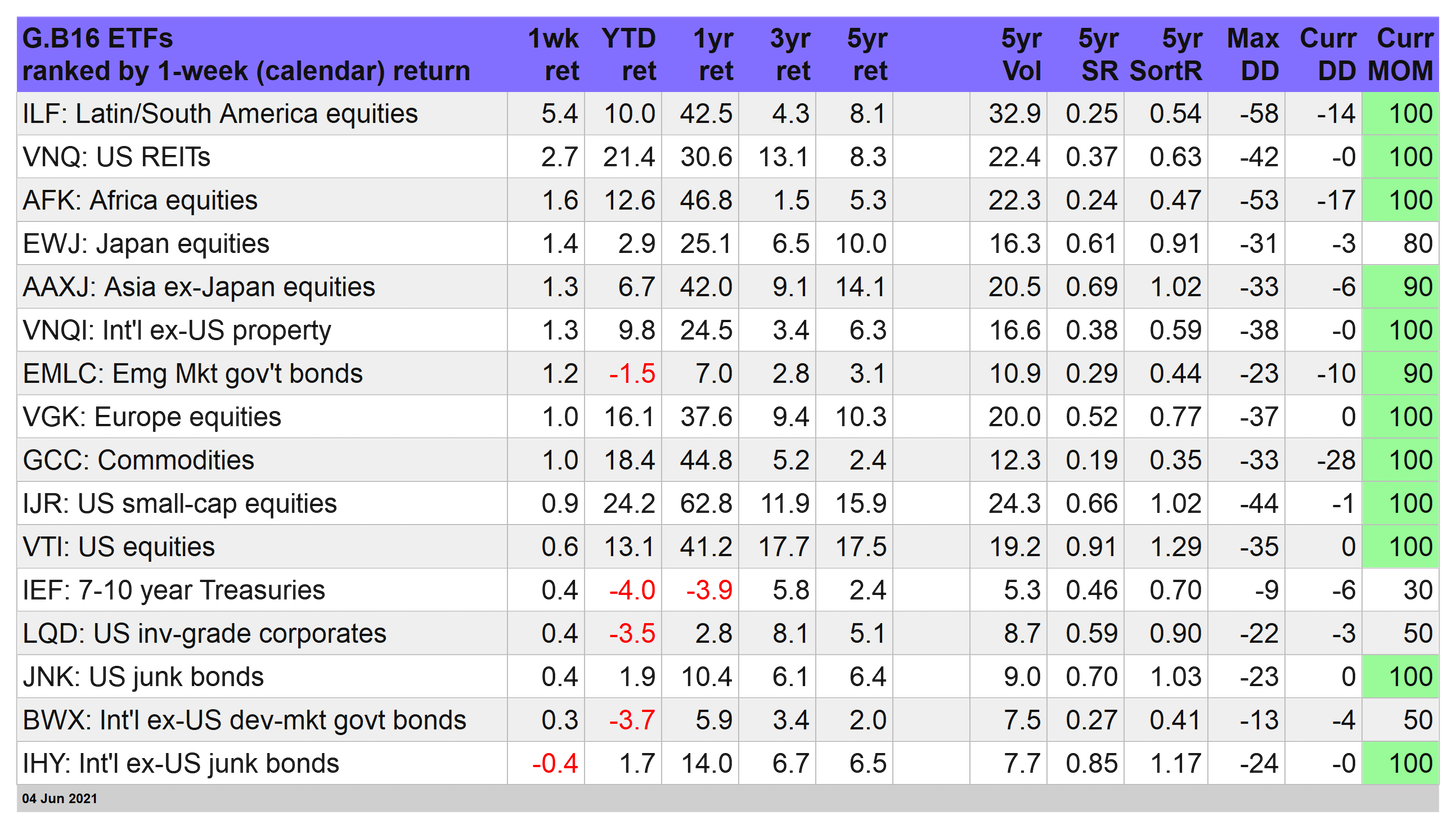

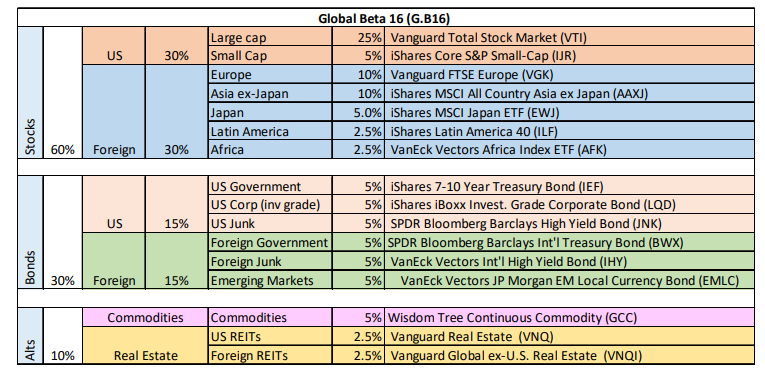

Finally, some alpha. Two of our three proprietary strategies dispensed some benchmark-beating returns last week (through June 4) after a stretch of underperformance. A third matched the benchmark, Global Beta 16 (G.B16), which continually holds the 16-fund opportunity set (shown in the table at the end of this update).

For the year-to-date and one-year trailing periods, however, G.B16 still has the edge by a comfortable margin. Dumb beta, in other words, still looks pretty smart in recent history. For details on strategy rules and risk metrics in the tables below, please see this summary.

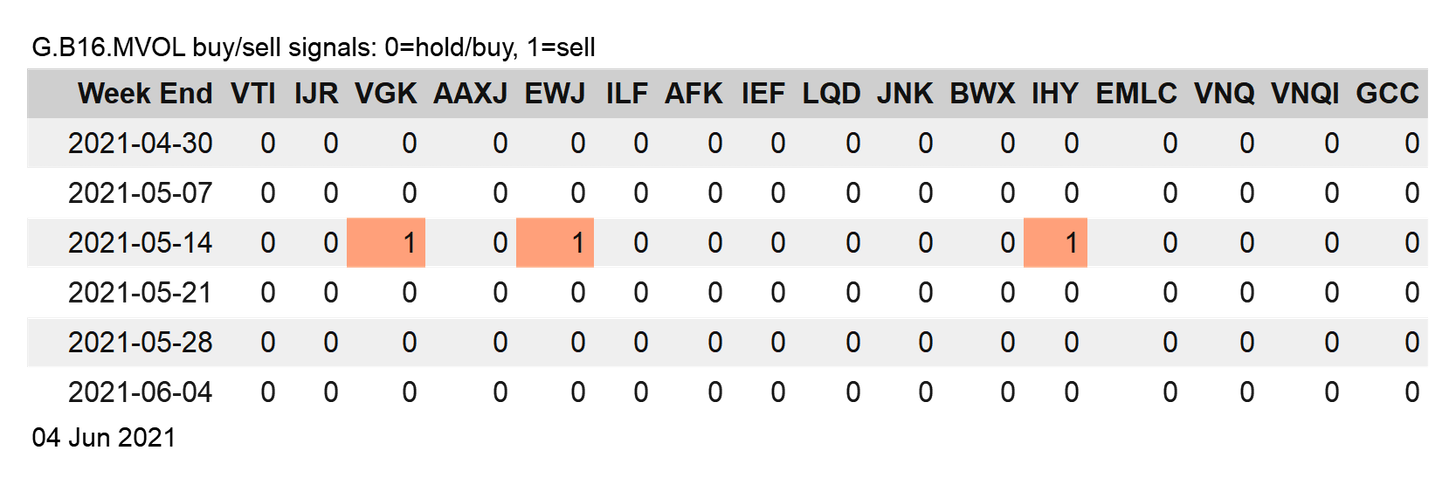

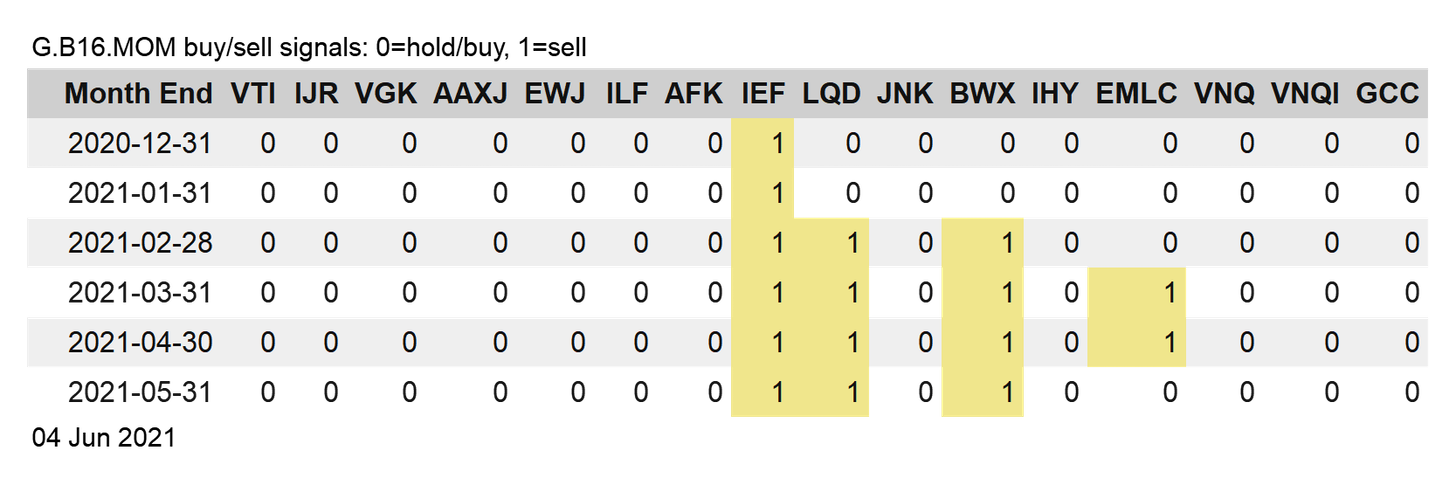

On the rebalancing front, all was quiet last week, again. For a second week in a row, Global Managed Drawdown (G.B16.MDD) maintained a full-out risk-on position for all 16 funds. For Global Managed Volatility (G.B16.MVOL), it’s three straight weeks of a complete risk-on profile. Meantime, Global Momentum (G.B16.MOM) is on a month-end rebalancing schedule and so its May 31 profile (13 of 16 funds are risk-on) remains intact until at least the end of June.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.