The Dow closed over 15,000 for the first time ever. New all time highs for the S&P 500, Russell 2000 and the Nasdaq holding at 12 year highs. This move in the equity markets is still the most hated move higher ever. So what do you do? Go buy a washing machine! Well, at least a washing machine stock. Whirlpool, WHR, closed Tuesday at a new All time high as well, and is showing signs of continued upside out of the recent consolidation.

Whirlpool, WHR

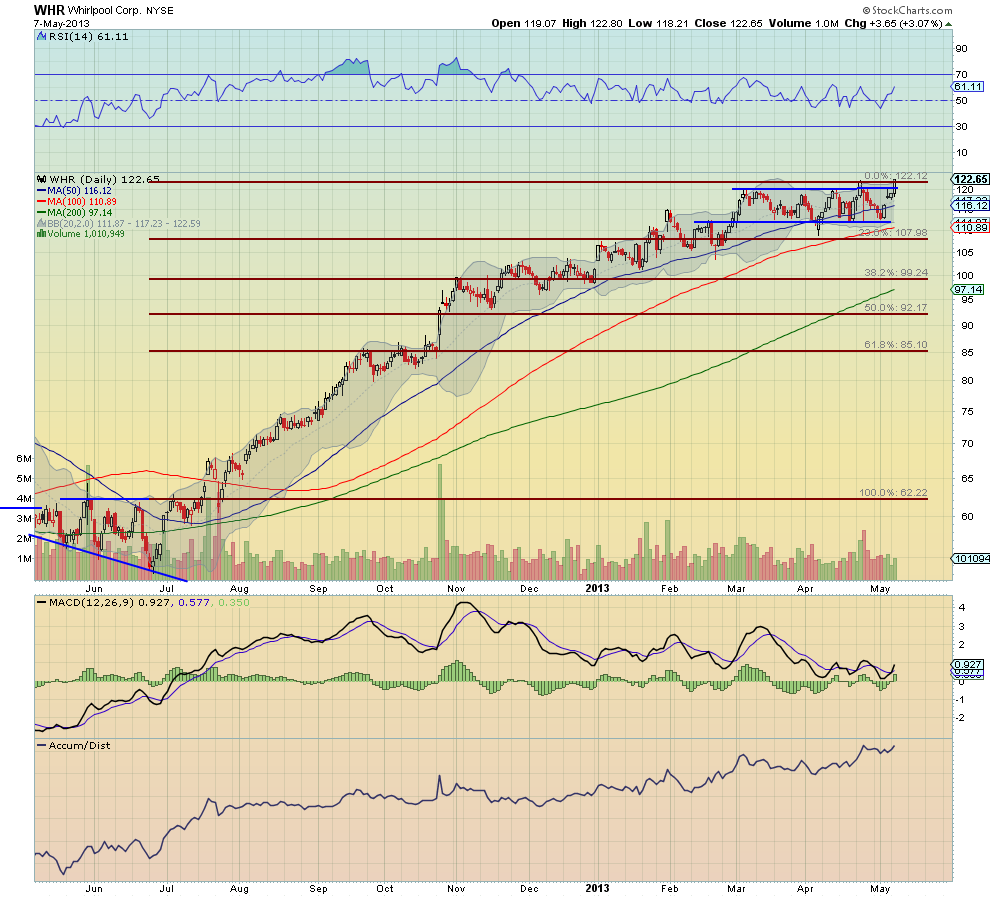

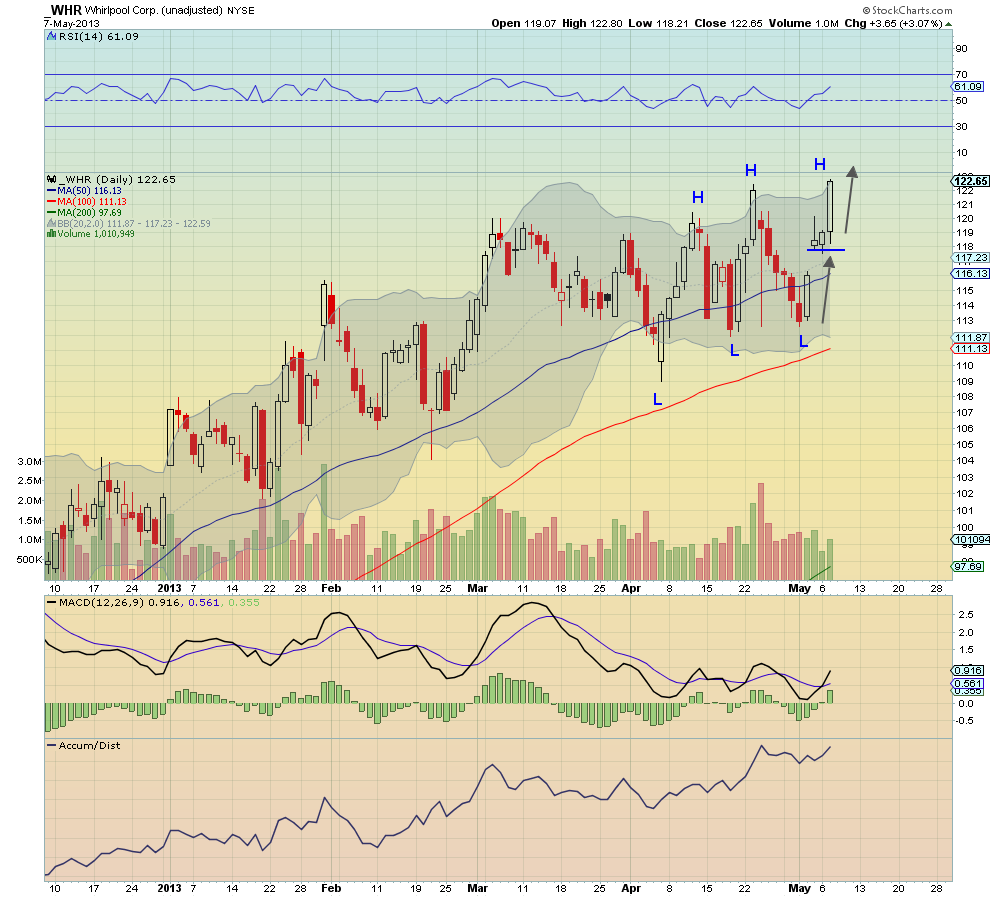

The longer view chart shows the price piercing the all time high, as well as moving out of the consolidation range it has been in since the beginning of March. From a technical perspective, the move to this consolidation from the the previous base at 62 projects a similar move higher to 165. But we're getting a bit ahead of ourselves. Zooming in on the most recent activity shows that the price has made a series of higher lows and higher highs.

The current Measured Move will take it to 124, but the Relative Strength Index (RSI) and Moving Average Convergence Divergence indicator (MACD) are both supportive of a continued move higher. Finally, notice that the accumulation/distribution has been strong and is rising again. If that is not enough for you - it also sports a 2.1% dividend yield.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.